WeightWatchers 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

8. Treasury Stock

On October 9, 2003, the Company, at the direction of its Board of Directors, authorized a program to

repurchase up to $250,000 of the Company’s outstanding common stock. On each of June 13, 2005 and May 25,

2006, the Company, at the direction of its Board of Directors, authorized adding $250,000 to this program. The

repurchase program allows for shares to be purchased from time to time in the open market or through privately

negotiated transactions. No shares will be purchased from Artal under the program.

On December 18, 2006, the Company commenced a tender offer in which it sought to acquire up to 8,300

shares of its common stock at a price between $47.00 and $54.00 per share (the “Tender Offer”). Prior to the

Tender Offer, the Company entered into an agreement with Artal whereby Artal agreed to sell to the Company, at

the same price as is determined in the Tender Offer, the number of its shares of the Company’s common stock

necessary to keep its percentage ownership in the Company at substantially the same level after the Tender Offer.

Artal also agreed not to participate in the Tender Offer so that it would not affect the determination of the price in

the Tender Offer.

The Tender Offer expired at midnight on January 18, 2007, and on January 26, 2007 the Company

repurchased approximately 8,548 shares at a price of $54.00 per share. These repurchased shares were comprised

of 8,300 shares that the Company offered to purchase and approximately 248 shares purchased pursuant to the

Company’s right to purchase up to an additional 2% of the outstanding shares as of November 30, 2006. On

February 2, 2007, the Company repurchased approximately 10,511 of Artal’s shares at a purchase price of $54.00

per share pursuant to its prior agreement with Artal. In January 2007, the Company amended and supplemented

the WWI Credit Facility to finance these repurchases. See Note 7.

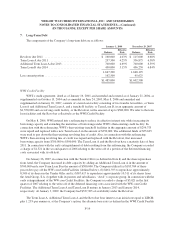

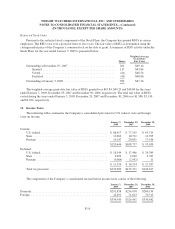

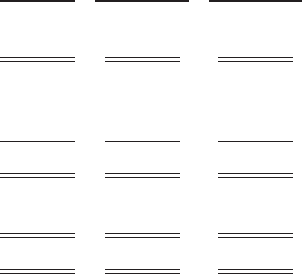

9. Earnings Per Share

Basic earnings per share (“EPS”) computations are calculated utilizing the weighed average number of

common shares outstanding during the periods presented. Diluted EPS is calculated utilizing the weighted

average number of common shares outstanding adjusted for the effect of dilutive common stock equivalents.

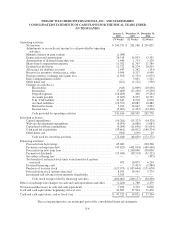

The following table sets forth the computation of basic and diluted EPS for the fiscal years ended:

January 3,

2009

December 29,

2007

December 30,

2006

Numerator:

Net income ............................................. $204,331 $201,180 $209,825

Denominator:

Weighted average shares of common stock outstanding .......... 78,250 80,583 98,719

Effect of dilutive common stock equivalents ................... 245 524 707

Weighted average diluted common shares outstanding ........... 78,495 81,107 99,426

EPS:

Basic .................................................. $ 2.61 $ 2.50 $ 2.13

Diluted ................................................. $ 2.60 $ 2.48 $ 2.11

The number of anti-dilutive common stock equivalents excluded from the calculation of weighted average

shares for diluted EPS was 1,693, 1,095, and 1,208 for the years ended January 3, 2009, December 29, 2007, and

December 30, 2006, respectively.

F-16