WeightWatchers 2008 Annual Report Download - page 49

Download and view the complete annual report

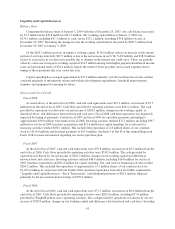

Please find page 49 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Hedging Activities,” which require that all derivative financial instruments be recorded on the consolidated

balance sheet at fair value as either assets or liabilities. Fair value adjustments for qualifying derivative

instruments are recorded as a component of other comprehensive income and will be included in earnings in the

periods in which earnings are affected by the hedged item. Fair value adjustments for non-qualifying derivative

instruments are recorded in our results of operations.

Income Taxes

Deferred income taxes result primarily from temporary differences between financial and tax reporting. If it

is more likely than not that some portion of a deferred tax asset will not be realized, a valuation allowance is

recognized. We consider historic levels of income, estimates of future taxable income and feasible tax planning

strategies in assessing the need for a tax valuation allowance.

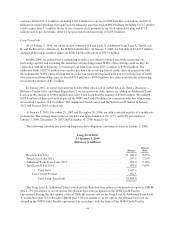

On December 31, 2006, the first day of fiscal 2007, the Company adopted the provisions of FASB

Interpretation No. 48, “Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement

No. 109”, or FIN 48. FIN 48 prescribes a recognition threshold and a measurement attribute for the financial

statement recognition and measurement of tax positions taken or expected to be taken in a tax return. For those

benefits to be recognized, a tax position must be more likely than not to be sustained upon examination by taxing

authorities. The amount recognized is measured as the largest amount of benefit that is greater than 50 percent

likely of being realized upon ultimate settlement. As a result of the December 31, 2006 adoption of FIN 48, the

Company increased its tax liability for unrecognized tax benefits by $1.9 million, which was accounted for as a

reduction to the opening balance of retained earnings for fiscal 2007.

Capitalized Software Development

We follow the provisions of the American Institute of Certified Public Accountants Statement of Position

98-1, “Accounting for the Costs of Computer Software Developed or Obtained for Internal Use”, which requires

the capitalization of certain costs incurred in connection with developing or obtaining software for internal use.

These costs are amortized over a period of three to five years, the estimated useful life of the software. We

periodically evaluate for impairment capitalized software development costs by considering, among other factors,

whether the software is still expected to provide substantive service potential, and whether a significant change is

being made or will be made to the software.

Share-Based Compensation

We adopted the provisions of FASB Statement No. 123R, “Share-Based Payment”, or FAS 123R, on January 1,

2006. Upon adopting this standard, we began recognizing the cost of all share-based awards based on their estimated

grant-date fair value over the related service period of such awards. In accordance with FAS 123R, we elected to apply

the modified prospective transition method to all past awards outstanding and unvested as of the date of adoption and

began recognizing the associated expense over the remaining vesting period based on the fair values previously

determined and disclosed as part of our pro forma disclosures. We have not restated the results of prior periods.

The fair value of restricted stock units and vested shares is determined by the market price of our common stock

on the date of grant. The fair value of option awards is estimated on the date of grant using the Black-Scholes option

pricing model, which requires estimates of the expected term of the option, the expected volatility of the Company’s

stock price, the risk-free interest rate and the expected dividend yield. We recognize expense for all share-based

awards based on the fair value of the number of awards we estimate will fully vest. A change in these underlying

assumptions will cause a change in the estimated fair value of share-based awards and the underlying expense

recorded. We continue to evaluate these estimates and assumptions and believe that these assumptions are appropriate.

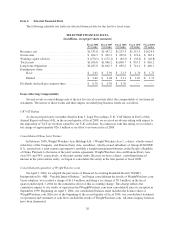

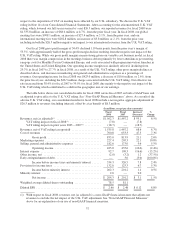

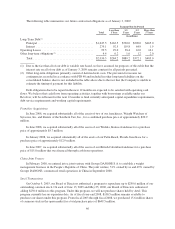

Results of Operations

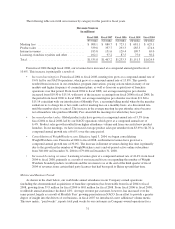

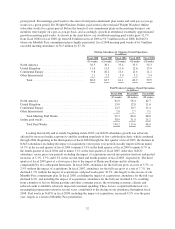

Comparison of Fiscal 2008 (53 weeks) to Fiscal 2007 (52 weeks)

Certain key metrics were significantly negatively affected by net offsets to revenue recorded in fiscal 2008

resulting from the adverse U.K. VAT ruling received by the Company during the second quarter 2008 with

36