WeightWatchers 2008 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2008 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

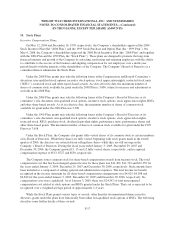

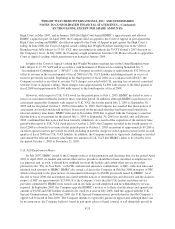

Long-Lived Assets

January 3,

2009

December 29,

2007

December 30,

2006

North America .............................................. $828,580 $799,587 $759,221

United Kingdom ............................................. 13,919 17,969 15,220

Continental Europe ........................................... 7,131 6,795 5,697

Australia, New Zealand and other ............................... 16,277 16,392 15,154

$865,907 $840,743 $795,292

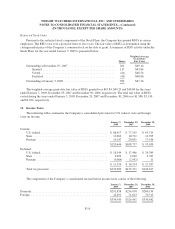

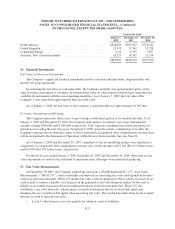

16. Financial Instruments

Fair Value of Financial Instruments:

The Company’s significant financial instruments include cash and cash equivalents, long-term debt, and

interest rate swap agreements.

In evaluating the fair value of cash equivalents, the Company generally uses quoted market prices of the

same or similar instruments or calculates an estimated fair value on a discounted cash flow basis using the rates

available for instruments with the same remaining maturities. As of January 3, 2009, the fair value of the

Company’s cash equivalents approximated their recorded value.

As of January 3, 2009, the fair value of the Company’s long-term debt was approximately $1,367,000.

Derivative Instruments and Hedging:

The Company enters into interest rate swaps to hedge a substantial portion of its variable rate debt. As of

January 3, 2009 and December 29, 2007, the Company held contracts for interest rate swaps with notional

amounts totaling $900,000 and $1,050,000, respectively. The Company is hedging forecasted transactions for

periods not exceeding the next four years. At January 3, 2009, given the current configuration of its debt, the

Company estimates that no derivative gains or losses reported in accumulated other comprehensive income (loss)

will be reclassified to the Statement of Operations within the next twelve months. See also Note 20.

As of January 3, 2009 and December 29, 2007, cumulative losses for qualifying hedges were reported as a

component of accumulated other comprehensive income (loss) in the amounts of $37,326 ($61,193 before taxes)

and $14,994 ($24,582 before taxes), respectively.

For the fiscal years ended January 3, 2009, December 29, 2007 and December 30, 2006, there were no fair

value adjustments recorded in the statement of operations since all hedges were considered qualifying.

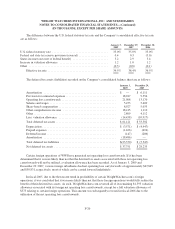

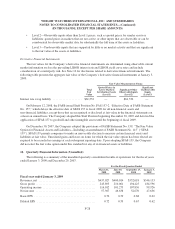

17. Fair Value Measurements

On December 30, 2007, the Company adopted the provisions of FASB Statement No. 157, “Fair Value

Measurements” (“SFAS 157”), which establishes a framework for measuring fair value and expands disclosures

about fair value measurements. SFAS 157 defines fair value as the exchange price that would be received for an

asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or

liability in an orderly transaction between market participants on the measurement date. SFAS 157 also

establishes a fair value hierarchy, which requires an entity to maximize the use of observable inputs and

minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs

that may be used to measure fair value:

• Level 1—Quoted prices in active markets for identical assets or liabilities.

F-27