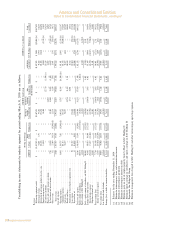

U-Haul 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75 I AMERCO ANNUAL REPORT

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

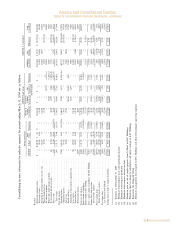

interest of SAC Holdings is controlled by Mark V.

Shoen, a significant shareholder and executive officer

of AMERCO. The Company does not have an equity

ownershipinterestinSACHoldings,exceptforminority

investments made by RepWest and Oxford in a SAC

Holdings-controlled limited partnership which holds

Canadianself-storageproperties.TheCompanyreceived

cashinterestpaymentsof$11.7millionand$26.6million,

fromSACHoldingsduringfiscal2005andfiscal2004.

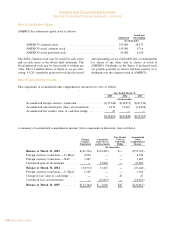

The notes receivable balance outstanding at March 31,

2005 and 2004 was, in the aggregate, $203.8 million.

The largest aggregate amount outstanding during the

fiscal year ended March 31, 2005 was $203.8 million.

Of this amount, $75.1 million is with SAC Holding II

Corporationandeliminatesinconsolidation.

Interestaccruesontheoutstandingprincipalbalanceof

juniornotesofSACHoldingsthattheCompanyholdsat

astatedrateofbasicinterest.Afixedportionofthatbasic

interestispaidonamonthlybasis.

Additional interest is paid on the same payment date

basedontheamountofremainingbasicinterestdueand

on the cash flow generated by the underlying property.

This amount is referred to as the “cash flow-based

calculation.”

To the extent that this “cash flow-based calculation” is

less than the amount of remaining basic interest, the

additional interest payable on the applicable monthly

date is limited to the amount of that “cash flow-based

calculation.”Insuchacase,theexcessoftheremaining

basic interest over the “cash flow-based calculation”

is deferred and all amounts so deferred bear the stated

rate of basic interest until maturity of the junior note.

For the note with SAC Holding II Corporation and for

certainnoteswithspecifiedsubsidiariesofSACHolding

Corporation, to the extent that this “cash flow-based

calculation” exceeds the amount of remaining basic

interest,contingentinterestispaidonthesamemonthly

date as the fixed portion of basic interest. In addition,

subject to certain contingencies, the note with SAC

Holding II Corporation and certain notes with SAC

HoldingCorporationprovidethattheholderofthenoteis

entitledtoparticipateinanyappreciationrealizedupon,

among other things, the sale of certain properties by

SACHoldings.

The Company currently manages the self-storage

properties owned by SAC Holdings, Mercury, 4 SAC,

5 SAC and 19 SAC pursuant to a standard form of

management agreement, under which the Company

receivesamanagementfeebasedongrossreceipts.The

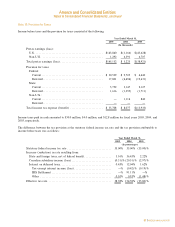

Company received management fees of $14.4 million,

and$12.9millionduringfiscalyear2005and2004.This

management fee is consistent with the fee received for

otherpropertiestheCompanymanagesforthirdparties.

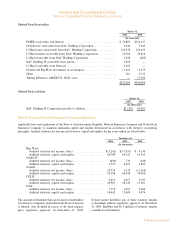

RepWest and Oxford currently hold a 46% limited

partnershipinterestinSecurespace Limited Partnership

(“Securespace”), a Nevada limited partnership. A SAC

Holdings subsidiary serves as the general partner of

Securespace and owns a 1% interest. Another SAC

Holdings subsidiary owns the remaining 53% limited

partnership interest in Securespace. Securespace was

formed by SAC Holdings to be the owner of various

Canadianself-storageproperties.RepWest’sandOxford’s

investment in Securespace is included in Investments,

Other, and is accounted for using the equity method.

We do not believe that the carrying amount of their

investmentsinSecurespaceisinexcessoffairvalue.

During fiscal 2005, the Company leased space for

marketingcompanyoffices,vehiclerepairshopsandhitch

installationcentersinpropertiesownedbysubsidiariesof

SAC Holdings. Total lease payments pursuant to such

leases were$2.7millionand $2.6millionduringfiscal

2005andfiscal2004.Thetermsoftheleasesaresimilar

to the terms of leases for other properties owned by

unrelatedpartiesthatareleasedtotheCompany.

AtMarch31,2005,subsidiariesofSACHoldingsacted

asU-Haulindependentdealers.The financialandother

terms of the dealership contracts with subsidiaries of

SAC Holdings are substantially identical to the terms

ofthosewiththeCompany’sotherindependentdealers.

During fiscal 2005 and fiscal 2004, the Company

paid subsidiaries of SAC Holdings $33.1 million and

$29.1 million in commissions pursuant to such

dealershipcontracts.

SAC Holdings was established in order to acquire self-

storageproperties.These propertiesare beingmanaged

by the Company pursuant to management agreements.

The sale of self-storage properties by the Company to

SAC Holdingshas inthe pastprovidedsignificantcash

flows to the Company and the Company’s outstanding

loanstoSACHoldingsentitletheCompanytoparticipate

in SAC Holdings’ excess cash flows (after senior

debtservice).