U-Haul 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69 I AMERCO ANNUAL REPORT

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

ESOP Plan

The Company also provides an Employee Stock Ownership Plan (the “Plan”) under which the Company may make

contributions of its common stock or cash to acquire such stock on behalf of participants. Generally, employees are

eligible to participate in the Plan upon completion of one year of service. The Company has arranged financing to

fundthePlanTrust(ESOT)andtoenabletheESOTtopurchaseshares.Listedbelowisasummaryofthesefinancing

arrangementsasoffiscalyear-end:

Sharesarereleasedfromcollateralandallocatedtoactiveemployeesbasedontheproportionofdebtservicepaidinthe

planyear.ContributionstotheESOTthatwerechargedtoexpenseduringfiscal2005,2004and2003were$2.1million,

$2.1millionand$2.2million,respectively.

SharesheldbythePlanasofyear-endwereasfollows:

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

accumulation of funds for retirement on a tax-deferred basis and provide for annual discretionary employer

contributions. Amounts to be contributed are determined by the chief executive officer of the Company under

the delegation of authority from the Board of Directors, pursuant to the terms of the Profit Sharing Plan. No

contributions were made to the profit sharing plan during fiscal 2005, 2004 or 2003.

The Company also provides an employee savings plan which allows participants to defer income under

Section 401(k) of the Internal Revenue Code of 1986.

ESOP Plan

The Company also provides an Employee Stock Ownership Plan (the ""Plan'') under which the Company

may make contributions of its common stock or cash to acquire such stock on behalf of participants.

Generally, employees are eligible to participate in the Plan upon completion of one year of service. The

Company has arranged financing to fund the Plan Trust (ESOT) and to enable the ESOT to purchase shares.

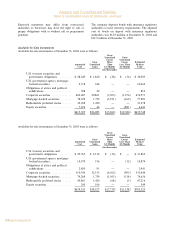

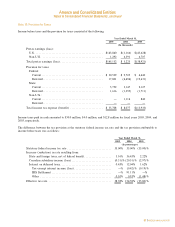

Listed below is a summary of these financing arrangements as of fiscal year-end:

Outstanding as of Interest Payments

March 31,

Financing Date 2005 2005 2004 2003

(In thousands)

June, 1991 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,583 $1,008 $1,159 $978

March, 1999ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 100 8 11 11

February, 2000ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 628 54 74 62

April, 2001 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 121 9 12 5

Shares are released from collateral and allocated to active employees based on the proportion of debt

service paid in the plan year. Contributions to the ESOT that were charged to expense during fiscal 2005, 2004

and 2003 were $2.1 million, $2.1 million and $2.2 million, respectively.

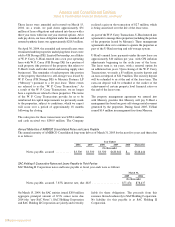

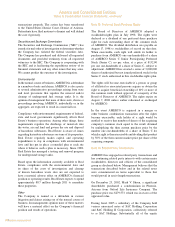

Shares held by the Plan as of year-end were as follows:

March 31,

2005 2004

(In thousands)

Allocated shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,514 1,577

Unreleased shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 652 727

Fair value of unreleased sharesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $21,554 $12,249

For purposes of the above schedule, the fair value of unreleased shares issued prior to 1992 is defined as

the historical cost of such shares. The fair value of unreleased shares issued subsequent to December 31, 1992

is defined as the trading value of such shares as of March 31, 2005 and March 31, 2004, respectively.

Insurance Plans

Oxford insures various group life and group disability insurance plans covering employees of the

Company. Premiums earned by Oxford on these policies were $1.5 million, $4.5 million and $4.4 million for

the years ended December 31, 2004, 2003, and 2002, respectively. The group life premiums are paid by the

Company and those amounts were eliminated from the Company's financial statements in consolidation.

Post Retirement and Post Employment Benefits

The Company provides medical and life insurance benefits to eligible employees and dependents. To be

eligible, employees need to be over age 65 and meet specified years of service requirements. The Company

F-27

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

accumulation of funds for retirement on a tax-deferred basis and provide for annual discretionary employer

contributions. Amounts to be contributed are determined by the chief executive officer of the Company under

the delegation of authority from the Board of Directors, pursuant to the terms of the Profit Sharing Plan. No

contributions were made to the profit sharing plan during fiscal 2005, 2004 or 2003.

The Company also provides an employee savings plan which allows participants to defer income under

Section 401(k) of the Internal Revenue Code of 1986.

ESOP Plan

The Company also provides an Employee Stock Ownership Plan (the ""Plan'') under which the Company

may make contributions of its common stock or cash to acquire such stock on behalf of participants.

Generally, employees are eligible to participate in the Plan upon completion of one year of service. The

Company has arranged financing to fund the Plan Trust (ESOT) and to enable the ESOT to purchase shares.

Listed below is a summary of these financing arrangements as of fiscal year-end:

Outstanding as of Interest Payments

March 31,

Financing Date 2005 2005 2004 2003

(In thousands)

June, 1991 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,583 $1,008 $1,159 $978

March, 1999ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 100 8 11 11

February, 2000ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 628 54 74 62

April, 2001 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 121 9 12 5

Shares are released from collateral and allocated to active employees based on the proportion of debt

service paid in the plan year. Contributions to the ESOT that were charged to expense during fiscal 2005, 2004

and 2003 were $2.1 million, $2.1 million and $2.2 million, respectively.

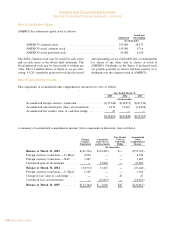

Shares held by the Plan as of year-end were as follows:

March 31,

2005 2004

(In thousands)

Allocated shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,514 1,577

Unreleased shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 652 727

Fair value of unreleased sharesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $21,554 $12,249

For purposes of the above schedule, the fair value of unreleased shares issued prior to 1992 is defined as

the historical cost of such shares. The fair value of unreleased shares issued subsequent to December 31, 1992

is defined as the trading value of such shares as of March 31, 2005 and March 31, 2004, respectively.

Insurance Plans

Oxford insures various group life and group disability insurance plans covering employees of the

Company. Premiums earned by Oxford on these policies were $1.5 million, $4.5 million and $4.4 million for

the years ended December 31, 2004, 2003, and 2002, respectively. The group life premiums are paid by the

Company and those amounts were eliminated from the Company's financial statements in consolidation.

Post Retirement and Post Employment Benefits

The Company provides medical and life insurance benefits to eligible employees and dependents. To be

eligible, employees need to be over age 65 and meet specified years of service requirements. The Company

F-27

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

uses the accrual method of accounting for post-retirement benefits and funds these benefit costs as claims are

incurred.

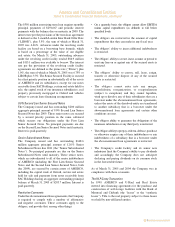

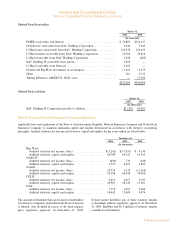

The components of net periodic post retirement benefit cost for fiscal years ended March 31, 2005, 2004

and 2003 were as follows:

Year Ended March 31,

2005 2004 2003

(In thousands)

Service cost for benefits earned during the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 316 $ 315 $ 299

Interest cost on accumulated postretirement benefit ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 313 331 355

Other components ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (317) (549) (279)

Net periodic postretirement benefit cost ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 312 $ 97 $ 375

The fiscal 2005 and fiscal 2004 post retirement benefit liability included the following components:

Year Ended

March 31,

2005 2004

(In thousands)

Beginning of year ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $5,074 $4,978

Service cost for benefits earned during the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 316 315

Interest cost on accumulated post retirement benefit ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 313 331

Benefit payments and expense ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (116) (108)

Actuarial gainÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (201) (441)

Accumulated postretirement benefit obligation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,386 5,075

Unrecognized net gainÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,397 4,512

Total post retirement benefit liability ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $9,783 $9,587

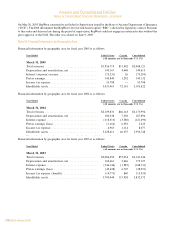

The discount rate assumptions in computing the information above were as follows:

March 31,

2005 2004 2003

(In percentages)

Accumulated postretirement benefit obligation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5.75% 6.25% 6.75%

The discount rate represents the expected yield on a portfolio of high grade (AA to AAA rated or

equivalent) fixed income investments with cash flow streams sufficient to satisfy benefit obligations under the

plan when due. Fluctuations in the discount rate assumptions primarily reflect changes in U.S. interest rates.

The estimated health care cost inflation rates used to measure the accumulated post retirement benefit

obligation was 5.75% in fiscal 2005, which was projected to decline annually to an ultimate rate of 4.20% in

fiscal 2017.

If the estimated health care cost inflation rate assumptions were increased by one percent, the

accumulated post retirement benefit obligation as of fiscal year-end would increase by approximately

$379,653. A decrease in the estimated health care cost inflation rate assumption of one percent would

decrease the accumulated post retirement benefit obligation as of fiscal year-end by $413,256.

Post employment benefits provided by the Company, other than retirement, are not material.

F-28

For purposes of the above schedule, the fair value of

unreleasedsharesissuedpriorto1992isdefinedasthe

historicalcostofsuchshares.Thefairvalueofunreleased

sharesissuedsubsequenttoDecember31,1992isdefined

asthetradingvalueofsuchsharesasofMarch31,2005

andMarch31,2004,respectively.

Insurance Plans

Oxford insures various group life and group disability

insurance plans covering employees of the Company.

PremiumsearnedbyOxfordonthesepolicieswere$1.5

million,$4.5millionand$4.4millionfortheyearsended

December 31, 2004, 2003, and 2002, respectively. The

grouplifepremiumsarepaidbytheCompanyandthose

amountswereeliminatedfromtheCompany’sfinancial

statementsinconsolidation.

Post Retirement and Post Employment Benefits

The Company provides medical and life insurance

benefits to eligible employees and dependents. To be

eligible, employees need to be over age 65 and meet

specified years of service requirements. The Company

usestheaccrualmethodofaccountingforpost-retirement

benefits and funds these benefit costs as claims are

incurred.

ThecomponentsofnetperiodicpostretirementbenefitcostforfiscalyearsendedMarch31,2005,2004and2003were

asfollows: