U-Haul 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63 I AMERCO ANNUAL REPORT

• On a quarterly basis, the obligors cannot allow EBITDA

minus capital expenditures (as defined) to fall below

specifiedlevels.

• The obligors are restricted in the amount of capital

expendituresthattheycanmakeinanyfiscalyear.

• Theobligors’abilitytoincuradditionalindebtedness

isrestricted.

• Theobligors’abilitytocreate,incur,assumeorpermitto

existanylienonoragainstanyofthesecuredassetsis

restricted.

• The obligors’ ability to convey, sell, lease, assign,

transfer or otherwise dispose of any of the secured

assetsisrestricted.

• The obligors cannot enter into any merger,

consolidation, reorganization, or recapitalization

(subject to exceptions) and they cannot liquidate,

windupordissolveanyoftheirsubsidiariesthatarea

borrowerundertheabovementionedloanagreements,

unlesstheassetsofthedissolvedentityaretransferred

to another subsidiary that is a borrower under the

abovementioned loan agreements and certain other

conditionsaremet.

• The obligorsability toguaranteetheobligationsof the

insurancesubsidiariesoranythirdpartyisrestricted.

• Theobligorsabilitytoprepay,redeem,defease,purchase

orotherwiseacquireanyoftheirindebtednessorany

indebtednessofasubsidiarythatisaborrowerunder

theabovementionedloanagreementsisrestricted.

• The Company’s credit facility and its senior note

indentureslimittheCompany’sabilitytopaydividends

and accordingly, the Company does not anticipate

declaringand payingdividendson itscommonstock

intheforeseeablefuture.

As of March 31, 2005 and 2004 the Company was in

compliancewiththesecovenants.

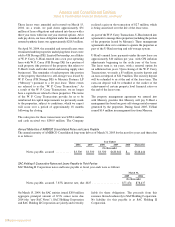

The W.P.Carey Transaction

In 1999, AMERCO and U-Haul and Real Estate

entered into financingagreements forthe purchase and

construction of self-storage facilities with the Bank of

Montreal and Citibank (the “leases” or the “synthetic

leases”).Titletotherealpropertysubjecttotheseleases

washeldbynon-affiliatedentities.

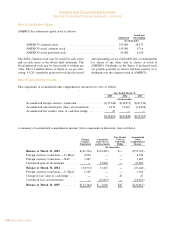

The$350millionamortizingtermloanrequiresmonthly

principal payments of $291,667 and periodic interest

paymentswiththebalancedueonmaturityin2009.The

interestratepertheprovisionsofthetermloanagreement

isdefinedasthe3-monthLondonInterBankOfferRate

(“LIBOR”), plus 3.5%, the sum of which at March 31,

2005 was 6.46%. Advances under the revolving credit

facility are based on a borrowing base formula, which

is based on a percentage of the value of our eligible

real estate. On March 31, 2005, outstanding advances

under therevolvingcreditfacility totaled $84.9million

and$115.1millionwasavailabletoborrow.Theinterest

rate per the provisions of the revolving credit facility

agreementsaredefinedastheprimerate(“Prime”)plus

1.0%,thesumofwhichatMarch31,2005was6.75%or

LIBORplus3.5%.TheSeniorSecuredFacilityissecured

byafirstprioritypositioninsubstantiallyalloftheassets

of AMERCO and its subsidiaries, except for our notes

receivablefromSACHoldings,certainrealestateheldfor

sale,thecapitalstockofourinsurancesubsidiaries,real

property previously mortgaged to Oxford and vehicles

subjecttocertainleasefinancingarrangements.

9.0% Second Lien Senior Secured Notes

The Companyissuedandhas outstanding$200million

aggregateprincipalamountof9.0%SecondLienSenior

SecuredNotesdue2009.Theseseniornotesaresecured

by a second priority position in the same collateral

which secures our obligations under the First Lien

Senior Secured Notes. No principal payments are due

ontheSecondLienSeniorSecuredNotesuntilmaturity.

Interestispaidquarterly.

Senior Subordinated Notes

The Company issued and has outstanding $148.6

million aggregate principal amount of 12.0% Senior

SubordinatedNotesdue2011(the“SeniorSubordinated

Notes”). No principal payments are due on the Senior

Subordinated Notes until maturity. These senior notes,

whicharesubordinatedtoalloftheseniorindebtedness

of AMERCO (including the First Lien Senior Secured

Notesand the SecondLienSeniorSecured Notes, both

due 2009), are secured by certain assets of AMERCO,

includingthecapitalstockofOxford,certainrealestate

held for sale and payments from notes receivable from

SACHoldingshavinganaggregateoutstandingprincipal

balanceatMarch31,2005of$203.7million.Interestis

paidquarterly.

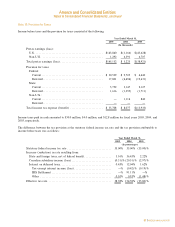

Restrictive Covenants

Undertheabovementionedloanagreements,theCompany

is required to comply with a number of affirmative

and negative covenants. These covenants apply to the

obligors,andprovidethat,amongotherthings:

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued