U-Haul 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 I AMERCO ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

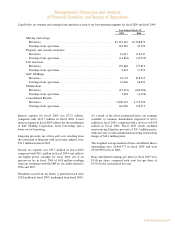

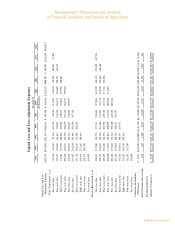

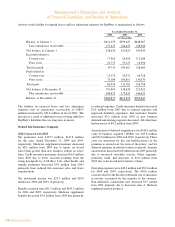

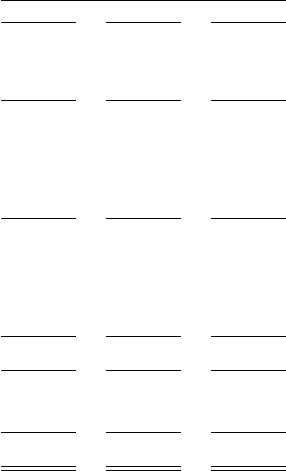

ActivityintheliabilityforunpaidlossesandlossadjustmentexpensesforRepWestissummarizedasfollows:

Activity in the liability for unpaid losses and loss adjustment expenses for RepWest is summarized as

follows:

Year Ended December 31,

2004 2003 2002

(In thousands)

Balance at January 1 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $416,259 $399,447 $448,987

Less reinsurance recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 177,635 146,622 128,044

Net balance at January 1ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 238,624 252,825 320,943

Incurred related to:

Current year ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,960 56,454 112,284

Prior years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,773 53,127 16,396

Total incurred ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 39,733 109,581 128,680

Paid related to:

Current year ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 13,570 22,931 66,728

Prior years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 73,384 100,851 130,070

Total paidÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 86,954 123,782 196,798

Net balance at December 31ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 191,403 238,624 252,825

Plus reinsurance recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 189,472 177,635 146,622

Balance at December 31 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $380,875 $416,259 $399,447

The liability for incurred losses and loss adjustment expenses (net of reinsurance recoverable of

$189.5 million) increased by $21.8 million in fiscal 2004. The increase is a result of additional reserves being

added for RepWest's liabilities that are long term in nature.

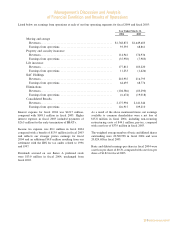

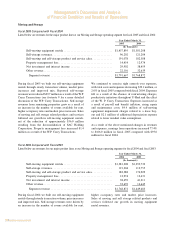

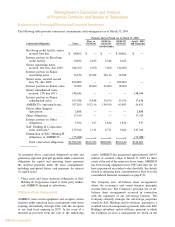

Oxford Life Insurance Company

2004 Compared with 2003

Net premiums were $127.7 million, $147.8 million for the years ended December 31, 2004 and 2003,

respectively. Medicare supplement premiums decreased by $8.2 million from 2003 due to lapses on closed

lines being greater than new business written on active lines. Credit insurance premiums decreased

$6.9 million from 2003 due to fewer accounts resulting from the rating downgrade by A.M. Best. Life, other

health, and annuity premiums decreased $5.0 million from 2003 primarily from reduced life insurance sales

and fewer annuitizations.

Net investment income was $23.5 million and $19.0 million for 2004 and 2003, respectively.

Benefits incurred were $91.5 million and $103.5 million for 2004 and 2003, respectively. Medicare

supplement benefits decreased $5.8 million from 2003 due primarily to reduced exposure. Credit insurance

benefits decreased $2.8 million from 2003 due to reduced exposure and improved disability experience. Life

insurance benefits decreased $3.6 million from 2003 as new business declined and existing exposure decreased.

All other lines had increases of $0.2 million from 2003.

Amortization of deferred acquisition costs (DAC) and the value of business acquired (VOBA) was

$23.8 million and $25.0 million for 2004 and 2003, respectively. These costs are amortized for life and health

policies as the premium is earned over the term of the policy; and for deferred annuities in relation to interest

spreads. Annuity amortization increased $0.8 million from 2003 primarily due to increased surrender activity.

Other segments, primarily credit, had decreases of $2.0 million from 2003 due to decreased new business

volume.

Operating expenses were $42.2 million and $38.1 million for 2004 and 2003, respectively. The

$10.6 million accrual related to the Kocher settlement, net of insurance recoveries, accounted for the majority

27

The liability for incurred losses and loss adjustment

expenses (net of reinsurance recoverable of $189.5

million)increased by$21.8 millionin fiscal2004.The

increaseisaresultofadditionalreservesbeingaddedfor

RepWest’sliabilitiesthatarelongterminnature.

OxfordLifeInsuranceCompany

2004 Compared with 2003

Net premiums were $127.7 million, $147.8 million

for the years ended December 31, 2004 and 2003,

respectively. Medicare supplement premiums decreased

by $8.2 million from 2003 due to lapses on closed

lines beinggreater than newbusiness written onactive

lines.Creditinsurancepremiumsdecreased$6.9million

from 2003 due to fewer accounts resulting from the

ratingdowngradebyA.M.Best.Life,other health, and

annuity premiums decreased $5.0 million from 2003

primarily from reduced life insurance sales and fewer

annuitizations.

Net investment income was $23.5 million and $19.0

millionfor2004and2003,respectively.

Benefitsincurredwere$91.5millionand$103.5million

for 2004 and 2003, respectively. Medicare supplement

benefitsdecreased$5.8millionfrom2003dueprimarily

toreducedexposure.Creditinsurancebenefitsdecreased

$2.8 million from 2003 due to reduced exposure and

improved disability experience. Life insurance benefits

decreased $3.6 million from 2003 as new business

declinedandexistingexposuredecreased.Allotherlines

hadincreasesof$0.2millionfrom2003.

Amortizationofdeferredacquisitioncosts(DAC)andthe

value of business acquired (VOBA) was $23.8 million

and$25.0millionfor2004and2003,respectively.These

costs are amortized for life and health policies as the

premiumis earned over the termofthe policy;and for

deferredannuitiesinrelationtointerestspreads.Annuity

amortizationincreased$0.8millionfrom2003primarily

due to increased surrender activity. Other segments,

primarily credit, had decreases of $2.0 million from

2003duetodecreasednewbusinessvolume.

Operatingexpenseswere$42.2millionand$38.1million

for 2004 and 2003, respectively. The $10.6 million

accrualrelatedtotheKochersettlement,netofinsurance

recoveries, accounted for the majority of the variance.

Non-deferrable

commissions have decreased $5.5 million

from 2003 primarily due to decreased sales of Medicare

supplementandlife

products.