U-Haul 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24 I AMERCO ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

assumptionsbemadetoestimatethevalueoftheentity

andajudgmentbemadeastowhetherornottheentity

has the financial strength to fund its own operations

and execute its business plan without the subordinated

financialsupportofanothercompany.

InFebruary,2004,SACHoldingCorporationrestructured

theindebtednessofthreesubsidiariesandthendistributed

its interest in those subsidiaries to its sole shareholder.

This triggered a requirement to reassess AMERCO’s

involvement with those subsidiaries, which led to the

conclusionthatbasedonthenexistingcurrentcontractual

and ownership interests between AMERCO and this

entity, AMERCO ceased to have a variable interest in

thosethreesubsidiariesatthatdate.

Separately, in March 2004, SAC Holding Corporation

restructured its indebtedness, triggering a similar

reassessmentofSACHoldingCorporationthatledtothe

conclusionthatSACHoldingCorporationwasnotaVIE

andthatAMERCOceasedtobetheprimarybeneficiaryof

SACHoldingCorporationanditsremainingsubsidiaries,

based onSAC HoldingCorporation’sability tofund its

ownoperationsandexecuteitsbusinessplanwithoutany

futuresubordinatedfinancialsupport.

Accordingly, at the dates AMERCO ceased to have a

variableinterestandceasedtobetheprimarybeneficiary,

itdeconsolidatedthoseentities.Thedeconsolidationwas

accounted for as a distribution of AMERCO’s interests

to the sole shareholder of the SAC entities. Because of

AMERCO’s continuing involvement with SAC Holding

Corporationanditscurrentandformersubsidiaries,the

distributionsdonotqualifyasdiscontinuedoperationsas

definedbySFASNo.144.

It is possible that SAC Holding Corporation could take

actions that would require us to re-determine whether

SAC Holding Corporation was a VIE or whether we

have become the primary beneficiary of SAC Holding

Corporation.Shouldthisoccur,wecouldberequiredto

re-consolidate someorallofSAC HoldingCorporation

withourfinancialstatements.

Similarly,SACHoldingIICorporationcouldtakeactions

thatwouldrequireustore-determinewhetheritisaVIE

or whether we continue to be the primary beneficiary

ofourvariableinterestin SAC HoldingIICorporation.

Should we cease to be the primary beneficiary, we

would be required to de-consolidate some or all of our

variableinterestinSACHoldingIICorporationfromour

financialstatements.

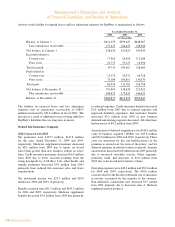

RecoverabilityofProperty,PlantandEquipment

Property, plant and equipment is stated at cost.

Interest cost incurred during the initial construction of

buildings and rental equipment is considered part of

cost. Depreciation is computed for financial reporting

purposesprincipallyusingthestraight-linemethodover

the following estimated useful lives: rental equipment

2-20 years and buildings and non-rental equipment

3-55 years. Major overhauls to rental equipment are

capitalizedandareamortizedovertheestimatedperiod

benefited. Routine maintenance costs are charged to

operating expense as they are incurred. Gains and

losses on dispositions of property, plant and equipment

are netted against depreciation expense when realized.

Depreciation is recognized in amounts expected to

resultintherecoveryofestimatedresidualvaluesupon

disposal,i.e.,nogainsorlosses.Duringthefirstquarter

offiscal year 2005,the Companyloweredits estimates

forresidualvaluesonnewrentaltrucksandrentaltrucks

purchasedoffTRACleasesfrom25%oftheoriginalcost

to20%.Indeterminingthe depreciationrate,historical

disposal experience, holding periods and trends in the

marketforvehiclesarereviewed.

Weregularlyperformreviewstodeterminewhetherfacts

andcircumstancesexistwhichindicatethatthecarrying

amount of assets, including estimates of residual value,

maynotberecoverableorthattheusefullifeofassetsis

shorter or longer than originally estimated. Reductions

inresidualvalues(i.e.,thepriceatwhichweultimately

expecttodisposeofrevenueearningequipment)oruseful

lives will result in an increase in depreciation expense

over the life of the equipment. Reviews are performed

basedonvehicleclass,generallysubcategoriesoftrucks

and trailers. We assess the recoverability of the cost of

ourassetsbycomparingtheprojectedundiscountednet

cashflowsassociatedwiththerelatedassetorgroupof

assetsovertheirestimatedremaininglivesagainsttheir

respectivecarryingamounts.Weconsiderfactorssuchas

currentandexpectedfuturemarketpricetrendsonused

vehiclesandtheexpectedlifeofvehiclesincludedinthe

fleet. Impairment, if any, is based on the excess of the

carryingamountoverthefairvalueofthoseassets.Ifthe

remainingcostofassetsisdeterminedtoberecoverable,

buttheusefullivesareshorterorlongerthanoriginally

estimated,thenetbookvalueoftheassetsisdepreciated

overthenewlydeterminedremainingusefullives.

Duringthefourthquarteroffiscalyear2005,basedonan

economic market analysis, the Company decreased the

estimatedresidualvalueofcertainrentaltrucks.Theeffect

ofthechangedecreasedpre-taxincomeforfiscal2005

by$2.1million.Thein-houseanalysisofsalesoftrucks

comparedthetruckmodel,size,ageandaverageresidual

valueofunitssold.Basedontheanalysis,theestimated

residual values are decreased to approximately 20% of

historiccost.Theadjustmentreflectsmanagement’sbest

estimate,basedoninformationavailable,oftheestimated

residualvalueoftheserentaltrucks.