U-Haul 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68 I AMERCO ANNUAL REPORT

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

Under the provisions of the Tax Reform Act of 1984

(the Act), the balance in Oxford’s account designated

“Policyholders’ Surplus Account” is frozen at its

December 31, 1983 balance of $19.3 million. Federal

income taxes (Phase III) will be payable thereon at

applicable current rates if amounts in this account are

distributedtothestockholderortotheextenttheaccount

exceedsaprescribed maximum.Oxforddidnotincura

PhaseIIIliabilityfortheyearsendedDecember31,2004,

2003and2002.

AtMarch31,2005andMarch31,2004,theAMERCO

affiliated group has non-life net operating loss

carryforwardsavailabletooffsetfederaltaxableincomein

futureyearsof$0and$95.4million,respectively.These

carryforwards expire in 2012 through 2020. At March

31,2005andMarch31,2004,AMERCOhasalternative

minimumtaxcreditcarryforwardsof$19.1millionand

$9.6million,respectively,whichdonothaveanexpiration

date,andmayonlybeutilizedinyearsinwhichregular

taxexceedsalternativeminimumtax.AtMarch31,2005

and March 31, 2004, U-HAUL Co. (Canada) Ltd. has

net Canadian operating loss carryforwards available to

offset Canadian taxable income of $5.5 million, stated

inU.S.dollars.Thesecarryforwardsexpirein2012and

2011respectively.

SACHoldingsbegantofiletaxreturnsinthefiscalyear

endingMarch31, 2003,andhasnetoperatinglossesof

$20.6millionand$14.2millioninthefiscalyearsending

March31,2005andMarch31,2004,respectively,tooffset

taxable income in future years. These carryforwards

expirein2024and2025.

UndercertaincircumstancesandsectionsoftheInternal

RevenueCode, achangein ownershipfor tax purposes

willlimittheamountofnetoperatinglosscarryforwards

thatcanbeusedtooffsetfuturetaxableincome.

Note 14: Employee Benefit Plans

Profit Sharing Plans

The Company provides tax-qualified profit sharing

retirement plans for the benefit of eligible employees,

former employees and retirees in the U.S. and Canada.

The plans are designed to provide employees with an

accumulation of funds for retirement on a tax-deferred

basis and provide for annual discretionary employer

contributions.Amountstobecontributedaredetermined

by the chief executive officer of the Company under

thedelegationofauthorityfromtheBoardofDirectors,

pursuant to the terms of the Profit Sharing Plan. No

contributionsweremadetotheprofitsharingplanduring

fiscal2005,2004or2003.

The Company also provides an employee savings plan

whichallowsparticipantstodeferincomeunderSection

401(k)oftheInternalRevenueCodeof1986.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

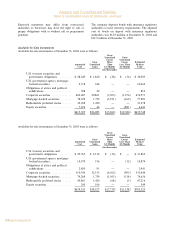

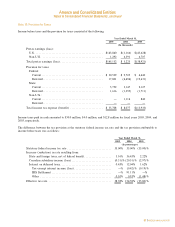

Significant components of the Company's deferred tax assets and liabilities at fiscal year-ends were as

follows:

March 31,

2005 2004

(In thousands)

Deferred tax assets:

Net operating loss and credit carryforwards ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 27,183 $ 48,287

Accrued expensesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 102,962 91,780

Deferred revenue from sale/leasebackÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 9,772

Policy benefit and losses, claims and loss expenses payable, net ÏÏÏÏÏÏÏ 21,048 22,767

Unrealized gains and (losses) ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,235 (1,442)

Total deferred tax assets ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 158,428 171,164

Deferred tax liabilities:

Property, plant and equipment ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 214,562 211,682

Deferred policy acquistion costs ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,367 16,107

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,623 7,175

Total deferred tax liabilities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 236,552 234,964

Net deferred tax liabilityÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 78,124 $ 63,800

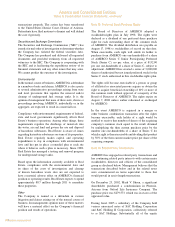

Under the provisions of the Tax Reform Act of 1984 (the Act), the balance in Oxford's account

designated ""Policyholders' Surplus Account'' is frozen at its December 31, 1983 balance of $19.3 million.

Federal income taxes (Phase III) will be payable thereon at applicable current rates if amounts in this

account are distributed to the stockholder or to the extent the account exceeds a prescribed maximum. Oxford

did not incur a Phase III liability for the years ended December 31, 2004, 2003 and 2002.

At March 31, 2005 and March 31, 2004, the AMERCO affiliated group has non-life net operating loss

carryforwards available to offset federal taxable income in future years of $0 and $95.4 million, respectively.

These carryforwards expire in 2012 through 2020. At March 31, 2005 and March 31, 2004, AMERCO has

alternative minimum tax credit carryforwards of $19.1 million and $9.6 million, respectively, which do not

have an expiration date, and may only be utilized in years in which regular tax exceeds alternative minimum

tax. At March 31, 2005 and March 31, 2004, U-HAUL Co. (Canada) Ltd. has net Canadian operating loss

carryforwards available to offset Canadian taxable income of $5.5 million, stated in U.S. dollars. These

carryforwards expire in 2012 and 2011 respectively.

SAC Holdings began to file tax returns in the fiscal year ending March 31, 2003, and has net operating

losses of $20.6 million and $14.2 million in the fiscal years ending March 31, 2005 and March 31, 2004,

respectively, to offset taxable income in future years. These carryforwards expire in 2024 and 2025.

Under certain circumstances and sections of the Internal Revenue Code, a change in ownership for tax

purposes will limit the amount of net operating loss carryforwards that can be used to offset future taxable

income.

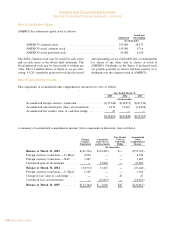

Note 14: Employee Benefit Plans

Profit Sharing Plans

The Company provides tax-qualified profit sharing retirement plans for the benefit of eligible employees,

former employees and retirees in the U.S. and Canada. The plans are designed to provide employees with an

F-26

SignificantcomponentsoftheCompany’sdeferredtaxassetsandliabilitiesatfiscalyear-endswereasfollows: