U-Haul 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35 I AMERCO ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

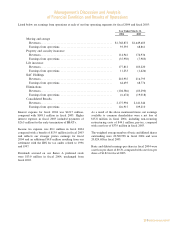

Earnings from operations were $2.1 million and $11.3

million for 2004 and 2003, respectively. The decrease

in2004from2003isdueprimarilytothe$10.6million

accrual for the Kocher settlement offset by improved

investment income, and positive loss experience in the

MedicaresupplementandCreditinsurancesegments.

2003 Compared with 2002

Net premiums were $147.8 million and $161.4 million

for 2003 and 2002, respectively. Medicare supplement

premiums decreased by $3.5 million from 2002. Life

Insurance premiums decreased $4.1 million from

2002. Credit life and disability premiums decreased

$4.8 million from 2002 due to account cancellations

and decreased penetration. Other health and annuity

premiums decreased $1.3 million from 2002 primarily

fromreducedlifeinsurancesales.

Net investment income was $19.0 million and $13.9

million for 2003 and 2002, respectively. The increase

from2002isduetofewercapitallossesandfewerlimited

partnership losses offset by a lower invested asset base

andreducedreinvestmentrates.

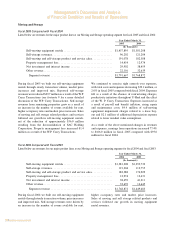

Benefitsincurredwere$103.5millionand$115.6million

for 2003 and 2002, respectively. Medicare supplement

benefitsdecreased$6.5millionfrom2002primarilydue

to decreased exposure and improved experience. Credit

insurance benefits decreased $2.3 million from 2002

due to reduced exposure. Benefits from other health

linesincreased$0.3millionfrom2002duetoincreased

morbidity. Annuity and life benefits decreased $3.6

million from 2002 due to decreases in life insurance

exposure.

Amortizationofdeferredacquisitioncosts(DAC)andthe

value of business acquired (VOBA) was $25.0 million

and $20.5 million for 2003 and 2002, respectively.

These costs are amortized for life and health policies

as the premium is earned over the term of the policy;

andfordeferredannuitiesinrelationtointerestspreads.

Amortizationassociatedwithannuitypoliciesincreased

$6.4 million from 2002 primarily due to increased

surrenderactivity.Othersegmentsdecreased$1.9million

from2002duetodecreasednewbusinessvolume.

Operatingexpenseswere$38.1millionand$48.5million

for2003and2002,respectively.Commissionsdecreased

$4.1millionfrom2002primarilyduetodecreasesinnew

business.Generalandadministrativeexpensesdecreased

$6.3millionfrom2002.

Earnings/(losses) from operations were $11.3 million

and ($1.4) million for 2003 and 2002, respectively.

The increase from 2002 is due primarily from fewer

other than temporary declines in the investment

portfolio and improved loss ratios in the Medicare

supplementsegment.