U-Haul 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30 I AMERCO ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

MovingandStorage

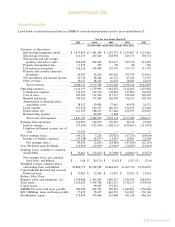

Fiscal 2005 Compared with Fiscal 2004

ListedbelowarerevenuesforthemajorproductlinesatourMovingandStorageoperatingsegmentforfiscal2005andfiscal2004:

Moving and Storage

Fiscal 2005 Compared with Fiscal 2004

Listed below are revenues for the major product lines at our Moving and Storage operating segment for

fiscal 2005 and fiscal 2004:

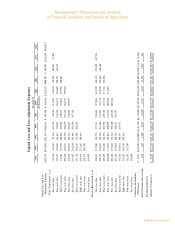

Year Ended March 31,

2005 2004

(In thousands)

Self-moving equipment rentals ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,437,895 $1,381,208

Self-storage revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 96,202 121,204

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 191,078 182,388

Property management fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14,434 12,974

Net investment and interest income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 29,902 38,459

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 22,156 32,639

Segment revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,791,667 $1,768,872

During fiscal 2005 we built our self-moving equipment rentals through steady transaction volume, modest

price increases and improved mix. Reported self-storage revenues were reduced $29.7 million as a result of the

W.P. Carey Transactions (see footnote 9 for a more detailed discussion of the W.P. Carey Transactions).

Self-storage revenues from remaining properties grew as a result of an increase in the number of rooms

available for rent, higher occupancy rates and modest price increases. Sales of moving and self storage related

products and services followed our growth in self-moving equipment rentals, net of the reduction of

approximately $36.0 million resulting from the deconsolidation of SAC Holding Corporation. Property

management fees increased $1.4 million as a result of the W.P. Carey Transactions.

We continued to exercise tight controls over expenses, with total costs and expenses decreasing

$32.1 million, or 2.0% in fiscal 2005 compared with fiscal 2004. Expenses fell as a result of the absence of

restructuring charges, productivity initiatives throughout U-Haul and the effect of the W. P. Carey

Transaction. Expenses increased as a result of payroll and benefit inflation, rising repair and maintenance

costs, $4.4 million of self-moving equipment impairment charges related to a lease buy-out and $2.1 million of

additional depreciation expense related to lower residual value assumptions.

As a result of the above mentioned changes in revenues and expenses, earnings from operations increased

77.4% to $166.0 million in fiscal 2005 compared with $93.6 million for fiscal 2004.

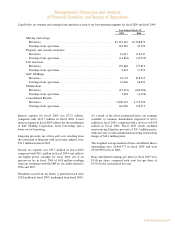

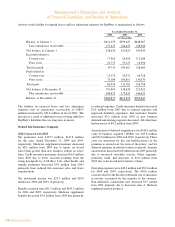

Fiscal 2004 Compared with Fiscal 2003

Listed below are revenues for our major product lines at our Moving and Storage operating segment for

fiscal 2004 and fiscal 2003:

Year Ended March 31,

2004 2003

(In thousands)

Self-moving equipment rentals ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,381,208 $1,293,732

Self-storage revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 121,204 112,755

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 182,388 174,909

Property management fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,974 12,431

Net investment and interest income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 38,459 41,211

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 32,639 14,645

Segment revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,768,872 $1,649,683

22

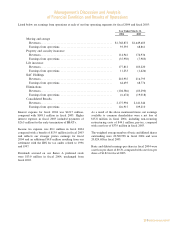

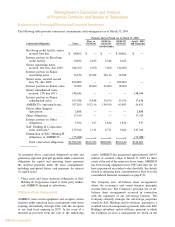

Moving and Storage

Fiscal 2005 Compared with Fiscal 2004

Listed below are revenues for the major product lines at our Moving and Storage operating segment for

fiscal 2005 and fiscal 2004:

Year Ended March 31,

2005 2004

(In thousands)

Self-moving equipment rentals ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,437,895 $1,381,208

Self-storage revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 96,202 121,204

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 191,078 182,388

Property management fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14,434 12,974

Net investment and interest income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 29,902 38,459

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 22,156 32,639

Segment revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,791,667 $1,768,872

During fiscal 2005 we built our self-moving equipment rentals through steady transaction volume, modest

price increases and improved mix. Reported self-storage revenues were reduced $29.7 million as a result of the

W.P. Carey Transactions (see footnote 9 for a more detailed discussion of the W.P. Carey Transactions).

Self-storage revenues from remaining properties grew as a result of an increase in the number of rooms

available for rent, higher occupancy rates and modest price increases. Sales of moving and self storage related

products and services followed our growth in self-moving equipment rentals, net of the reduction of

approximately $36.0 million resulting from the deconsolidation of SAC Holding Corporation. Property

management fees increased $1.4 million as a result of the W.P. Carey Transactions.

We continued to exercise tight controls over expenses, with total costs and expenses decreasing

$32.1 million, or 2.0% in fiscal 2005 compared with fiscal 2004. Expenses fell as a result of the absence of

restructuring charges, productivity initiatives throughout U-Haul and the effect of the W. P. Carey

Transaction. Expenses increased as a result of payroll and benefit inflation, rising repair and maintenance

costs, $4.4 million of self-moving equipment impairment charges related to a lease buy-out and $2.1 million of

additional depreciation expense related to lower residual value assumptions.

As a result of the above mentioned changes in revenues and expenses, earnings from operations increased

77.4% to $166.0 million in fiscal 2005 compared with $93.6 million for fiscal 2004.

Fiscal 2004 Compared with Fiscal 2003

Listed below are revenues for our major product lines at our Moving and Storage operating segment for

fiscal 2004 and fiscal 2003:

Year Ended March 31,

2004 2003

(In thousands)

Self-moving equipment rentals ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,381,208 $1,293,732

Self-storage revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 121,204 112,755

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 182,388 174,909

Property management fees ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,974 12,431

Net investment and interest income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 38,459 41,211

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 32,639 14,645

Segment revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,768,872 $1,649,683

22

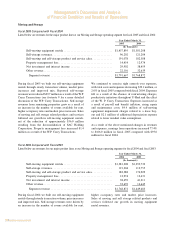

Duringfiscal 2005we builtour self-movingequipment

rentalsthroughsteadytransactionvolume,modestprice

increases and improved mix. Reported self-storage

revenueswerereduced$29.7millionasaresultoftheW.P.

Carey Transactions (see footnote 9 for a more detailed

discussionoftheW.P.CareyTransactions).Self-storage

revenues from remaining properties grew as a result of

an increase in the number of rooms available for rent,

higheroccupancyratesandmodestpriceincreases.Sales

ofmovingandselfstoragerelatedproductsandservices

followed our growth in self-moving equipment rentals,

net of the reduction of approximately $36.0 million

resulting from the deconsolidation of SAC Holding

Corporation. Property management fees increased $1.4

millionasaresultoftheW.P.CareyTransactions.

We continued to exercise tight controls over expenses,

withtotalcostsandexpensesdecreasing$32.1million,or

2.0%infiscal2005comparedwithfiscal2004.Expenses

fell as a result of the absence of restructuring charges,

productivityinitiativesthroughoutU-Haulandtheeffect

of the W. P. Carey Transaction. Expenses increased as

a result of payroll and benefit inflation, rising repair

and maintenance costs, $4.4 million of self-moving

equipment impairment charges related to a lease buy-

outand $2.1millionofadditionaldepreciationexpense

relatedtolowerresidualvalueassumptions.

Asaresultoftheabovementionedchangesinrevenues

andexpenses,earningsfromoperationsincreased77.4%

to $166.0 million in fiscal 2005 compared with $93.6

millionforfiscal2004.

Duringfiscal 2004webuiltourself-movingequipment

rentalsthroughsteadytransactionvolume,priceincreases

andimprovedmix.Self-storagerevenuesweredrivenby

an increase in the number of rooms available for rent,

higher occupancy rates and modest price increases.

Sales of moving and self storage related products and

services followed our growth in moving equipment

rentalrevenues.

Fiscal 2004 Compared with Fiscal 2003

ListedbelowarerevenuesforourmajorproductlinesatourMovingandStorageoperatingsegmentforfiscal2004andfiscal2003: