U-Haul 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 I AMERCO ANNUAL REPORT

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

SACHoldings

Fiscal 2005 Compared with Fiscal 2004

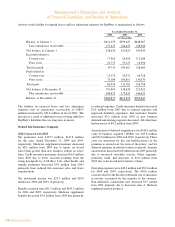

ListedbelowarerevenuesforourmajorproductlinesatSACHoldingsforfiscal2005andfiscal2004:

of the variance. Non-deferrable commissions have decreased $5.5 million from 2003 primarily due to

decreased sales of Medicare supplement and life products.

Earnings from operations were $2.1 million and $11.3 million for 2004 and 2003, respectively. The

decrease in 2004 from 2003 is due primarily to the $10.6 million accrual for the Kocher settlement offset by

improved investment income, and positive loss experience in the Medicare supplement and Credit insurance

segments.

2003 Compared with 2002

Net premiums were $147.8 million and $161.4 million for 2003 and 2002, respectively. Medicare

supplement premiums decreased by $3.5 million from 2002. Life Insurance premiums decreased $4.1 million

from 2002. Credit life and disability premiums decreased $4.8 million from 2002 due to account cancellations

and decreased penetration. Other health and annuity premiums decreased $1.3 million from 2002 primarily

from reduced life insurance sales.

Net investment income was $19.0 million and $13.9 million for 2003 and 2002, respectively. The increase

from 2002 is due to fewer capital losses and fewer limited partnership losses offset by a lower invested asset

base and reduced reinvestment rates.

Benefits incurred were $103.5 million and $115.6 million for 2003 and 2002, respectively. Medicare

supplement benefits decreased $6.5 million from 2002 primarily due to decreased exposure and improved

experience. Credit insurance benefits decreased $2.3 million from 2002 due to reduced exposure. Benefits

from other health lines increased $0.3 million from 2002 due to increased morbidity. Annuity and life benefits

decreased $3.6 million from 2002 due to decreases in life insurance exposure.

Amortization of deferred acquisition costs (DAC) and the value of business acquired (VOBA) was

$25.0 million and $20.5 million for 2003 and 2002, respectively. These costs are amortized for life and health

policies as the premium is earned over the term of the policy; and for deferred annuities in relation to interest

spreads. Amortization associated with annuity policies increased $6.4 million from 2002 primarily due to

increased surrender activity. Other segments decreased $1.9 million from 2002 due to decreased new business

volume.

Operating expenses were $38.1 million and $48.5 million for 2003 and 2002, respectively. Commissions

decreased $4.1 million from 2002 primarily due to decreases in new business. General and administrative

expenses decreased $6.3 million from 2002.

Earnings/(losses) from operations were $11.3 million and ($1.4) million for 2003 and 2002, respectively.

The increase from 2002 is due primarily from fewer other than temporary declines in the investment portfolio

and improved loss ratios in the Medicare supplement segment.

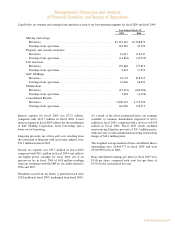

SAC Holdings

Fiscal 2005 Compared with Fiscal 2004

Listed below are revenues for our major product lines at SAC Holdings for fiscal 2005 and fiscal 2004:

Year Ended March 31,

2005 2004

(In thousands)

Self-moving rental ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 9,008 $ 29,155

Self-storage rental ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 17,953 126,436

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,020 50,577

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,191 12,787

Segment revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $43,172 $218,955

28

During March 2004, SAC Holding Corporation ceased to be a variable interest entity and AMERCO

ceased being the primary beneficiary of SAC Holding Corporation. As a result of this, AMERCO

deconsolidated its interests in SAC Holding Corporation at that time. AMERCO remains the primary

beneficiary of its contractual variable interests in SAC Holding II Corporation for fiscal 2005 and 2004.

Revenues for fiscal 2005 fell $175.8 million, primarily as a result of the above mentioned deconsolidation.

Total costs and expenses were $32.7 million in fiscal 2005, compared with $154.3 million in fiscal 2004.

Total costs and expenses fell $121.6 million, primarily as a result of the above mentioned deconsolidation.

Earnings from operations were $10.5 million in fiscal 2005 compared with $64.7 million in fiscal 2004.

Earnings from operations fell $54.2 million in fiscal 2005 compared with fiscal 2004, primarily as a result of

the above mentioned deconsolidation.

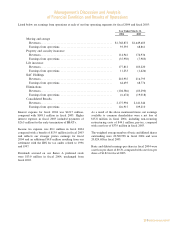

Fiscal 2004 Compared with Fiscal 2003

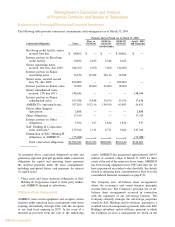

Listed below are revenues for our major product lines at SAC Holdings for fiscal 2004 and fiscal 2003:

Year Ended March 31,

2004 2003

(In thousands)

Self-moving equipment rentals ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 29,155 $ 27,680

Self-storage revenues ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 126,436 126,183

Self-moving and self-storage product and service sales ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 50,577 48,768

Other revenueÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 12,787 14,164

Segment revenue ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $218,955 $216,795

During fiscal 2004 we built our moving equipment rentals through steady transaction volume, price

increases and improved mix. Storage revenues were driven by an increase in the number of rooms available for

rent, higher occupancy rates and modest price increases. Sales of moving and self-storage related products and

services followed our growth in moving equipment rentals.

Total costs and expenses increased as a result of wage and benefit inflation and higher property taxes, cost

of sales, utilities and insurance costs.

As a result of the above mentioned changes in revenues and expenses, earnings from operations were

$64.7 million in fiscal 2004, compared with $68.8 million in fiscal 2003.

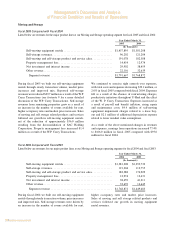

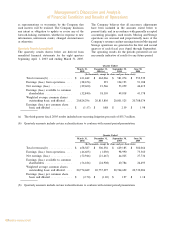

Liquidity and Capital Resources

Our financial condition remains strong. At March 31, 2005, cash and short-term investments totaled

$56.0 million, compared with $81.6 million at March 31, 2004. Total short-term and long-term debt, plus

capital lease obligations were $780.0 million at March 31, 2005, compared with $962.3 million at March 31,

2004, and represented 1.4 times stockholders' equity at March 31, 2005, compared with 1.9 times

stockholders' equity at March 31, 2004.

A summary of our cash flows for fiscal 2005, fiscal 2004 and fiscal 2003 is shown in the table below:

Year Ended March 31,

2005 2004 2003

(In thousands)

Cash flow from operating activitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 220,719 $(62,833) $118,133

Cash flow from investing activities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 36,176 60,187 (81,113)

Cash flow from financing activitiesÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (282,497) 17,369 (11,632)

Net cash flow ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (25,602) 14,723 25,388

Cash at the beginning of the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 81,557 66,834 41,446

Cash at the end of the period ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 55,955 $ 81,557 $ 66,834

29

DuringMarch2004,SACHoldingCorporationceasedto

beavariableinterestentityandAMERCOceasedbeing

theprimarybeneficiaryofSACHoldingCorporation.Asa

resultofthis,AMERCOdeconsolidateditsinterestsinSAC

HoldingCorporationatthattime.AMERCOremainsthe

primarybeneficiaryofitscontractualvariableinterestsin

SACHoldingIICorporationforfiscal2005and2004.

Revenuesforfiscal2005fell$175.8million,primarilyas

aresultoftheabovementioneddeconsolidation.

Total costs and expenses were $32.7 million in fiscal

2005,comparedwith$154.3millioninfiscal2004.Total

costs and expenses fell $121.6 million, primarily as a

resultoftheabovementioneddeconsolidation.

Earnings from operations were $10.5 million in fiscal

2005 compared with $64.7 million in fiscal 2004.

Earnings from operations fell $54.2 million in fiscal

2005comparedwithfiscal2004,primarilyasaresultof

theabovementioneddeconsolidation.

During fiscal 2004 we built our moving equipment

rentalsthroughsteadytransactionvolume,priceincreases

and improved mix. Storage revenues were driven by

an increase in the number of rooms available for rent,

higheroccupancyratesandmodestpriceincreases.Sales

ofmovingandself-storagerelatedproductsandservices

followedourgrowthinmovingequipmentrentals.

Total costs and expenses increased as a result of wage

and benefit inflation and higher property taxes, cost of

sales,utilitiesandinsurancecosts.

Asaresultoftheabovementionedchangesinrevenues

and expenses, earnings from operations were $64.7

millioninfiscal 2004,compared with $68.8millionin

fiscal2003.

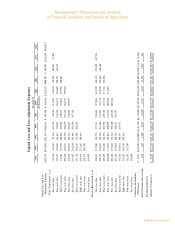

Fiscal 2004 Compared with Fiscal 2003

ListedbelowarerevenuesforourmajorproductlinesatSACHoldingsforfiscal2004andfiscal2003: