U-Haul 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 I AMERCO ANNUAL REPORT

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

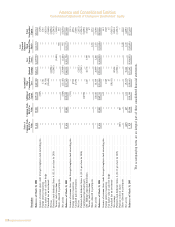

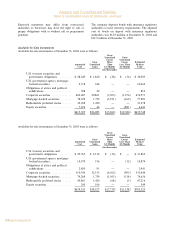

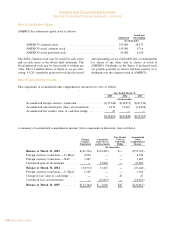

Note 7: Investments

Held-to-Maturity Investments

Held-to-maturity investments at December 31, 2004 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 566 $133 $Ì $ 699

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 23 (2) 885

$1,430 $156 $(2) $1,584

Held-to-maturity investments at December 31, 2003 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 522 $148 $Ì $ 670

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,308 109 (2) 5,415

$5,830 $257 $(2) $6,085

The adjusted cost and estimated market value of held-to-maturity investments in debt securities at

December 31, 2004 and December 31, 2003, by contractual maturity, were as follows:

December 31, 2004 December 31, 2003

Estimated

Amortized Estimated Amortized Market

Cost Market Value Cost Value

(In thousands)

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $ Ì $ Ì

Due after one year through five years ÏÏÏÏÏÏÏÏÏÏÏÏ 260 287 240 283

Due after five years through ten years ÏÏÏÏÏÏÏÏÏÏÏÏ 220 285 219 294

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 86 127 63 93

566 699 522 670

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 885 5,308 5,415

$1,430 $1,584 $5,830 $6,085

Expected maturities may differ from contractual maturities as borrowers may have the right to call or

prepay obligations with or without call or prepayment penalties.

The company deposits bonds with insurance regulatory authorities to meet statutory requirements. The

adjusted cost of bonds on deposit with insurance regulatory authorities was $12.9 million at December 31,

2004 and $12.9 million at December 31, 2003.

F-16

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Note 7: Investments

Held-to-Maturity Investments

Held-to-maturity investments at December 31, 2004 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 566 $133 $Ì $ 699

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 23 (2) 885

$1,430 $156 $(2) $1,584

Held-to-maturity investments at December 31, 2003 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 522 $148 $Ì $ 670

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,308 109 (2) 5,415

$5,830 $257 $(2) $6,085

The adjusted cost and estimated market value of held-to-maturity investments in debt securities at

December 31, 2004 and December 31, 2003, by contractual maturity, were as follows:

December 31, 2004 December 31, 2003

Estimated

Amortized Estimated Amortized Market

Cost Market Value Cost Value

(In thousands)

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $ Ì $ Ì

Due after one year through five years ÏÏÏÏÏÏÏÏÏÏÏÏ 260 287 240 283

Due after five years through ten years ÏÏÏÏÏÏÏÏÏÏÏÏ 220 285 219 294

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 86 127 63 93

566 699 522 670

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 885 5,308 5,415

$1,430 $1,584 $5,830 $6,085

Expected maturities may differ from contractual maturities as borrowers may have the right to call or

prepay obligations with or without call or prepayment penalties.

The company deposits bonds with insurance regulatory authorities to meet statutory requirements. The

adjusted cost of bonds on deposit with insurance regulatory authorities was $12.9 million at December 31,

2004 and $12.9 million at December 31, 2003.

F-16

Note 6: Notes and Mortgage Receivables, Net

Notesandmortgagereceivablesatfiscalyear-endswereasfollows:

Note 7: Investments

Held-to-Maturity Investments

Held-to-maturityinvestmentsatDecember31,2004wereasfollows:

Held-to-maturityinvestmentsatDecember31,2003wereasfollows:

Theadjustedcostandestimatedmarketvalueofheld-to-maturityinvestmentsindebtsecuritiesatDecember31,2004

andDecember31,2003,bycontractualmaturity,wereasfollows:

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

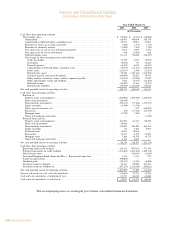

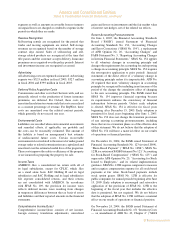

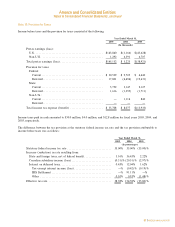

Note 4: Earnings Per Share

Net income for purposes of computing earnings per common share is net income minus preferred stock

dividends. Preferred stock dividends include accrued dividends of AMERCO.

The shares used in the computation of the Company's basic and diluted earnings per common share were

as follows:

Years Ended March 31,

2005 2004 2003

Basic and diluted earnings (loss) per common share $ 3.68 $ (0.76) $ (1.82)

Weighted average common share outstanding:

Basic and diluted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,804,773 20,749,998 20,824,618

The weighted average common shares outstanding listed above exclude post-1992 shares of the employee

stock ownership plan that have not been committed to be released as of March 31, 2005, 2004, and 2003,

respectively.

6,100,000 shares of preferred stock have been excluded from the weighted average shares outstanding

calculation because they are not common stock and they are not convertible into common stock.

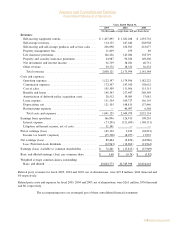

Note 5: Trade Receivables, Net

Trade receivables at fiscal year-ends were as follows:

March 31,

2005 2004

(In thousands)

Reinsurance recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $190,840 $180,481

Paid losses recoverable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,764 25,418

Trade accounts receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 9,847 5,080

Accrued investment income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,703 9,645

Premiums and agents' balances ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,799 9,091

E&O Recovery receivableÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,200 Ì

Independent dealer receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 1,054

Other receivable ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,191 39,629

238,208 270,398

Less allowance for doubtful accounts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (1,391) (2,012)

$236,817 $268,386

Note 6: Notes and Mortgage Receivables, Net

Notes and mortgage receivables at fiscal year-ends were as follows:

March 31,

2005 2004

(In thousands)

Notes, mortgage receivables and other, net of discount ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 4,589 $ 5,924

Less allowance for doubtful accounts ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (2,624) (2,624)

$ 1,965 $ 3,300

F-15

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Note 7: Investments

Held-to-Maturity Investments

Held-to-maturity investments at December 31, 2004 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 566 $133 $Ì $ 699

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 23 (2) 885

$1,430 $156 $(2) $1,584

Held-to-maturity investments at December 31, 2003 were as follows:

Gross Gross Estimated

Amortized Unrealized Unrealized Market

Cost Gains Losses Value

(In thousands)

U.S. treasury securities and government

obligations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 522 $148 $Ì $ 670

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,308 109 (2) 5,415

$5,830 $257 $(2) $6,085

The adjusted cost and estimated market value of held-to-maturity investments in debt securities at

December 31, 2004 and December 31, 2003, by contractual maturity, were as follows:

December 31, 2004 December 31, 2003

Estimated

Amortized Estimated Amortized Market

Cost Market Value Cost Value

(In thousands)

Due in one year or less ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ Ì $ Ì $ Ì $ Ì

Due after one year through five years ÏÏÏÏÏÏÏÏÏÏÏÏ 260 287 240 283

Due after five years through ten years ÏÏÏÏÏÏÏÏÏÏÏÏ 220 285 219 294

After ten years ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 86 127 63 93

566 699 522 670

Mortgage-backed securities ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 864 885 5,308 5,415

$1,430 $1,584 $5,830 $6,085

Expected maturities may differ from contractual maturities as borrowers may have the right to call or

prepay obligations with or without call or prepayment penalties.

The company deposits bonds with insurance regulatory authorities to meet statutory requirements. The

adjusted cost of bonds on deposit with insurance regulatory authorities was $12.9 million at December 31,

2004 and $12.9 million at December 31, 2003.

F-16

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued