U-Haul 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 I AMERCO ANNUAL REPORT

These leases were amended and restated on March 15,

2004. As a result, we paid down approximately $31

millionofleaseobligationsandenteredintoleaseswitha

threeyearterm,withfouroneyearrenewaloptions.After

suchpaydown,ourleaseobligationundertheamendedand

restatedsyntheticleaseswasapproximately$218.5million.

OnApril30,2004,theamendedandrestatedleaseswere

terminatedandthepropertiesunderlyingtheseleaseswere

soldtoUHStorage(DE)LimitedPartnership,anaffiliate

ofW.P.Carey.U-Haulenteredintoatenyearoperating

leasewithW.P.Carey(UHStorageDE)foraportionof

eachproperty(theportionofthepropertythatrelatesto

U-Haul’struckandtrailerrentalandmovingsupplysales

businesses).Theremainderofeachproperty(theportion

ofthepropertythatrelatestoself-storage)wasleasedby

W.P.Carey(UHStorageDE) to MercuryPartners,LP

(“Mercury”) pursuant to a 20 year lease. These events

are referred to as the “W. P. Carey Transactions.” As

a result of the W. P. Carey Transactions, we no longer

haveacapitalleaserelatedtotheseproperties.Theterms

of the W. P. Carey Transactions provide for us to be

reimbursedforcapitalimprovementswepreviouslymade

totheproperties,subjecttoconditions,whichweexpect

will occur over a period of approximately 18 months

followingtheclosing.

Thesalespriceforthesetransactionswas$298.4million

and cash received was $298.9 million. The Company

realizedagainonthetransactionof$2.7million,which

isbeingamortizedoverthelifeoftheleaseterm.

AspartoftheW.P.CareyTransactions,U-Haulenteredinto

agreementstomanagetheseproperties(includingtheportion

of the properties leased by Mercury). These management

agreementsallowustocontinuetooperatethepropertiesas

partoftheU-Haulmovingandself-storagesystem.

U-Haul’sannualleasepaymentsunderthenewleaseare

approximately $10 million per year, with CPI inflation

adjustments beginning in the sixth year of the lease.

The lease term is ten years, with a renewal option for

anadditionaltenyears.UponclosingoftheW.P.Carey

Transactions,wemadea$5millionsecuritydepositand

anearn-outdepositof$22.9million.Thesecuritydeposit

willberefundedtousattheendoftheleaseterm.The

earn-out deposit will be refunded at the earlier of the

achievementofcertainpropertylevelfinancialratiosor

theendoftheleaseterm.

The property management agreement we entered into

with Mercury provides that Mercury will pay U-Haul a

managementfeebasedongrossself-storagerentalrevenues

generated by the properties. During fiscal 2005, U-Haul

earned$1.4millioninmanagementfeesfromMercury.

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

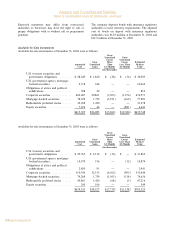

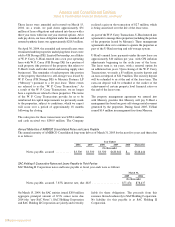

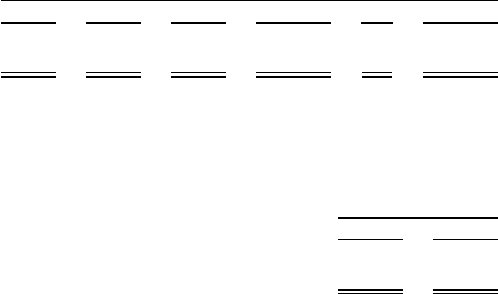

Annual Maturities of AMERCO Consolidated Notes and Loans Payable

The annual maturity of AMERCO Consolidated long-term debt as of March 31, 2005 for the next five

years and thereafter is as follows:

Year Ended

2006 2007 2008 2009 2010 Thereafter

(In thousands)

Notes payable, secured ÏÏÏÏÏÏÏÏÏÏÏ $3,500 $3,500 $3,500 $620,862 $Ì $148,646

SAC Holding II Corporation Notes and Loans Payable to Third Parties

SAC Holding II Corporation notes and loans payable at fiscal year-ends were as follows:

March 31,

2005 2004

(In thousands)

Notes payable, secured, 7.87% interest rate, due 2027 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $77,474 $78,637

On March 15, 2004, the SAC entities issued $200 million aggregate principal amount of 8.5% senior

notes due 2014 (the ""new SAC Notes''). SAC Holding Corporation and SAC Holding II Corporation are

jointly and severally liable for these obligations. The proceeds from this issuance flowed exclusively to SAC

Holding Corporation. No liability for this payable is at SAC Holding II Corporation.

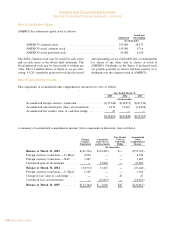

Annual Maturities of SAC Holding II Corporation Notes

The annual maturity of SAC Holding II Corporation long-term debt for the next five years and thereafter

is as follows:

Year Ended

2006 2007 2008 2009 2010 Thereafter

(In thousands)

Notes payable, securedÏÏÏÏÏÏÏÏÏÏÏÏ $1,331 $1,320 $1,430 $1,664 $1,800 $69,929

Secured notes payable are secured by deeds of trusts on the collateralized land and buildings. Principal

and interest payments on notes payable to third party lenders are due monthly. Certain notes payable contain

provisions whereby the loans may not be prepaid at any time prior to the maturity date without payment to the

lender of a Yield Maintenance Premium, as defined in the loan agreements.

F-22

AMERCO AND CONSOLIDATED ENTITIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Annual Maturities of AMERCO Consolidated Notes and Loans Payable

The annual maturity of AMERCO Consolidated long-term debt as of March 31, 2005 for the next five

years and thereafter is as follows:

Year Ended

2006 2007 2008 2009 2010 Thereafter

(In thousands)

Notes payable, secured ÏÏÏÏÏÏÏÏÏÏÏ $3,500 $3,500 $3,500 $620,862 $Ì $148,646

SAC Holding II Corporation Notes and Loans Payable to Third Parties

SAC Holding II Corporation notes and loans payable at fiscal year-ends were as follows:

March 31,

2005 2004

(In thousands)

Notes payable, secured, 7.87% interest rate, due 2027 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $77,474 $78,637

On March 15, 2004, the SAC entities issued $200 million aggregate principal amount of 8.5% senior

notes due 2014 (the ""new SAC Notes''). SAC Holding Corporation and SAC Holding II Corporation are

jointly and severally liable for these obligations. The proceeds from this issuance flowed exclusively to SAC

Holding Corporation. No liability for this payable is at SAC Holding II Corporation.

Annual Maturities of SAC Holding II Corporation Notes

The annual maturity of SAC Holding II Corporation long-term debt for the next five years and thereafter

is as follows:

Year Ended

2006 2007 2008 2009 2010 Thereafter

(In thousands)

Notes payable, securedÏÏÏÏÏÏÏÏÏÏÏÏ $1,331 $1,320 $1,430 $1,664 $1,800 $69,929

Secured notes payable are secured by deeds of trusts on the collateralized land and buildings. Principal

and interest payments on notes payable to third party lenders are due monthly. Certain notes payable contain

provisions whereby the loans may not be prepaid at any time prior to the maturity date without payment to the

lender of a Yield Maintenance Premium, as defined in the loan agreements.

F-22

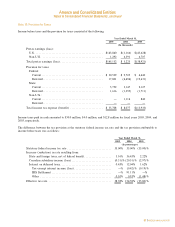

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued

Annual Maturities of AMERCO Consolidated Notes and Loans Payable

TheannualmaturityofAMERCOConsolidatedlong-termdebtasofMarch31,2005forthenextfiveyearsandthereafter

isasfollows:

SAC Holding II Corporation Notes and Loans Payable to Third Parties

SACHoldingIICorporationnotesandloanspayableatfiscalyear-endswereasfollows:

OnMarch15,2004,theSACentitiesissued$200million

aggregate principal amount of 8.5% senior notes due

2014(the“newSACNotes”).SACHoldingCorporation

andSACHoldingIICorporationarejointlyandseverally

liable for these obligations. The proceeds from this

issuanceflowedexclusivelytoSACHoldingCorporation.

No liability for this payable is at SAC Holding II

Corporation.