U-Haul 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57 I AMERCO ANNUAL REPORT

expensesaswellasamountsrecoverablefromre-insurers

onunpaidlossesarechargedorcreditedtoexpenseinthe

periodsinwhichtheyaremade.

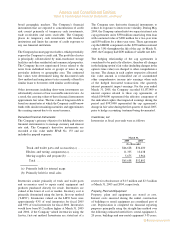

Revenue Recognition

Self-moving rentals are recognized for the period that

trucks and moving equipment are rented. Self-storage

revenuesarerecognizedbasedonthenumberofstorage

contract days earned. Sales of self-moving and self-

storagerelated productsarerecognizedatthe timethat

titlepassesandthecustomeracceptsdelivery.Insurance

premiumsarerecognizedoverthepolicyperiods.Interest

andinvestmentincomearerecognizedasearned.

Advertising

Alladvertisingcostsareexpensedasincurred.Advertising

expensewas$32.9millioninfiscal2005,$32.7million

infiscal2004and$39.9millioninfiscal2003.

Deferred Policy Acquisition Costs

Commissionsandothercoststhatfluctuatewith,andare

primarily related to the production of future insurance

premiums, are deferred. For Oxford, these costs are

amortizedinrelationtorevenuesuchthatcostsarerealized

asaconstantpercentageofrevenue.ForRepWest,these

costs are amortized over the related contract periods,

whichgenerallydonotexceedoneyear.

Environmental Costs

Liabilitiesarerecordedwhenenvironmentalassessments

and remedial efforts, if applicable, are probable and

the costs can be reasonably estimated. The amount of

the liability is based on management’s best estimate

of undiscounted future costs. Certain recoverable

environmentalcostsrelatedtotheremovalofunderground

storagetanksorrelatedcontaminationarecapitalizedand

amortizedovertheestimatedusefullivesoftheproperties.

Thesecostsimprovethesafetyorefficiencyoftheproperty

orareincurredinpreparingthepropertyforsale.

Income Taxes

AMERCO files a consolidated tax return with all of

its legal subsidiaries, except for CFLIC, which files

on a stand alone basis. SAC Holding II and its legal

subsidiariesand SAC Holding anditslegalsubsidiaries

file seperate consolidated returns, and their returns

are not consolidated with AMERCO. In accordance

with SFAS No. 109, the provision for income taxes

reflects deferred income taxes resulting from changes

intemporarydifferencesbetweenthetaxbasisofassets

andliabilitiesandtheirreportedamountsinthefinancial

statements.

Comprehensive Income/(Loss)

Comprehensive income/(loss) consists of net income,

foreign currency translation adjustments, unrealized

gainsandlossesoninvestmentsandthefairmarketvalue

ofinterestratehedges,netoftherelatedtaxeffects.

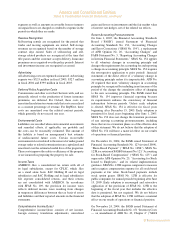

Recent Accounting Pronouncements

On June 1, 2005, the Financial Accounting Standards

Board (“FASB”) issued Statement of Financial

Accounting Standards No. 154, “Accounting Changes

andErrorCorrections(“SFASNo.154”),areplacement

of APB Opinion No. 20, “Accounting Changes” and

FASBStatementNo.3,“ReportingAccountingChanges

inInterimFinancialStatements.”SFASNo.154applies

to all voluntary changes in accounting principle and

changestherequirementsforaccountingforandreporting

achangeinaccountingprinciple.SFASNo.154requires

the retrospective application to prior periods’ financial

statements ofthe direct effectofa voluntary changein

accountingprincipleunlessitisimpracticable.APBNo.

20 required that most voluntary changes in accounting

principleberecognizedbyincludinginnetincomeofthe

period of the change the cumulative effect of changing

to the new accounting principle. The FASB stated that

SFAS No. 154 improves financial reporting because

its requirements enhance the consistency of financial

information between periods. Unless early adoption

is elected, SFAS No. 154 is effective for fiscal years

beginning after December 15, 2005. Early adoption is

permittedforfiscal yearsbeginningafterJune1,2005.

SFASNo.154doesnotchangethetransitionprovisions

of any existing accounting pronouncements, including

thosethatareinatransitionphaseasoftheeffectivedate

ofthisstatement.Wedonotbelievethattheadoptionof

SFASNo.154willhaveamaterialeffectonourresults

ofoperationsorfinancialposition.

On December 16, 2004, the FASB issued Statement of

FinancialAccountingStandardsNo.123(revised2004),

“Share-BasedPayment”(“SFASNo.123R”).SFASNo.

123RisarevisionofFASBStatementNo.123,“Accounting

for Stock-Based Compensation” (“SFAS No. 123”) and

supersedesAPBOpinionNo.25,“AccountingforStock

Issued to Employees,” and its related implementation

guidance.SFASNo.123Rrequirescompaniestomeasure

andrecognizecompensationexpenseforallstock-based

payments at fair value. Stock-based payments include

stock option grants. SFAS No. 123R is effective for

publiccompaniesforannualperiodsbeginningafterJune

15, 2005. Early adoption is encouraged and retroactive

application of the provisions of SFAS No. 123R to the

beginning of the fiscal year that includes the effective

date is permitted, but not required. We do not believe

thattheadoptionofSFASNo.123Rwillhaveamaterial

effectonourresultsofoperationsorfinancialposition.

On November 24, 2004, the FASB issued Statement of

FinancialAccountingStandardsNo.151“InventoryCosts

— an amendment of ARB No. 43, Chapter 4” (“SFAS

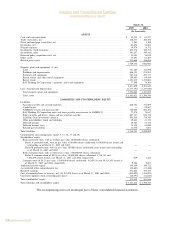

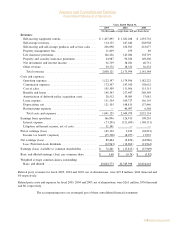

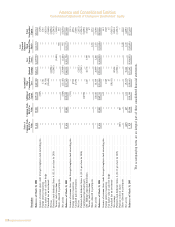

Amerco and Consolidated Entities

Notes to Consolidated Financial Statements, continued