Tyson Foods 2000 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

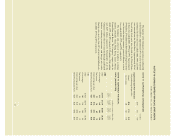

Under the terms of the leveraged equipment loans, the

Company had restricted cash totaling approximately $49 mil-

lion which is included in other assets at September 30, 2000.

Under these leveraged loan agreements, the Company entered

into interest rate swap agreements to effectively lock in a fixed

interest rate for these borrowings.

Annual maturities of long-term debt for the five years

subsequent to September 30, 2000, are: 2001– $123 million;

2002 – $307 million; 2003 – $178 million; 2004 – $29 million

and 2005 – $180 million.

The revolving credit agreement and notes contain various

covenants, the more restrictive of which require maintenance

of a minimum net worth, current ratio, cash flow coverage

of interest and fixed charges and a maximum total debt-to-

capitalization ratio. The Company is in compliance with

these covenants at fiscal year end.

Industrial revenue bonds are secured by facilities with a

net book value of $64 million at September 30, 2000. The

weighted average interest rate on all outstanding short-term

borrowing was 6.8% at September 30, 2000, and 5.5% at

October 2, 1999.

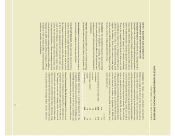

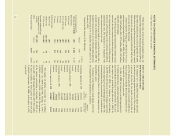

Long-term debt consists of the following:

in millions

Maturity 2000 1999

Commercial paper (6.7%

effective rate at 9/30/00) 2002 $ 260 $ 291

Debt securities:

6.75% notes 2005 149 150

6.625% notes 2006 149 150

6.39 – 6.41% notes 2001 –50

6% notes 2003 149 148

7% notes 2028 147 146

7% notes 2018 237 236

Institutional notes:

10.61% notes 2001 –53

10.84% notes 2002–2006 50 50

11.375% notes 1999–2002 48

Leveraged equipment loans

(rates ranging from 4.7%

to 6.0%) 2005–2008 138 154

Other various 74 79

Total long-term debt $1,357 $1,515

NOTE 11: STOCK OPTIONS

AND RESTRICTED STOCK

The Company has a nonqualified stock option plan that

provides for granting options for shares of Class A stock at

a price not less than the fair market value at the date of

grant. The options generally become exercisable ratably over

three to eight years from the date of grant and must be exer-

cised within 10 years of the grant date.

On May 4, 2000, the Company cancelled approximately

4.3 million option shares and granted approximately 1 mil-

lion restricted shares of Class A common stock. The restric-

tion expires over periods through December 1, 2003. At

September 30, 2000, the Company had outstanding

1,146,900 restricted shares of Class A common stock with

restrictions expiring over periods through July 1, 2020. The

unearned portion of the restricted stock is classified on the

Consolidated Balance Sheets as deferred compensation in

shareholders’ equity.

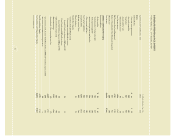

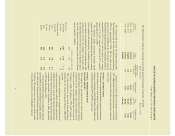

A summary of the Company’s stock option activity for

the nonqualified stock option plan is as follows:

Weighted

Shares average exercise

under option price per share

Outstanding, September 27, 1997 8,342,334 $15.99

Exercised (178,467) 14.18

Canceled (313,019) 15.84

Granted 504,700 18.00

Outstanding, October 3, 1998 8,355,548 16.15

Exercised (359,999) 14.23

Canceled (631,717) 16.35

Granted 4,722,500 15.00

Outstanding, October 2, 1999 12,086,332 15.74

Exercised (88,332) 14.23

Canceled (5,199,995) 15.17

Outstanding, September 30, 2000 6,798,005 $16.19

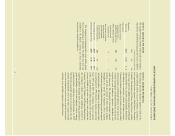

The number of options exercisable was as follows:

September 30, 2000 – 2,926,980; October 2, 1999 –

1,870,893 and October 3, 1998 –1,202,498. The remainder

of the options outstanding at September 30, 2000, are

exercisable ratably through November 2007. The number

of shares available for future grants was 7,568,614 and

2,368,619 at September 30, 2000, and October 2, 1999,

respectively.

40