Tyson Foods 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

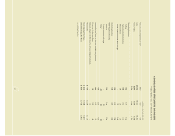

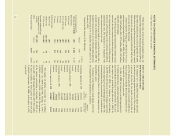

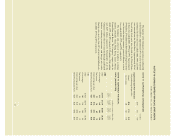

NOTE 7: PROPERTY, PLANT AND EQUIPMENT

The major categories of property, plant and equipment and

accumulated depreciation, at cost, are as follows:

in millions

2000 1999

Land $61 $57

Buildings and leasehold improvements 1,291 1,180

Machinery and equipment 2,219 2,033

Land improvements and other 110 112

Buildings and equipment under

construction 103 224

3,784 3,606

Less accumulated depreciation 1,643 1,421

Net property, plant and equipment $2,141 $2,185

The Company capitalized interest costs of $2 million in

2000, $5 million in 1999 and $2 million in 1998 as part of the

cost of major asset construction projects. Approximately

$121 million will be required to complete construction proj-

ects in progress at September 30, 2000.

In fiscal 2000, the Company adopted American Institute

of Certified Public Accountants Statement of Position 98-1,

“Accounting for the Costs of Computer Software Developed

or Obtained for Internal Use.” This statement provides

guidance on the capitalization of certain costs incurred in

developing or acquiring internal-use computer software. At

September 30, 2000, the Company has capitalized $25 million

in software costs and recorded $3 million of related software

depreciation.

NOTE 8: CONTINGENCIES

The Company is involved in various lawsuits and claims

made by third parties on an ongoing basis as a result of its

day-to-day operations. Although the outcome of such items

cannot be determined with certainty, the Company’s general

counsel and management are of the opinion that the final

outcome should not have a material effect on the Company’s

results of operations or financial position.

On June 22, 1999, 11 current and former employees of

the Company filed the case of M.H. Fox, et al. v. Tyson

Foods, Inc. (Fox v. Tyson) in the U.S. District Court for the

Northern District of Alabama claiming the Company

violated requirements of the Fair Labor Standards Act. The

suit alleges the Company failed to pay employees for all

hours worked and/or improperly paid them for overtime

hours. The suit generally alleges that (i) employees should

be paid for time taken to put on and take off certain work-

ing supplies at the beginning and end of their shifts and

breaks and (ii) the use of “mastercard” or “line” time fails

to pay employees for all time actually worked. Plaintiffs

seek to represent themselves and all similarly situated

current and former employees of the Company. At filing

159 current and/or former employees consented to join the

lawsuit and, to date, approximately 4,900 consents have

been filed with the court. Discovery in this case is ongoing.

A hearing was held on March 6, 2000, to consider the

plaintiff’s request for collective action certification and

court-supervised notice. No decision has been rendered.

The Company believes it has substantial defenses to the

claims made and intends to vigorously defend the case;

however, neither the likelihood of unfavorable outcome nor

the amount of ultimate liability, if any, with respect to this

case can be determined at this time.

Substantially similar suits have been filed against other

integrated poultry companies. In addition, organizing activity

conducted by representatives or affiliates of the United Food

and Commercial Workers Union against the poultry industry

has encouraged worker participation in Fox v. Tyson and the

other lawsuits.

On February 9, 2000, the Wage and Hour Division of the

U.S. Department of Labor (DOL) began an industry-wide

investigation of poultry producers, including the Company,

to ascertain compliance with various wage and hour issues.

As part of this investigation, the DOL inspected 14 of the

Company’s processing facilities. The Company has begun

preliminary discussions with the DOL regarding its investi-

gation to discuss a resolution of potential claims that might be

asserted by the DOL.

The Company has been advised of an investigation by the

Immigration and Naturalization Service (INS) and the U.S.

Attorney’s Office for the Eastern District of Tennessee into

possible violations of the Immigration and Naturalization Act

at several of the Company’s locations. On October 5, 2000,

the Company was advised that, in addition to a number of its

employees, the Company itself is a subject of the investigation.

The outcome of the investigation and any potential liability on

the part of the Company cannot be determined at this time.

38