Tyson Foods 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

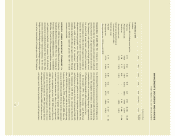

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

NOTE 1: BUSINESS AND SUMMARY OF

SIGNIFICANT ACCOUNTING POLICIES

Description of Business: Tyson Foods, Inc., headquartered in

Springdale, Ark., is the world’s largest fully integrated producer,

processor and marketer of chicken and chicken-based conve-

nience foods, with 68,000 team members and 7,400 contract

growers in 100 communities. Tyson has operations in 18 states

and 15 countries and exports to 73 countries worldwide.

Tyson is the recognized market leader in almost every retail

and foodservice market it serves. Through its Cobb-Vantress

subsidiary, Tyson is also a leading chicken breeding stock

supplier. In addition, Tyson is the nation’s second largest

maker of corn and flour tortillas under the Mexican Original

brand, as well as a leading provider of live swine.

Consolidation: The consolidated financial statements include

the accounts of subsidiaries including the Company’s

majority ownership in Tyson de Mexico. All significant inter-

company accounts and transactions have been eliminated in

consolidation.

Fiscal Year: The Company utilizes a 52- or 53-week accounting

period that ends on the Saturday closest to September 30.

Reclassifications: Certain reclassifications have been made to

prior periods to conform to current presentations.

Cash and Cash Equivalents: Cash equivalents consist of invest-

ments in short-term, highly liquid securities having original

maturities of three months or less, which are made as part of

the Company’s cash management activity. The carrying values

of these assets approximate their fair market values. As a

result of the Company’s cash management system, checks

issued, but not presented to the banks for payment, may

create negative cash balances. Checks outstanding in excess of

related cash balances totaling approximately $126 million at

September 30, 2000, and $135 million at October 2, 1999, are

included in trade accounts payable, accrued compensation

and benefits and other current liabilities.

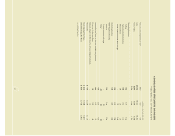

Inventories: Live chicken consists of broilers and breeders.

Broilers are stated at the lower of cost (first-in, first-out) or

market and breeders are stated at cost less amortization.

Breeder costs are accumulated up to the production stage

and amortized into broiler costs over the estimated produc-

tion lives based on historical egg production. Live swine

consist of breeding stock and finishing, which are carried at

lower of cost (first-in, first-out) or market. The cost of live

swine is included in cost of sales when the swine are sold.

Additionally, dressed and further-processed products, hatch-

ery eggs and feed and supplies are valued at the lower of cost

(first-in, first-out) or market. At September 30, 2000, live

swine inventory has been reclassified to inventory from

assets held for sale.

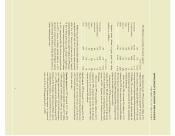

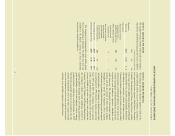

in millions

2000 1999

Dressed and further-processed products $460 $549

Live chickens 291 291

Live swine 75 –

Hatchery eggs and feed 67 67

Supplies 72 82

Total inventory $965 $989

Depreciation: Depreciation is provided primarily by the

straight-line method using estimated lives for buildings and

leasehold improvements of 10 to 39 years, machinery and

equipment of three to 12 years and other of three to 20 years.

Excess of Investments Over Net Assets Acquired: Costs in excess

of net assets of businesses purchased are amortized on a

straight-line basis over periods ranging from 15 to 40 years.

The Company reviews the carrying value of excess of

investments over net assets acquired at each balance sheet

date to assess recoverability from future operations using

undiscounted cash flows based upon historical results and

current projections of earnings before interest and taxes.

33