Tyson Foods 2000 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2000 ANNUAL REPORT

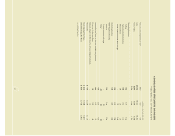

RESULTS OF OPERATIONS Earnings for fiscal 2000 were

$151 million or $0.67 per share compared to $230 million

or $1.00 per share in fiscal 1999. Earnings in fiscal 2000

were adversely affected by an oversupply of chicken and a

$33 million charge on non-recurring items including a bad

debt writeoff related to AmeriServe and growout issues at

Tyson de Mexico. The Company’s accounting cycle resulted

in a 52-week year for both 2000 and 1999 compared to a

53-week year for 1998.

2000 vs. 1999

Sales for 2000 decreased 2.8% from sales for 1999. This

decrease is primarily due to the sale of the seafood business

on July 17, 1999, and other divested non-core businesses.

Comparable sales increased 0.6% on a volume increase of

0.3% compared to 1999. Additionally, the operating results

for 2000 were negatively affected by a weak domestic market

for chicken and reduced volume by the Company’s Mexican

subsidiary. In response to the oversupply of chicken, the

Company maintained throughout fiscal 2000 a 3% cut in

the number of chickens produced. Management anticipates

this oversupply of chicken to continue into fiscal 2001.

The Company presently identifies segments based on the

products offered and the nature of customers, resulting in

four reported business segments: Food Service, Consumer

Products, International and Swine. The Company’s seafood

business, which was sold on July 17, 1999, is listed as a busi-

ness segment for fiscal 1999 and 1998.

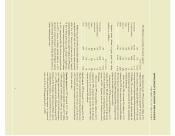

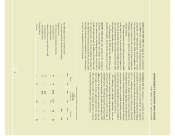

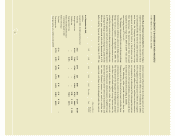

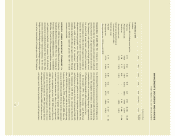

The following is an analysis of sales by segment:

dollars in millions

2000 1999 Change

Food Service $3,312 $3,354 $ (42)

Consumer Products 2,250 2,252 (2)

International 657 645 12

Swine 157 110 47

Seafood –189 (189)

Other 782 813 (31)

Tota l $7,158 $7,363 $(205)

Segment profit, defined as gross profit less selling

expenses, by segment is as follows:

dollars in millions

2000 1999 Change

Food Service $197 $311 $(114)

Consumer Products 145 241 (96)

International 50 68 (18)

Swine 19 (63) 82

Seafood –22 (22)

Other 140 155 (15)

Tota l $551 $734 $(183)

Food Service sales decreased $42 million or 1.3%

compared to 1999, with a 1.4% decrease in average sales

prices partially offset by a 0.2% increase in volume. Segment

profit for Food Service decreased $114 million or 36.7%

from 1999 primarily due to lower market prices, product

mix changes and higher grain costs. Food Service includes

fresh, frozen and value-added chicken products sold through

domestic foodservice, specialty and commodity distributors

who deliver to restaurants, schools and other accounts.

Consumer Products sales decreased $2 million or 0.1%

compared to 1999, with a 0.6% decrease in average sales prices

partially offset by a 0.6% increase in volume. Segment profit

for Consumer Products decreased $96 million or 39.7% from

1999 primarily due to lower market prices and higher grain

costs, which more than offset the improved product mix.

Consumer Products includes fresh, frozen and value-added

chicken products sold through domestic retail markets for

at-home consumption and through wholesale club markets

targeted to small foodservice operators, individuals and

small businesses.

International sales increased $12 million or 1.9% over

1999, with a 4.2% increase in average sales prices partially

offset by a 2.3% decrease in volume. International segment

profit decreased $18 million or 26.5% from 1999 primarily

due to losses incurred by the Company’s Mexican subsidiary

resulting from the outbreak of Exotic Newcastle disease

and associated decreases in production. The Newcastle

20