Tyson Foods 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2000 ANNUAL REPORT

IMPACT OF YEAR 2000 The Company has completed its

Year 2000 Project as scheduled. The Company’s products,

computing and communications infrastructure systems

have operated without Year 2000 related problems. The

Company is not aware that any of its major customers or

third-party suppliers has experienced significant Year 2000

related problems.

The Company believes all its critical systems are Year 2000

ready; however, there is no guarantee that the Company has

discovered all possible failure points including all systems,

non-ready third parties whose systems and operations affect

the Company and other uncertainties.

As of September 30, 2000, the Year 2000 Project was

considered complete and no further actions were required.

MARKET RISK Market risks relating to the Company’s

operations result primarily from changes in commodity

prices, interest rates and foreign exchange rates as well as

credit risk concentrations. To address certain of these risks

the Company enters into various hedging transactions as

described below. Financial instruments that do not qualify

for hedge accounting are marked to fair value and the gains

or losses are recognized currently in earnings.

Commodities Risk The Company is a purchaser of certain

commodities, primarily corn and soybeans. The Company

periodically uses commodity futures and options for hedging

purposes to reduce the effect of changing commodity prices

and as a mechanism to procure these grains. Generally,

contract terms of a hedge instrument closely mirror those of

the hedged item providing a high degree of risk reduction and

correlation. Contracts that effectively meet this risk reduction

and correlation criteria are recorded using hedge accounting.

Gains and losses on closed hedge transactions are recorded as

a component of the underlying inventory purchase.

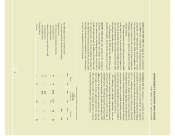

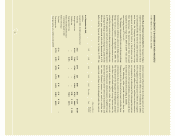

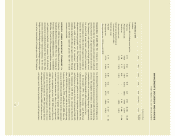

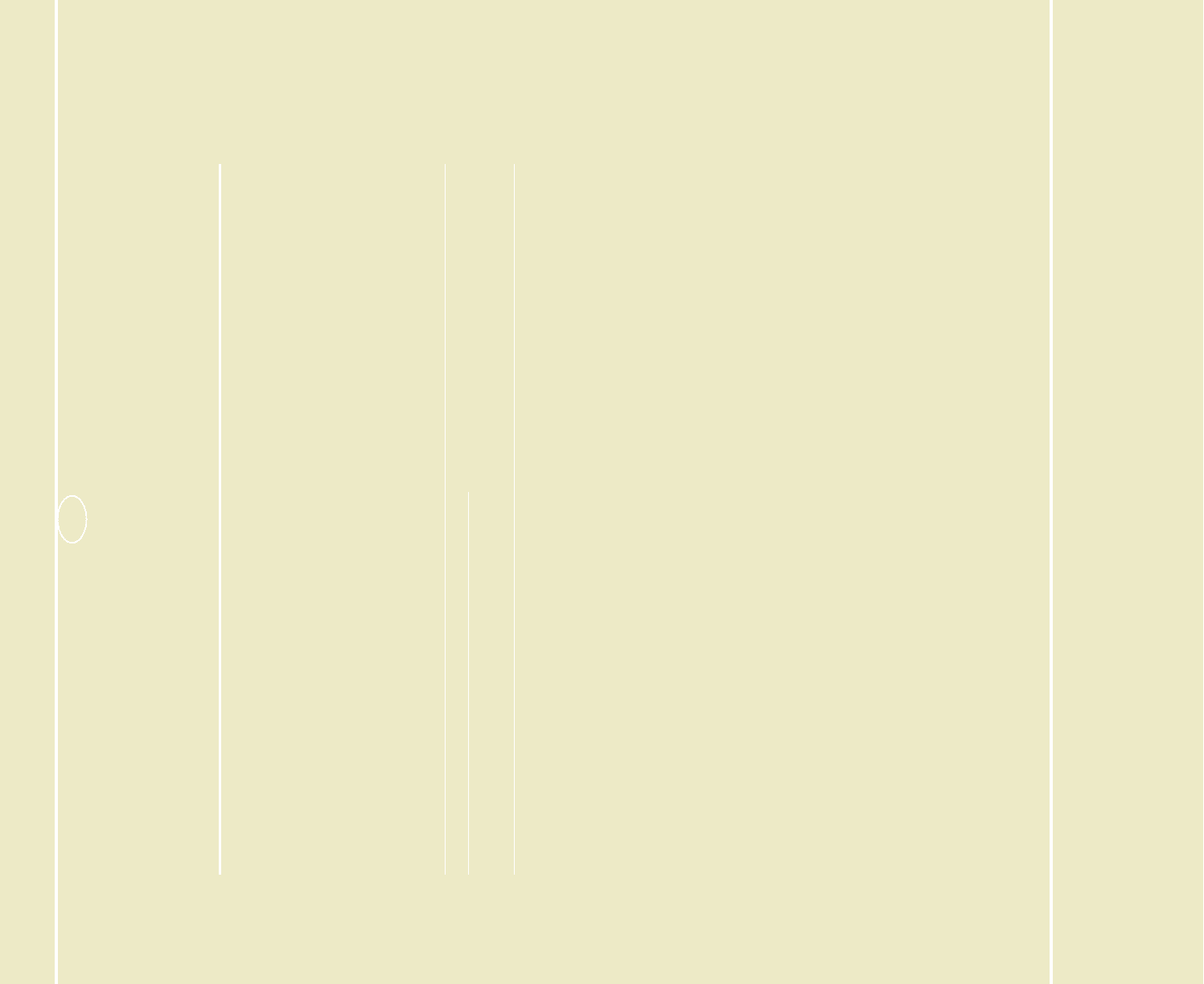

The following table provides information about the

Company’s corn, soybean and other feed ingredient inventory

and financial instruments that are sensitive to changes in

commodity prices. The table presents the carrying amounts

and fair values at September 30, 2000, and October 2, 1999.

Additionally, for puts and futures contracts, the latest of

which expires or matures eight months from the reporting

date, the table presents the notional amounts in units of

purchase and the weighted average contract prices.

volume and dollars in millions, except per unit amounts

Weighted

average strike

Volume price per unit Fair value

2000 1999 2000 1999 2000 1999

Recorded Balance Sheet Commodity Position:

Commodity inventory (book value of $33 and $34) ––––$33 $34

Hedging Positions

Corn futures contracts (volume in bushels)

Long (buy) positions 17 84 $2.50 $2.21 (9) (8)

Short (sell) positions –1–2.32 ––

Soybean oil futures contracts (volume in cwt)

Long (buy) positions 9–0.16 –––

Short (sell) positions 6–0.16 –––

Trading Positions

Corn puts –28 –2.10 –(3)

25