Tyson Foods 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2000 ANNUAL REPORT

Concentrations of Credit Risk The Company’s financial

instruments that are exposed to concentrations of credit risk

consist primarily of cash equivalents and trade receivables.

The Company’s cash equivalents are in high quality securi-

ties placed with major banks and financial institutions.

Concentrations of credit risk with respect to receivables are

limited due to the large number of customers and their

dispersion across geographic areas. The Company performs

periodic credit evaluations of its customers’ financial

condition and generally does not require collateral. No single

group or customer represents greater than 10% of total

accounts receivable.

RECENTLY ISSUED ACCOUNTING STANDARDS On

October 1, 2000, the Company adopted Financial Accounting

Standards Board Statement (SFAS) No. 133, “Accounting for

Derivative Instruments and Hedging Activities,” as amended by

SFAS Nos. 137 and 138. This statement establishes accounting

and reporting standards, which requires that all derivative

instruments be recorded on the balance sheet at fair value. This

statement also establishes “special accounting” for fair value

hedges, cash flow hedges and hedges of foreign currency expo-

sures of net investments in foreign operations. The Company

has determined the business processes related to hedging activ-

ities mainly consist of grain procurement and certain financing

activities. The adoption on October 1, 2000, resulted in the

cumulative effect of an accounting change of approximately

$9 million being charged to other comprehensive loss.

In December 1999, the Securities and Exchange

Commission issued Staff Accounting Bulletin (SAB) No. 101,

which provides guidance on the recognition, presentation

and disclosure of revenue in financial statements filed with

the Commission. SAB 101A was released on March 24,

2000, and delayed for one fiscal quarter the implementation

date of SAB 101 for registrants with fiscal years beginning

between December 16, 1999, and March 15, 2000. Since the

issuance of SAB 101 and SAB 101A, the staff has continued

to receive requests from a number of groups asking for addi-

tional time to determine the effect, if any, on registrant’s

revenue recognition practices. SAB 101B issued June 26,

2000, further delayed the implementation date of SAB 101

until no later than the fourth fiscal quarter of fiscal years

beginning after December 15, 1999. The Company believes

the adoption of SAB 101 in fiscal 2001 will not have a mate-

rial impact on its financial position or results of operations.

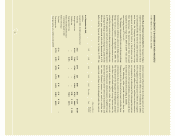

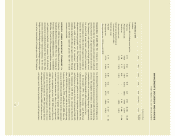

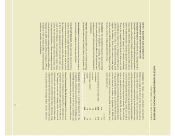

dollars in millions

Fair value

2000 2001 2002 2003 2004 Thereafter Total 10/2/99

As of October 2, 1999

Liabilities

Long-term debt, including current portion

Fixed rate $173 $126 $ 30 $178 $29 $794 $1,330 $1,299

Average interest rate 6.82% 8.18% 7.83% 6.18% 7.08% 6.78% 6.87%

Variable rate $ 50 $ 17 $291 – – $ 50 $ 408 $ 408

Average interest rate 5.51% 7.67% 5.85% – – 3.90% 5.65%

Interest rate derivative financial

instruments related to debt

Interest rate swaps

Pay fixed $ 17 $ 18 $ 20 $ 22 $21 $ 29 $ 127 $ (1)

Average pay rate 6.71% 6.69% 6.73% 6.73% 6.71% 6.50% 6.66%

Average receive rate– USD 6 month LIBOR

27