Tyson Foods 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

Recently Issued Accounting Standards: On October 1, 2000,

the Company adopted Financial Accounting Standards

Board Statement (SFAS) No. 133, “Accounting for Derivative

Instruments and Hedging Activities,” as amended, which

is required to be adopted in years beginning after June 15,

2000. This Statement requires the Company to recognize all

derivatives on the balance sheet at fair value. Derivatives that

are not hedges must be adjusted to fair value through income.

If the derivative is a hedge, depending on the nature of the

hedge, changes in the fair value of derivatives will be either

offset against the change in fair value of the hedged assets,

liabilities or firm commitments through earnings, or recog-

nized in other comprehensive income until the hedged item is

recognized in earnings. The ineffective portion of a deriva-

tive’s change in fair value will be immediately recognized

in earnings.

The adoption on October 1, 2000, resulted in the

cumulative effect of an accounting change of approximately

$9 million being charged to other comprehensive loss. The

Company does not believe the adoption of SFAS No. 133

will cause a significant change in normal business practices.

In December 1999, the Securities and Exchange

Commission issued Staff Accounting Bulletin (SAB) No. 101,

which provides guidance on the recognition, presentation and

disclosure of revenue in financial statements filed with the

Commission. SAB 101A was released on March 24, 2000,

and delayed for one fiscal quarter the implementation date of

SAB 101 for registrants with fiscal years beginning between

December 16, 1999, and March 15, 2000. Since the issuance

of SAB 101 and SAB 101A, the staff has continued to receive

requests from a number of groups asking for additional time

to determine the effect, if any, on registrant’s revenue recog-

nition practices. SAB 101B issued June 26, 2000, further

delayed the implementation date of SAB 101 until no later

than the fourth fiscal quarter of fiscal years beginning after

December 15, 1999. The Company believes the adoption of

SAB 101 in fiscal 2001 will not have a material impact on its

financial position or results of operations.

NOTE 2: ACQUISITIONS

On January 9, 1998, the Company completed the acquisition

of Hudson Foods, Inc. (Hudson or Hudson Acquisition). At

the effective time of the acquisition, the Class A and Class B

shareholders of Hudson received approximately 18.4 million

shares of the Company’s Class A common stock valued at

approximately $364 million and approximately $257 million

in cash. The Company borrowed funds under its commercial

paper program to finance the cash portion of the Hudson

Acquisition and repay approximately $61 million under

Hudson’s revolving credit facilities. The Hudson Acquisition

has been accounted for as a purchase and the excess of invest-

ment over net assets acquired is being amortized straight-line

over 40 years. The Company’s consolidated results of operations

include the operations of Hudson since the acquisition date.

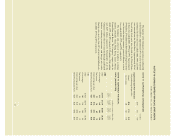

The following unaudited pro forma information shows the

results of operations as though the purchase of Hudson had

been made at the beginning of fiscal 1997.

in millions, except per share data

1998 1997

Sales $7,831 $8,021

Net income 17 140

Basic earnings per share 0.07 0.60

Diluted earnings per share $ 0.07 $ 0.59

The unaudited pro forma results are not necessarily

indicative of the actual results of operations that would have

occurred had the purchase actually been made at the begin-

ning of 1997, or the results that may occur in the future.

35