Tyson Foods 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2000 ANNUAL REPORT

Interest expense in 1999 decreased 10.9% compared to 1998.

As a percent of sales, interest expense was 1.7% in 1999

compared to 1.9% in 1998. The Company had a lower level

of borrowing in 1999, which decreased the Company’s aver-

age indebtedness by 6.4% from 1998. The Company’s short-

term interest rates were slightly lower than in 1998, and the

net average effective interest rate on total debt was 6.2% for

1999 compared to 6.6% for 1998.

The effective tax rate for 1999 was 34.9% compared to 64.7%

for 1998. The 1998 effective tax rate was affected by certain

costs related to asset impairment and foreign losses not

deductible for tax purposes.

Return on invested capital for 1999 was 10.9% compared to

4.9% for 1998.

LIQUIDITY AND CAPITAL RESOURCES Cash provided

by operations continues to be the Company’s primary source

of funds to finance operating needs and capital expenditures.

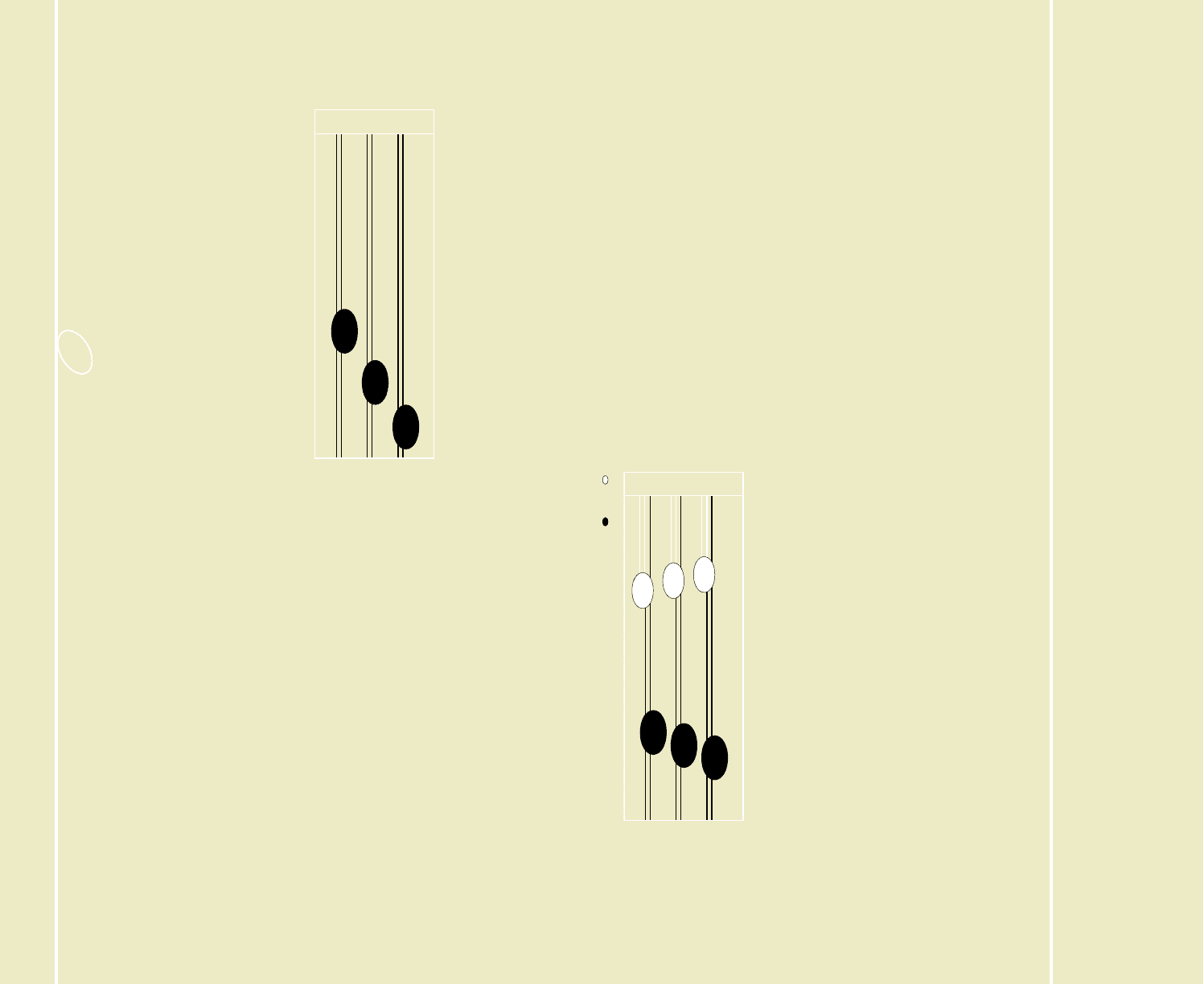

In 2000, net cash of $587 million was provided by oper-

ating activities, an increase of $40 million from 1999. The

Company’s foreseeable cash needs for operations and capital

expenditures will continue to be met primarily through cash

flows from operations. At September 30, 2000, the Company

had construction projects in progress that will require approx-

imately $121 million to complete.

Total debt at September 30, 2000, was $1.5 billion, a

decrease of $262 million from October 2, 1999. The Company

has an unsecured revolving credit agreement totaling $1 bil-

lion that supports the Company’s commercial paper program.

This $1 billion facility expires in May 2002. At September 30,

2000, $260 million in commercial paper was outstanding

under this $1 billion facility. Additional outstanding debt at

September 30, 2000, consisted of $880 million of public debt,

$112 million of institutional notes, $155 million of leveraged

equipment loans, $62 million of notes payable and $73 million

of other indebtedness.

The revolving credit agreement and notes contain various

covenants, the more restrictive of which require maintenance

of a minimum net worth, current ratio, cash flow coverage

of interest and a maximum total debt-to-capitalization

ratio. The Company is in compliance with these covenants

at fiscal year end.

Shareholders’ equity increased 2.2% during 2000 and has

grown at a compounded annual rate of 8.2% over the past

five years.

24

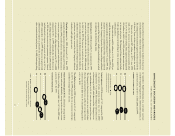

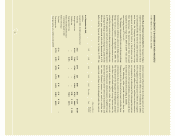

’00

’99

’98

547

496

587

CASH PROVIDED BY OPERATING ACTIVITIES

dollars in millions

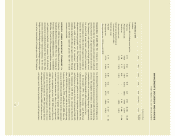

’00

’99

’98

2.2

2.1

2.0

2.1

1. 8

1.5

TOTAL CAPITALIZATION

dollars in billions

debt equity