Tyson Foods 2000 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

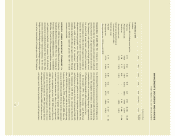

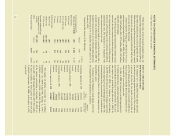

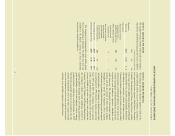

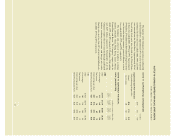

NOTE 6: FINANCIAL INSTRUMENTS

Commodity and Foreign Currency Contracts: At September 30, 2000, and October 2, 1999, the Company held the following

commodity and foreign currency contracts:

dollars in millions, except per unit contract/strike prices

Notional Weighted average

amount contract/strike price Fair value

Units 2000 1999 2000 1999 2000 1999

Hedging positions

Long positions in corn bushels 17 84 $2.50 $2.21 $(9) $(8)

Short positions in corn bushels –1–2.32 ––

Long positions in soybean oil cwt 9–0.16 –––

Short positions in soybean oil cwt 6–0.16 –––

Foreign forward exchange contracts dollars –$7 –$10.13 –$(1)

Trading positions

Short positions in corn puts bushels –28 –2.10 –(3)

37

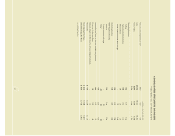

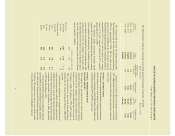

Fair Value of Financial Instruments: The Company’s significant

financial instruments include cash and cash equivalents,

investments and debt. In evaluating the fair value of signif-

icant financial instruments, the Company generally uses

quoted market prices of the same or similar instruments or

calculates an estimated fair value on a discounted cash flow

basis using the rates available for instruments with the

same remaining maturities. As of September 30, 2000,

and October 2, 1999, the fair value of financial instruments

held by the Company approximated the recorded value

except for long-term debt. Fair value of long-term debt

including current portion was $1.4 billion and $1.7 billion at

September 30, 2000, and October 2, 1999, respectively.

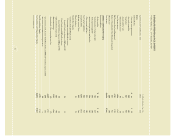

Concentrations of Credit Risk: The Company’s financial instru-

ments that are exposed to concentrations of credit risk

consist primarily of cash equivalents and trade receivables.

The Company’s cash equivalents are in high quality securi-

ties placed with major banks and financial institutions.

Concentrations of credit risk with respect to receivables are

limited due to the large number of customers and their

dispersion across geographic areas. The Company performs

periodic credit evaluations of its customers’ financial condi-

tion and generally does not require collateral. No single

group or customer represents greater than 10% of total

accounts receivable.

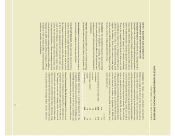

Interest Rate Instruments: The Company uses interest rate

swap contracts on certain borrowing transactions. Interest

rate swaps with notional amounts of $110 million and

$127 million were in effect at September 30, 2000, and

October 2, 1999, respectively. Fair values of these swaps

were $500,000 and a negative $1 million at September 30,

2000, and October 2, 1999, respectively. Fair values of inter-

est rate instruments are estimated amounts the Company

would receive or pay to terminate the agreements at the

reporting dates. These swaps mature from 2005 to 2008.