Tyson Foods 2000 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

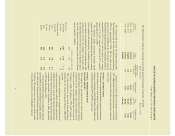

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

NOTE 3: DISPOSITIONS

On July 17, 1999, the Company completed the sale of the

assets of Tyson Seafood Group in two separate transactions.

Under the terms of the agreements, the Company received

proceeds of approximately $165 million, which was used to

reduce indebtedness, and subsequently collected receivables

totaling approximately $16 million. The Company recognized

a pretax loss of approximately $19 million on the sale of the

seafood assets.

Effective December 31, 1998, the Company sold Willow

Brook Foods, its integrated turkey production and processing

business, and its Albert Lea, Minn., processing facility which

primarily produced sausages, lunch and deli meats. In addi-

tion, on December 31, 1998, the Company sold its National

Egg Products Company operations in Social Circle, Ga. These

facilities were sold for amounts that approximated their

carrying values. These operations were acquired as part of the

Hudson Acquisition.

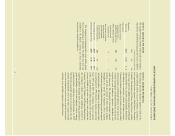

NOTE 4: IMPAIRMENT AND OTHER CHARGES

In the fourth quarter of fiscal 1999, the Company recorded

a pretax charge totaling $35 million related to the antici-

pated loss on the sale and closure of the Pork Group assets.

In the first quarter of fiscal 2000, the Company ceased nego-

tiations for the sale of the Pork Group. Additionally, in the

fourth quarter of fiscal 1999, the Company recorded pretax

charges totaling $23 million for impairment of property and

equipment and write-down of related excess of investments

over net assets acquired of Mallard’s Food Products.

In the fourth quarter of fiscal 1998, as a result of

the Company’s restructuring plan, pretax charges totaling

$215 million were recorded. These charges were classified in

the Consolidated Statements of Income as $142 million asset

impairment and other charges, $48 million in selling expenses,

$21 million in cost of sales and $4 million in other expense.

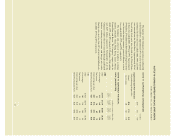

NOTE 5: ALLOWANCE FOR DOUBTFUL ACCOUNTS

On January 31, 2000, AmeriServe Food Distribution, Inc.

(AmeriServe), a significant distributor of products to fast food

and casual dining restaurant chains, filed for reorganization

in Delaware under Chapter 11 of the federal Bankruptcy

Code. The Company is a major supplier to several

AmeriServe customers. In the second quarter of fiscal 2000,

the Company recorded a $24 million bad debt reserve to fully

reserve the AmeriServe receivable. At September 30, 2000,

and October 2, 1999, allowance for doubtful accounts,

excluding the AmeriServe writeoff, was $17 million and

$22 million, respectively.

36