Tyson Foods 2000 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2000 ANNUAL REPORT

disease had been eradicated from our facilities by fiscal year

end and production volumes had returned to normal levels.

The Company’s International segment markets and sells the

full line of Tyson chicken products throughout the world.

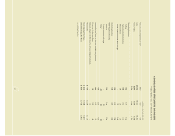

Swine sales increased $47 million or 42.7% over 1999,

with a 56.5% increase in average sales prices partially offset

by an 8.3% decrease in volume. Swine segment profit improved

$82 million or 130.2% over 1999 primarily due to the increase

in average sales prices. The Company’s Swine segment includes

feeder pig finishing and marketing of swine to regional and

national packers.

Other sales decreased $31 million or 3.8% from 1999 pri-

marily due to non-core businesses sold during fiscal 1999. Other

segment profit decreased $15 million or 9.7% from 1999. The

majority of revenue included in the Other segment is derived

from the Company’s Specialty Products and Prepared Foods

groups and the Company’s wholly owned subsidiary involved

in supplying chicken breeding stock.

Cost of sales for 2000 decreased 0.2% as compared to 1999.

This decrease is primarily the result of decreased sales. As a

percent of sales, cost of sales was 84.4% for 2000 compared

to 82.2% for 1999. The increase in cost of sales as a percent

of sales was due to the weak domestic market for chicken, the

reduction in volume associated with the Company’s ongoing

production cut, losses incurred by the Company’s Mexican

subsidiary and higher grain costs.

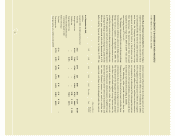

Operating expenses for 2000 decreased 6.8% from 1999,

primarily due to impairment and other charges of $77 million

recorded in 1999 partially offset by a $21 million increase in

current year expenses, primarily general and administrative.

As a percent of sales, selling expense increased to 7.9% in 2000

compared to 7.8% in 1999, primarily due to the decrease in

sales. Selling expense decreased $12 million in 2000 compared

to 1999 due to a decrease in sales promotion expenses. General

and administrative expense, as a percent of sales, was 2.4% in

2000 compared to 1.8% in 1999. The increase in general and

administrative expense is primarily due to a $24 million bad

debt writeoff related to the January 31, 2000, bankruptcy filing

by AmeriServe Food Distribution, Inc. and other increases

related to ongoing litigation costs. Amortization expense, as

a percent of sales, was 0.5% in both 2000 and 1999.

Interest expense in 2000 decreased 7.3% compared to 1999.

As a percent of sales, interest expense was 1.6% in 2000

compared to 1.7% in 1999. The Company had a lower level

of borrowing in 2000, which decreased the Company’s aver-

age indebtedness by 14.8% over the same period last year.

The Company’s short-term interest rates were slightly higher

than the same period last year, and the net average effective

interest rate on total debt was 6.9% for 2000 compared to

6.2% for 1999.

The effective tax rate for 2000 increased to 35.6% compared

to 34.9% for 1999 primarily due to an increase in foreign

subsidiary earnings effective tax rate.

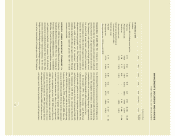

Return on invested capital (ROIC), defined as earnings before

interest and taxes divided by average total assets less current

liabilities excluding current debt, was 8.2% for 2000 com-

pared to 10.9% for 1999.

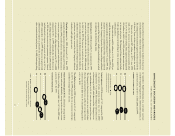

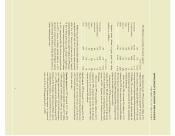

21

’00

’99

’98

7.9%

7.8%

8.0%**

1.8%

1.8%

2.0%*

EXPENSES AS A PERCENT OF SALES

general & administrative selling

*Excludes $24 million bad debt writeoff

**Excludes $48 million impairment loss

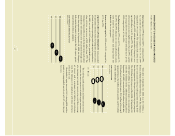

’00

’99

’98 4.9%

12.6%

10.9%

8.7%

9.9%

8.2%

RETURN ON INVESTED CAPITAL

ROIC ROIC excluding bad debt charge of $24 million

in 2000 and impairment and other charges

of $77 million in 1999 and $211 million in 1998