Tyson Foods 2000 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

TYSON FOODS, INC. 2000 ANNUAL REPORT

Interest Rate and Foreign Currency Risks The Company hedges

exposure to changes in interest rates on certain of its finan-

cial instruments. Under the terms of various leveraged equip-

ment loans, the Company enters into interest rate swap

agreements to effectively lock in a fixed interest rate for

these borrowings. The maturity dates of these leveraged

equipment loans range from 2005 to 2008 with interest

rates ranging from 4.7% to 6%.

The Company also periodically enters into foreign exchange

forward contracts and option contracts to hedge some of its

foreign currency exposure. At September 30, 2000, the

Company did not have any outstanding instruments or trans-

actions that are sensitive to foreign currency exchange rates.

In 1999, the Company used such contracts to hedge exposure

to changes in foreign currency exchange rates, primarily the

Mexican peso, associated with debt denominated in U.S.

dollars held by Tyson de Mexico. At October 2, 1999, the

notional amount of these forward exchange contracts to sell

Mexican pesos for U.S. dollars was $7 million due in 2000,

with a weighted average strike price of $10.13 and a negative

fair value of $1 million. Gains and losses on these contracts

are recognized as an adjustment of the subsequent transaction

when it occurs. Forward and option contracts generally have

maturities or expirations not exceeding 12 months.

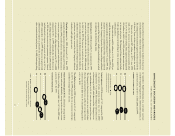

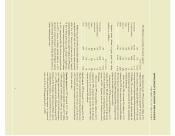

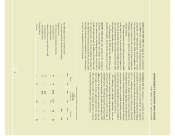

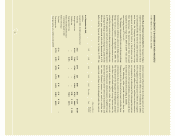

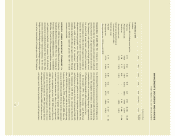

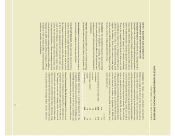

The following tables provide information about the

Company’s derivative financial instruments and other finan-

cial instruments that are sensitive to changes in interest rates.

The tables present the Company’s debt obligations, principal

cash flows and related weighted average interest rates by

expected maturity dates and fair values. For interest rate

swaps, the tables present notional amounts, weighted average

interest rates or strike rates by contractual maturity dates and

fair values. Notional amounts are used to calculate the

contractual cash flows to be exchanged under the contract.

dollars in millions

Fair value

2001 2002 2003 2004 2005 Thereafter Total 9/30/00

As of September 30, 2000

Liabilities

Long-term debt, including current portion

Fixed rate $123 $ 31 $178 $29 $180 $613 $1,154 $1,104

Average interest rate 8.23% 7.84% 6.18% 7.09% 6.80% 6.78% 6.88%

Variable rate – $276 – – – $ 50 $ 326 $ 326

Average interest rate – 6.78% – – – 5.64% 6.61%

Interest rate derivative financial

instruments related to debt

Interest rate swaps

Pay fixed $ 18 $ 20 $ 22 $21 $ 16 $ 13 $ 110 –

Average pay rate 6.72% 6.73% 6.73% 6.71% 6.44% 6.60% 6.66%

Average receive rate– USD 6 month LIBOR

26