Tyson Foods 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 Tyson Foods annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

TYSON FOODS, INC. 2000 ANNUAL REPORT

On January 20, 2000, McCarty Farms, Inc. (McCarty),

a former subsidiary of the Company which has been

merged into the Company, was indicted in the U.S. District

Court for the Southern District of Mississippi, Jackson

Division, for conspiracy to violate the federal Clean Water

Act. The alleged conspiracy arose out of McCarty’s partial

ownership of Central Industries, Inc. (Central), which oper-

ates a rendering plant in Forest, Miss. On November 3, 2000,

Central pled to 25 counts of knowing violations of the Act

and one count of conspiracy pursuant to a plea agreement,

which resulted in a $14 million fine against Central payable

over five years. The conspiracy indictment against McCarty

and other Central shareholders was dismissed. A related civil

proceeding by the United States arising from the same

circumstances, and a state environmental administrative

complaint were also fully resolved and dismissed as a part of

Central’s Plea Agreement.

The Company’s Sedalia, Mo., facility is currently under

investigation by the U.S. Attorney’s office of the Western

District of Missouri for possible violations of environmental

laws or regulations. Neither the likelihood of an unfavorable

outcome nor the amount of ultimate liability, if any, with

respect to this investigation can be determined at this time.

On October 17, 2000, a Washington County (Arkansas)

Chancery Court jury awarded the Company approximately

$20 million in its lawsuit against ConAgra, Inc. and ConAgra

Poultry Company. In its suit, the Company alleged that

ConAgra, Inc. and ConAgra Poultry Company violated the

Arkansas Trade Secrets Act when they improperly obtained

and implemented Tyson’s confidential feed nutrient profile.

The court ruled that the Company’s feed nutrient profile is a

trade secret under the Arkansas Trade Secrets Act and that

ConAgra, Inc. and ConAgra Poultry Company misappropri-

ated the feed nutrient profile. The court’s ruling and the award

are subject to appeal; therefore, the Company has not recorded

this award at September 30, 2000.

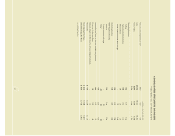

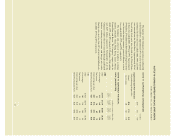

NOTE 9: COMMITMENTS

The Company leases certain farms and other properties and

equipment for which the total rentals thereon approximated

$66 million in 2000, $64 million in 1999 and $47 million

in 1998. Most farm leases have terms ranging from one to

10 years with various renewal periods. The most signifi-

cant obligations assumed under the terms of the leases are

the upkeep of the facilities and payments of insurance and

property taxes.

Minimum lease commitments under noncancelable leases

at September 30, 2000, total $124 million composed of

$54 million for 2001, $34 million for 2002, $18 million for

2003, $9 million for 2004, $5 million for 2005 and

$4 million for later years. These future commitments are

expected to be offset by future minimum lease payments to

be received under subleases of approximately $12 million.

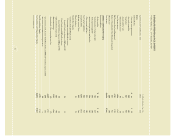

The Company assists certain of its swine and chicken

growers in obtaining financing for growout facilities by

providing the growers with extended growout contracts and

conditional operation of the facilities should a grower default

under their growout or loan agreement. The Company also

guarantees debt of outside third parties of $41 million.

NOTE 10: LONG-TERM DEBT

The Company has an unsecured revolving credit agreement

totaling $1 billion that supports the Company’s commercial

paper program. This $1 billion facility expires in May 2002.

At September 30, 2000, $260 million in commercial paper

was outstanding under this facility.

At September 30, 2000, the Company had outstanding

letters of credit totaling approximately $99 million issued

primarily in support of workers’ compensation insurance

programs, industrial revenue bonds and the leveraged equip-

ment loans.

39