Toyota 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

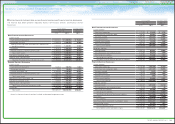

Derivative financial instruments:

20

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

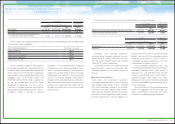

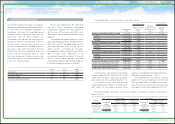

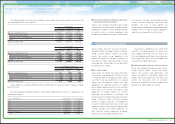

The following tables summarize the changes in Level 3 plan assets measured at fair value for the

years ended March 31, 2010 and 2011:

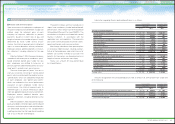

Toyota expects to contribute ¥97,231 million ($1,169 million) to its pension plans in the year ending

March 31, 2012.

The following pension benefit payments, which reflect expected future service, as appropriate, are

expected to be paid:

Yen in millions

For the year ended March 31, 2010

Debt securities

Other Total

Balance at beginning of year ¥ 5,242 ¥45,825 ¥51,067

Actual return on plan assets 818 (2,206) (1,388)

Purchases, sales and settlements (2,233) 3,467 1,234

Other (236) (568) (804)

Balance at end of year ¥ 3,591 ¥46,518 ¥50,109

Yen in millions

For the year ended March 31, 2011

Debt securities

Other Total

Balance at beginning of year ¥ 3,591 ¥46,518 ¥50,109

Actual return on plan assets 312 1,908 2,220

Purchases, sales and settlements (2,948) 11,490 8,542

Other (209) (1,065) (1,274)

Balance at end of year ¥ 746 ¥58,851 ¥59,597

U.S. dollars in millions

For the year ended March 31, 2011

Debt securities

Other Total

Balance at beginning of year $ 43 $560 $603

Actual return on plan assets 4 23 27

Purchases, sales and settlements (35) 138 103

Other (3) (13) (16)

Balance at end of year $ 9 $708 $717

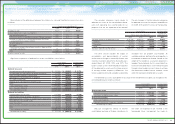

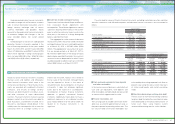

Years ending March 31, Yen in millions

U.S. dollars in millions

2012 ¥ 72,170 $ 868

2013 71,235 857

2014 73,345 882

2015 76,567 921

2016 79,591 957

from 2017 to 2021 442,737 5,324

Total ¥815,645 $9,809

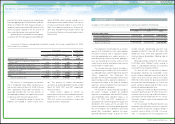

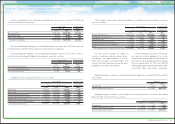

Toyota’s U.S. subsidiaries provide certain health

care and life insurance benefits to eligible retired

employees. In addition, Toyota provides benefits

to certain former or inactive employees after

employment, but before retirement. These benefits

are currently unfunded and provided through

various insurance companies and health care

providers. The costs of these benefits are

recognized over the period the employee provides

credited service to Toyota. Toyota’s obligations

under these arrangements are not material.

Postretirement benefits other than pensions

and postemployment benefits

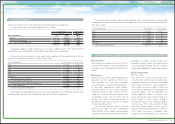

Toyota employs derivative financial instruments,

including foreign exchange forward contracts,

foreign currency options, interest rate swaps,

interest rate currency swap agreements and

interest rate options to manage its exposure to

fluctuations in interest rates and foreign currency

exchange rates. Toyota does not use derivatives

for speculation or trading.

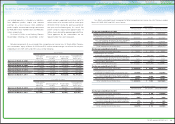

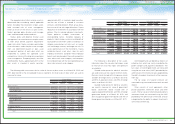

Toyota enters into interest rate swaps and interest

rate currency swap agreements mainly to convert

its fixed-rate debt to variable-rate debt. Toyota

uses interest rate swap agreements in managing

interest rate risk exposure. Interest rate swap

agreements are executed as either an integral

part of specific debt transactions or on a portfolio

basis. Toyota uses interest rate currency swap

agreements to hedge exposure to currency

exchange rate fluctuations on principal and

interest payments for borrowings denominated in

foreign currencies. Notes and loans payable

issued in foreign currencies are hedged by

concurrently executing interest rate currency swap

agreements, which involve the exchange of foreign

currency principal and interest obligations for

each functional currency obligations at agreed-

upon currency exchange and interest rates.

For the years ended March 31, 2009, 2010

and 2011, the ineffective portion of Toyota’s fair

value hedge relationships was not material. For

fair value hedging relationships, the components

of each derivative’s gain or loss are included in the

assessment of hedge effectiveness.

Toyota uses foreign exchange forward contracts,

foreign currency options, interest rate swaps,

interest rate currency swap agreements, and

interest rate options, to manage its exposure to

foreign currency exchange rate fluctuations and

interest rate fluctuations from an economic

perspective, and for which Toyota is unable or has

elected not to apply hedge accounting.

Fair value hedges

Undesignated derivative financial instruments

95TOYOTA ANNUAL REPORT 2011