Toyota 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Finance receivables:

7

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

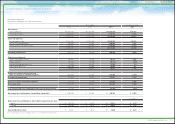

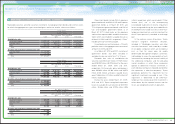

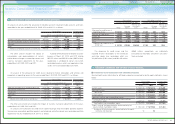

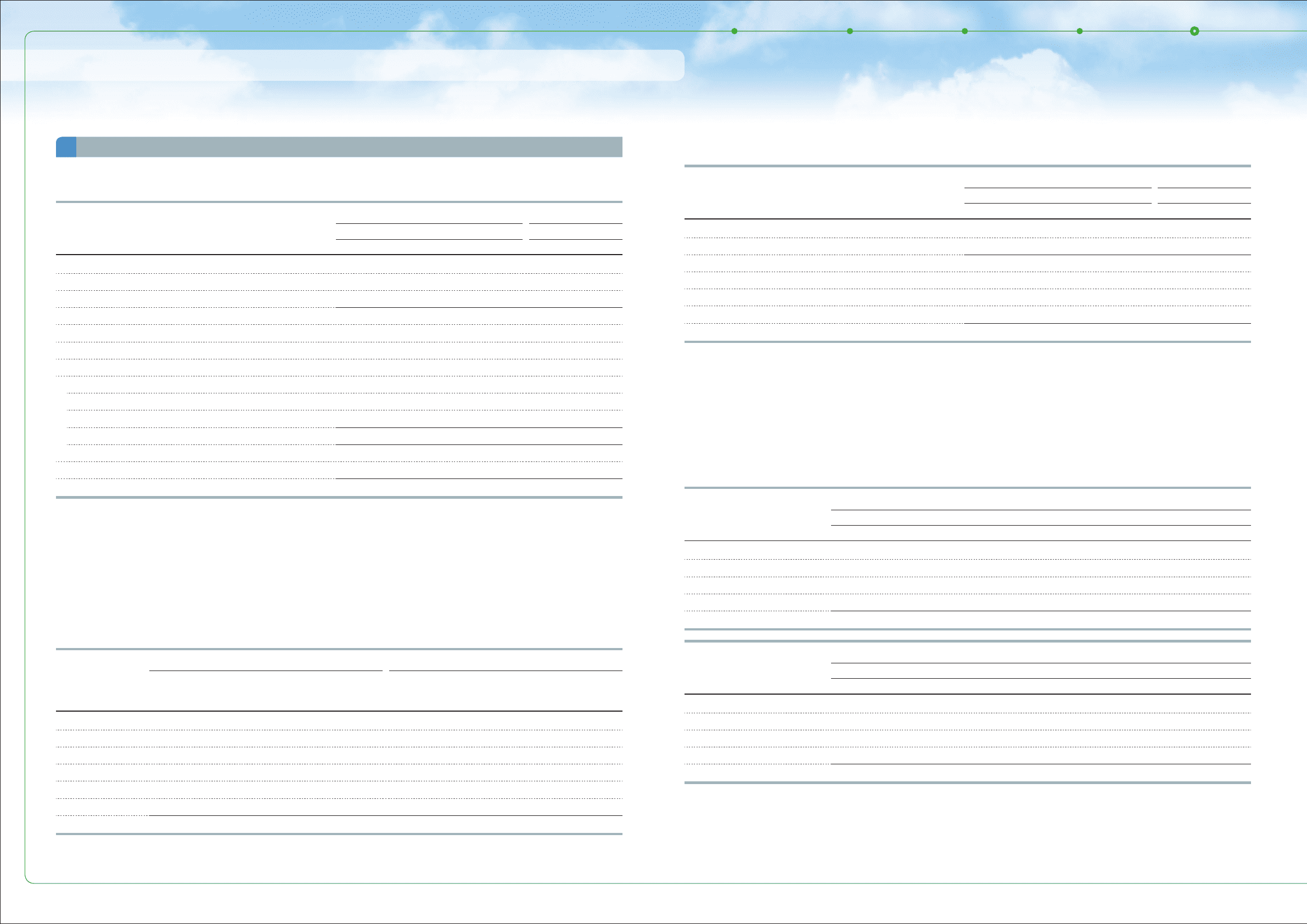

Finance receivables consist of the following:

Finance leases consist of the following:

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Retail ¥ 7,162,082 ¥ 7,128,453 $ 85,730

Finance leases 1,232,508 1,123,188 13,508

Wholesale and other dealer loans 2,051,301 1,990,557 23,939

10,445,891 10,242,198 123,177

Deferred origination costs 109,747 104,391 1,256

Unearned income

(

482,983) (496,235) (5,968)

Allowance for credit losses

Retail

(

160,351)

(

92,199) (1,109)

Finance leases

(

36,917)

(

36,024) (433)

Wholesale and other dealer loans

(

35,211)

(

28,580) (344)

Total allowance for credit losses

(

232,479)

(

156,803) (1,886)

Total finance receivables, net 9,840,176 9,693,551 116,579

Less - Current portion

(

4,209,496)

(

4,136,805) (49,751)

Noncurrent finance receivables, net ¥ 5,630,680 ¥ 5,556,746 $ 66,828

Finance receivables were geographically

distributed as follows: in North America 61.9%, in

Japan 12.8%, in Europe 10.3%, in Asia 4.7% and

in Other 10.3% as of March 31, 2010, and in North

Toyota is exposed to credit risk on Toyota’s

finance receivables. Credit risk is the risk of loss

arising from the failure of customers or dealers to

meet the terms of their contracts with Toyota or

America 59.0%, in Japan 12.7%, in Europe 10.4%,

in Asia 5.8% and in Other 12.1% as of March 31,

2011.

otherwise fail to perform as agreed. Toyota

estimates allowance for credit losses by variety of

credit-risk evaluation process to cover probable

and estimable losses above.

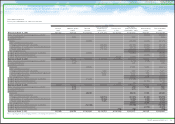

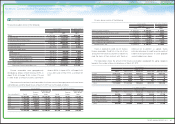

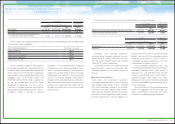

The contractual maturities of retail receivables, the future minimum lease payments on finance leases

and wholesale and other dealer loans at March 31, 2011 are summarized as follows:

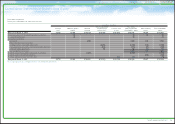

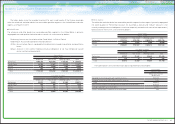

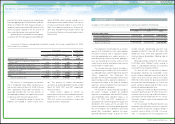

The table below shows the amount of the finance receivables segregated into aging categories

based on the number of days outstanding as of March 31, 2011:

Yen in millions U.S. dollars in millions

Years ending March 31,

Retail

Finance

leases

Wholesale and

other dealer

loans Retail

Finance

leases

Wholesale and

other dealer

loans

2012 ¥2,429,001 ¥326,116 ¥1,529,447 $29,212 $3,922 $18,394

2013 1,758,024 216,387 106,809 21,143 2,602 1,284

2014 1,343,998 165,018 153,470 16,164 1,985 1,846

2015 911,785 62,632 52,361 10,966 753 630

2016 444,633 28,095 59,945 5,347 338 721

Thereafter 241,012 6,623 88,525 2,898 80 1,064

¥7,128,453 ¥804,871 ¥1,990,557 $85,730 $9,680 $23,939

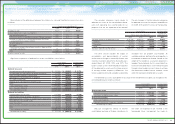

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Minimum lease payments ¥ 903,201 ¥ 804,871 $ 9,680

Estimated unguaranteed residual values 329,307 318,317 3,828

1,232,508 1,123,188 13,508

Deferred origination costs 6,423 5,406 65

Less - Unearned income (121,664) (104,419) (1,256)

Less - Allowance for credit losses (36,917) (36,024) (433)

Finance leases, net ¥1,080,350 ¥ 988,151 $11,884

Yen in millions

March 31, 2011

Retail

Finance leases

Wholesale Real estate Working capital

Current ¥7,017,171 ¥1,111,453 ¥897,971 ¥494,700 ¥593,516

31-60 days past due 72,082 5,968 2,260 404 44

61-90 days past due 15,466 1,283 355 34 0

Over 90 days past due 23,734 4,484 74 621 578

Total ¥7,128,453 ¥1,123,188 ¥900,660 ¥495,759 ¥594,138

U.S. dollars in millions

March 31, 2011

Retail

Finance leases

Wholesale Real estate Working capital

Current $84,392 $13,367 $10,799 $5,950 $7,138

31-60 days past due 867 72 27 5 1

61-90 days past due 186 15 4 0 0

Over 90 days past due 285 54 1 7 7

Total $85,730 $13,508 $10,831 $5,962 $7,146

81

TOYOTA ANNUAL REPORT 2011