Toyota 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

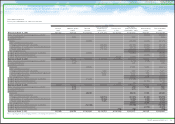

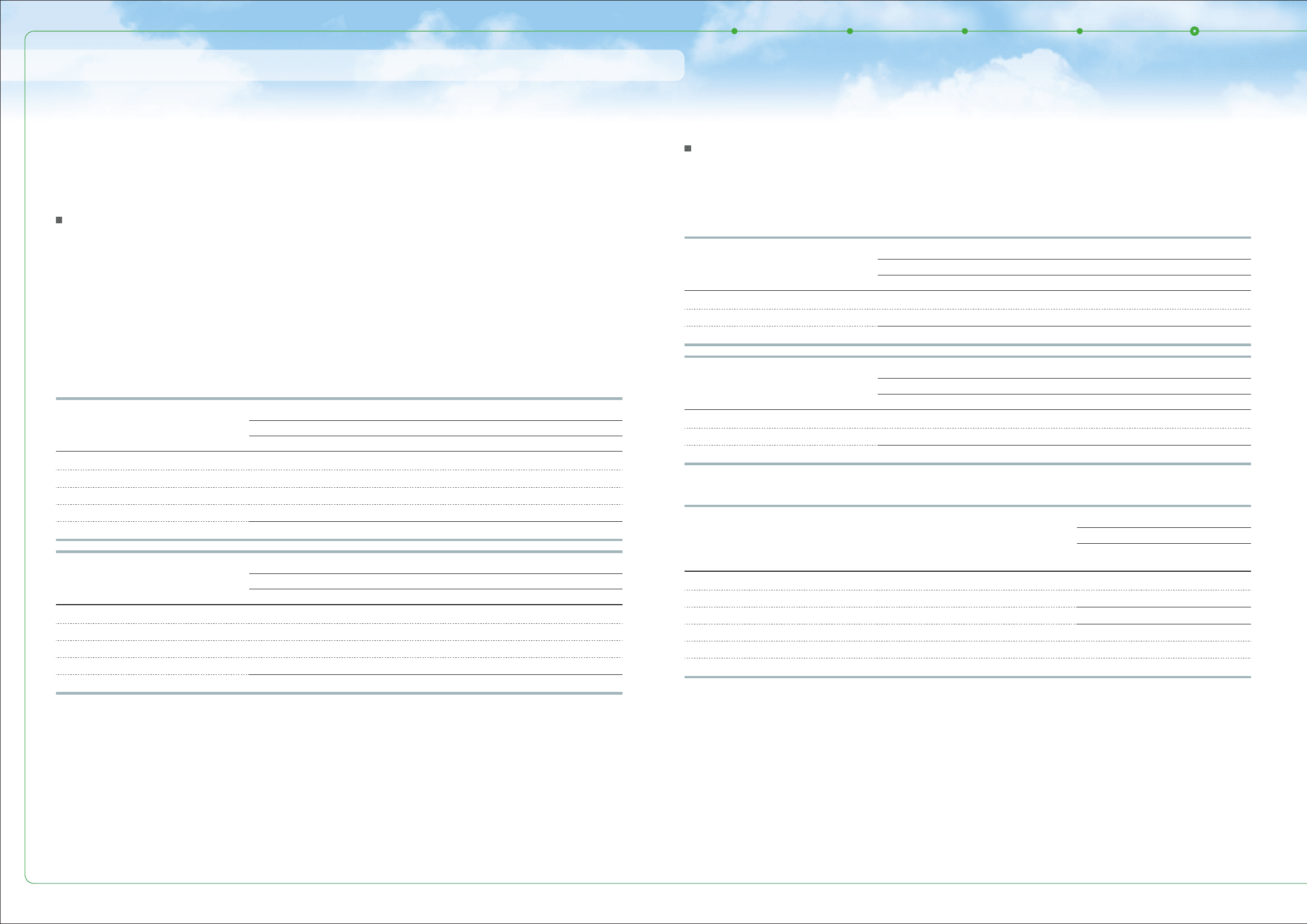

The tables below show the recorded investment for each credit quality of the finance receivable

within the wholesale and other dealer loan receivables portfolio segment in the United States and other

regions as of March 31, 2011:

United States

Other regions

The wholesale and other dealer loan receivables portfolio segment in the United States is primarily

segregated into credit qualities below based on internal risk assessments by dealers.

Performing: Account not classified as either Credit Watch, At Risk or Default

Credit Watch: Account designated for elevated attention

At Risk: Account where there is a probability that default exists based on qualitative and quantitative

factors

Default: Account is not currently meeting contractual obligations or we have temporarily waived

certain contractual requirements

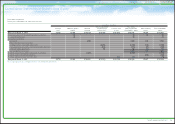

The wholesale and other dealer loan receivables portfolio segment in other regions is primarily segregated

into credit qualities of “Performing” (Account not classified as Default) and “Default” (Account is not

currently meeting contractual obligations or we have temporarily waived certain contractual requirements)

below based on internal risk assessments by dealers.

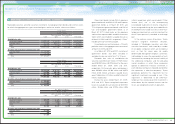

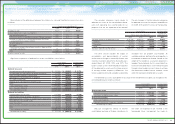

The tables below summarize information about impaired finance receivables:

Yen in millions

March 31, 2011

Wholesale Real estate Working capital Total

Performing ¥504,960 ¥283,450 ¥ 90,545 ¥ 878,955

Credit Watch 58,106 41,967 12,198 112,271

At Risk 6,494 12,344 1,066 19,904

Default 803 931 655 2,389

Total ¥570,363 ¥338,692 ¥104,464 ¥1,013,519

U.S. dollars in millions

March 31, 2011

Wholesale Real estate Working capital Total

Performing $6,073 $3,409 $1,089 $10,571

Credit Watch 698 505 147 1,350

At Risk 78 148 13 239

Default 10 11 8 29

Total $6,859 $4,073 $1,257 $12,189

Yen in millions

March 31, 2011

Wholesale Real estate Working capital Total

Performing ¥315,744 ¥151,020 ¥485,974 ¥952,738

Default 14,553 6,047 3,700 24,300

Total ¥330,297 ¥157,067 ¥489,674 ¥977,038

U.S. dollars in millions

March 31, 2011

Wholesale Real estate Working capital Total

Performing $3,797 $1,816 $5,845 $11,458

Default 175 73 44 292

Total $3,972 $1,889 $5,889 $11,750

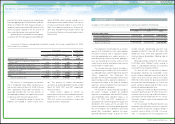

Yen in millions

March 31, 2010

Wholesale and other

dealer loans

Impaired finance receivables with specific reserves ¥37,273

Impaired finance receivables without specific reserves 1,582

Total ¥38,855

Allowance for credit losses recorded for impaired finance receivables ¥14,000

Average impaired finance receivables 42,581

Interest recognized on impaired finance receivables 464

82

TOYOTA ANNUAL REPORT 2011