Toyota 2011 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

0729

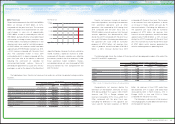

On a consolidated basis for the fiscal year ended March 31, 2011,

year-on-year vehicle sales improved 71 thousand units to 7,308 thousand

units, and net revenues increased 0.2% to ¥18,993.6 billion. Operating

income rose ¥320.7 billion to ¥468.2 billion, whereas net income

advanced ¥198.7 billion to ¥408.1 billion. As a result, Toyota succeeded

in increasing both revenue and income.

Factors contributing to the increase in operating income included

¥490.0 billion from marketing efforts (including ¥130.0 billion from our

financial services operations) and ¥180.0 billion from our continuous

cost-reduction efforts, including companywide VA (Value Analysis)

activities. Major factors reducing income were exchange rate fluctua-

tions, amounting to ¥290.0 billion, increases in expenses, etc., of ¥30.0

billion, and other factors reducing income that amounted to ¥29.3 billion.

In Japan, subsidies for eco-car purchases ended, which had a negative

effect on income, and vehicle sales were drastically down due to the

earthquake of March 11. Nonetheless, sales of IMVs were strong,

especially in Asian countries such as Thailand and Indonesia, reaching

their highest levels ever for the full year and contributing to an increase

in income. The negative impact of the Great East Japan Earthquake on

income amounted to ¥110.0 billion: ¥100.0 billion was due to operating

factors such as reduced vehicle sales as a result of reduced production

and the recording of allowances for our financial services business; other

factors contributing to a ¥10.0 billion reduction in income were decreased

cost reduction associated with lower unit sales and an increase in costs.

Taking the above into consideration, we view the increase in income for

the fiscal year ended March 31, 2011, as offsetting two major impacts

that reduced income, namely, the rapid and steep increase in the value

of the yen and the Great East Japan Earthquake.

Although I have noted previously that in the fiscal year ended March

31, 2010, we succeeded in broadly lowering our break-even point, we

continued to make structural improvements during the fiscal year ended

March 31, 2011, so if we leave out temporary factors such as the impact

of the earthquake, I believe we have succeeded in creating “a structure

that generates profits even with the exchange rate at ¥85 to the U.S.

dollar, and consolidated unit sales of 6.6 million.” We will continue to put

strong efforts into marketing, as well as work to achieve cost reductions

by holding down fixed costs and conducting companywide VA efforts so

as to improve our profitability.

For the fiscal year ending March 31, 2012, we forecast vehicle sales of

7.24 million units, net revenues of ¥18,600.0 billion, operating income of

¥300.0 billion and net income of ¥280.0 billion on a consolidated basis.

The exchange rates assumed for this forecast are ¥82 per US$1 and

¥115 per €1.

Factors that are expected to increase income include cost-reduction

efforts amounting to ¥100.0 billion. Factors that are expected to cause a

decrease in income include the effect of exchange rate fluctuations

amounting to ¥100.0 billion, sales volume/mix effects totaling ¥120.0

billion and an increase in expenses, etc., reaching ¥48.2 billion. In terms

of the impact in the next fiscal year of the Great East Japan Earthquake,

we expect a decrease in unit sales, including a surplus after recovery to

regular production levels amounting to ¥320.0 billion and decreased cost

reduction amounting to ¥40.0 billion, for a total impact of ¥360.0 billion.

Despite temporary factors such as the effect of the disaster, I believe we

are making steady progress toward achieving the goal set forth in our

Global Vision of building solid profitability by which we can consistently

achieve a return to profitability in nonconsolidated operating income,

with a consolidated operating margin of 5% and operating income of

around ¥1 trillion even under such severe conditions as an exchange

rate of ¥85 to the U.S. dollar, and consolidated unit sales of 7.5 million.

I believe that the profitability called for in the Global Vision represents

a “bottom line for sustainable growth,” which means creating a structure

that will generate earnings even in the event of another economic

downturn that, for example, results in a 20% decline in unit sales. Doing

so means creating a stable business base by creating “better cars” that

are accepted by our customers and society, and contributing to “enriching

lives of communities,” which will result in winning the hearts of a growing

number of customers. By fostering that kind of virtuous cycle we can

realize sustainable growth and increase our corporate value.

Fiscal 2011 Business Results

Consolidated Financial Forecasts for Fiscal 2012

Message from the Executive Vice President Responsible for Accounting

39TOYOTA ANNUAL REPORT 2011