Toyota 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity and Capital Resources

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

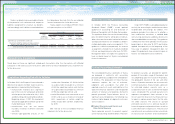

Historically, Toyota has funded its capital expendi-

tures and research and development activities

through cash generated by operations.

In fiscal 2012, Toyota expects to sufficiently

fund its capital expenditures and research and

development activities through cash and cash

equivalents on hand, and cash generated by

operations. Toyota will use its funds for the

development of environment technologies,

maintenance and replacement of manufacturing

facilities, and the introduction of new products.

See “Information on the Company — Business

Overview — Capital Expenditures and Divesti-

tures” for information regarding Toyota’s material

capital expenditures and divestitures for fiscal

2009, 2010 and 2011, and information concerning

Toyota’s principal capital expenditures and

divestitures currently in progress.

Toyota funds its financing programs for

customers and dealers, including loans and

vehicle unit sales, which exceed the factors

increasing operating income. As a result, Toyota

expects that operating income will decrease in

fiscal 2012 compared with fiscal 2011. Also,

Toyota expects income before income taxes and

equity in earnings of affiliated companies and net

income attributable to Toyota Motor Corporation

will decrease in fiscal 2012. Exchange rate

fluctuations can materially affect Toyota’s

operating results. In particular, a strengthening of

the Japanese yen against the U.S. dollar can

have a material adverse effect on Toyota’s

operating results. See “Operating and Financial

Review and Prospects — Operating Results —

Overview — Currency Fluctuations” for further

leasing programs, from both cash generated by

operations and borrowings by its sales finance

subsidiaries. Toyota seeks to expand its ability to

raise funds locally in markets throughout the world

by expanding its network of finance subsidiaries.

Repurchasing of its own shares occurred at

an approximate total cost of ¥73 billion for fiscal

2009. Toyota refrained from repurchasing of its

own shares for fiscal 2010 and 2011. Toyota has

decided, for the time being, to refrain from

repurchasing its own shares, in order to prioritize

retention of cash reserves given the continued

uncertainties surrounding future global economy.

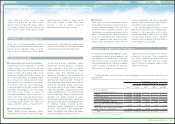

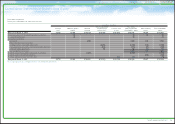

Net cash provided by operating activities was

¥2,024.0 billion for fiscal 2011, compared with

¥2,558.5 billion for the prior fiscal year. The

decrease in net cash provided by operating

activities resulted from an increase in cash

payment to suppliers attributable to the increase

in cost of products sold in the automotive

discussion. See “Information on the Company —

Business Overview” for a more detailed

information of the Great East Japan Earthquake.

The foregoing statements are forward-looking

statements based upon Toyota’s management’s

assumptions and beliefs regarding exchange

rates, market demand for Toyota’s products,

economic conditions and others. See “Cautionary

Statement Concerning Forward-Looking

Statements”. Toyota’s actual results of operations

could vary significantly from those described

above as a result of unanticipated changes in the

factors described above or other factors, including

those described in “Risk Factors”.

operations, and cash payments for income taxes,

partially offset by an increase in cash collection

received from sale of products due to an increase

in net revenue for the automotive operations.

Net cash used in investing activities was

¥2,116.3 billion for fiscal 2011, compared with

¥2,850.1 billion for the prior fiscal year. The

decrease in net cash used in investing activities

resulted from an increase in sales and maturity of

marketable securities and security investments,

partially offset by an increase in purchases of

marketable securities and security investments.

Net cash provided by or used in financing

activities was a ¥434.3 billion increase for fiscal

2011, compared with ¥277.9 billion decrease for

the prior fiscal year. The increase in net cash

provided by financing activities resulted from an

increase in short-term borrowings and decrease

in repayment of long-term debt.

Total capital expenditures for property, plant

and equipment, excluding vehicles and equipment

on operating leases, were ¥629.3 billion during

fiscal 2011, an increase of 4.1% over the ¥604.5

billion in total capital expenditures during the prior

fiscal year. The increase in capital expenditures

resulted from an increase of investments in North

America and Asia.

Total capital expenditures for vehicles and

equipment on operating leases were ¥1,061.8

billion during fiscal 2011, an increase of 27.5%

over the ¥833.0 billion in expenditures from the

prior fiscal year. The increase in expenditures for

vehicles and equipment on operating leases

resulted from an increase in investments in the

financial services operations.

Toyota expects investments in property, plant

and equipment, excluding vehicles and equipment

on operating leases, to be approximately ¥720.0

billion during fiscal 2012.

Based on current available information, Toyota

does not expect environmental matters to have a

material impact on its financial position, results of

operations, liquidity or cash flows during fiscal

2012. However, there exists uncertainty with

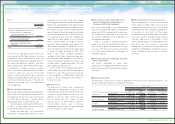

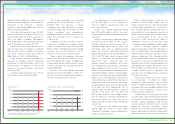

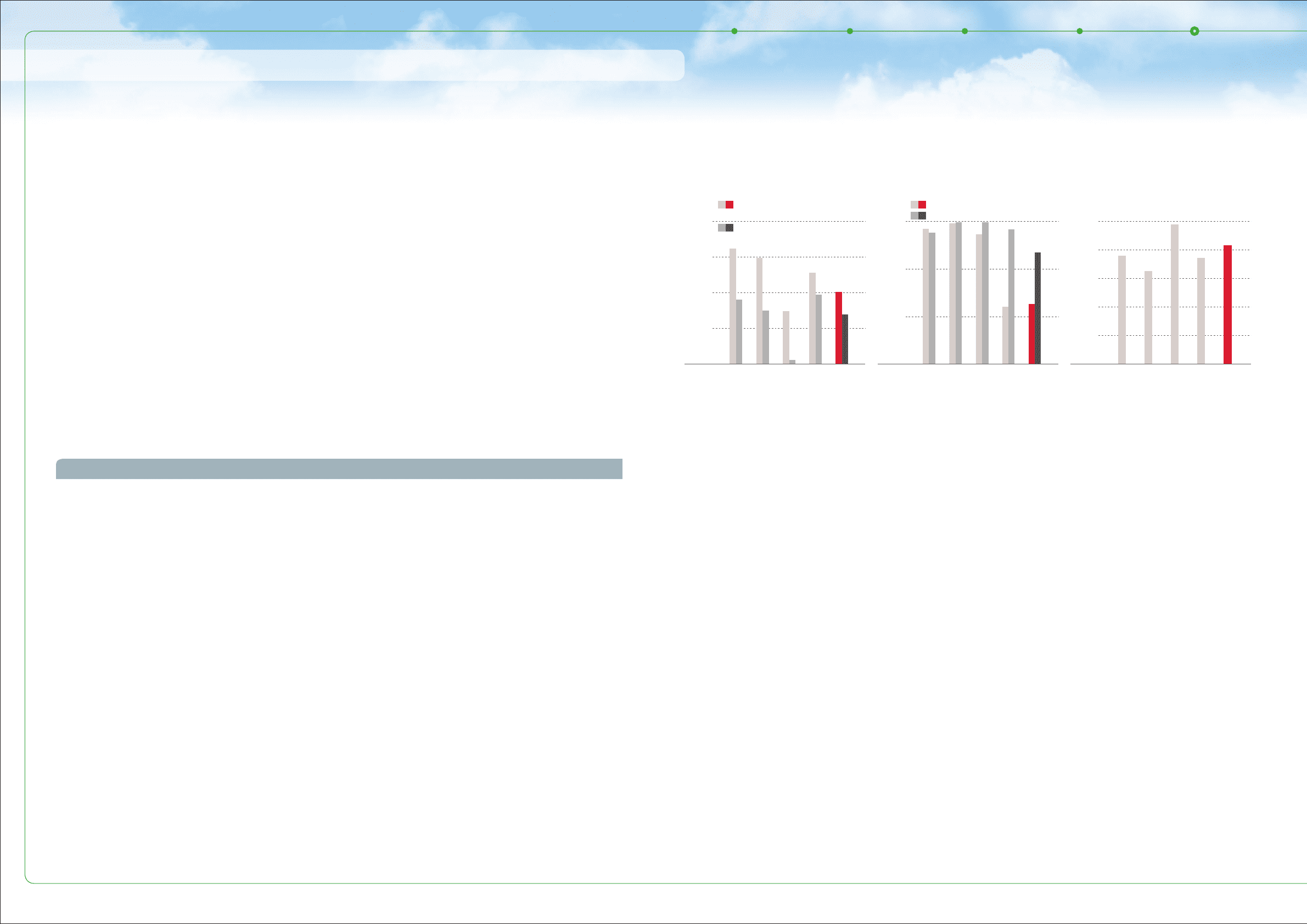

0

1,000

2,000

3,000

4,000

FY ‘07 ‘11‘09

‘08‘10

(¥ Billion)

Net cash provided by

operating activities

Free cash flow

0

500

1,000

1,500

(¥ Billion)

FY ‘07 ‘11

Capital expenditures

Depreciation

‘09‘08‘10

0

500

1,000

1,500

2,500

2,000

(¥ Billion)

FY ‘07 ‘11‘10‘09‘08

Net Cash Provided by

Operating Activities and

Free Cash Flow*

Capital Expenditures for Property,

Plant and Equipment* and

Depreciation

Cash and Cash Equivalents

at End of Year

* (Net cash provided by operating activities)-

(Capital expenditures for property, plant

and equipment, excluding vehicles and

equipment on operating leases)

* Excluding vehicles and equipment on

operating leases

63

TOYOTA ANNUAL REPORT 2011