Toyota 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Per share amounts:

25

Fair value measurements:

26

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

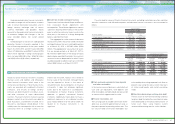

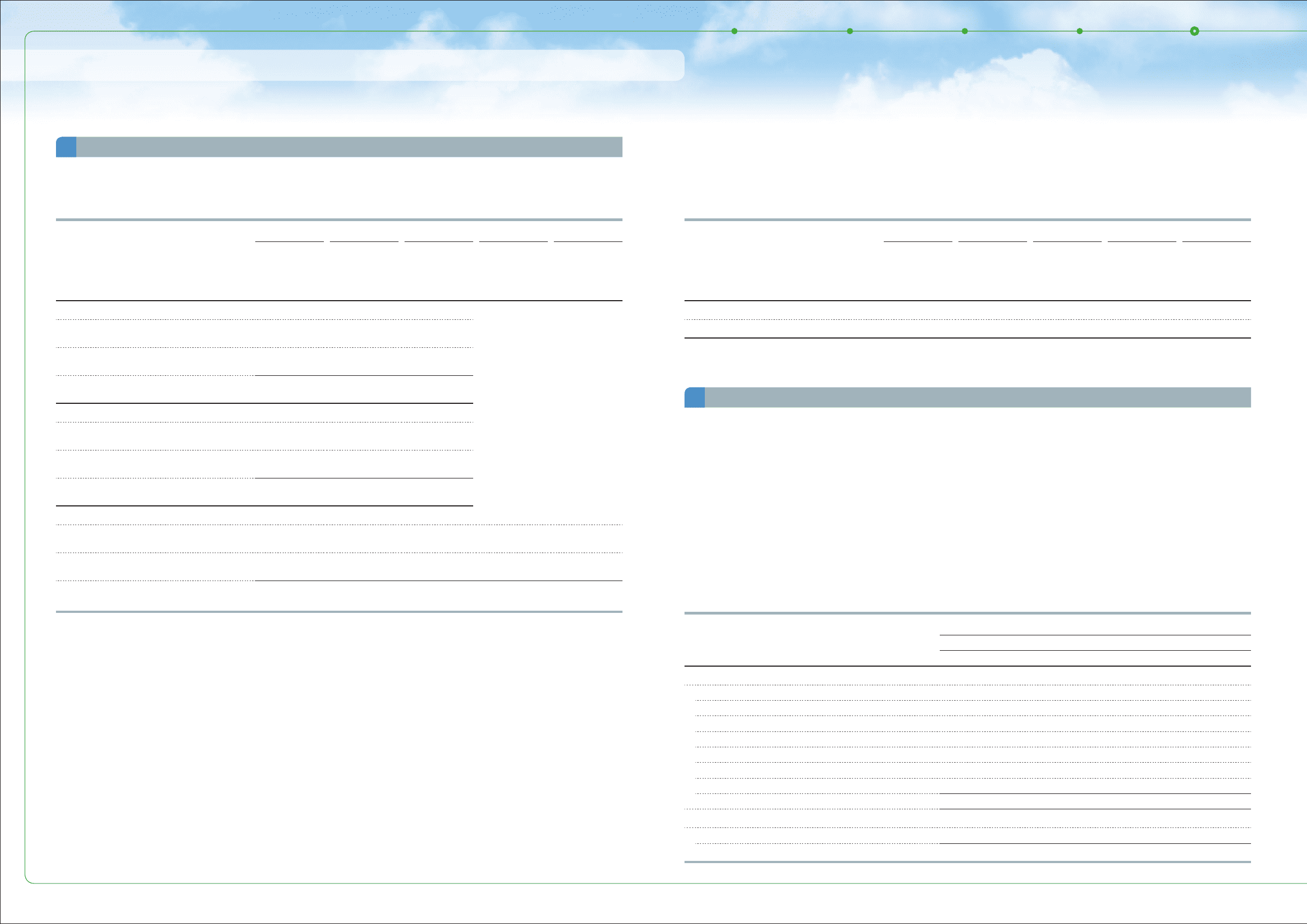

Reconciliations of the differences between basic and diluted net income (loss) attributable to Toyota Motor

Corporation per share for the years ended March 31, 2009, 2010 and 2011 are as follows:

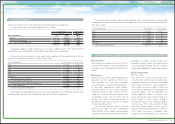

The following table shows Toyota Motor Corporation shareholders’ equity per share as of March 31,

2010 and 2011. Toyota Motor Corporation shareholders’ equity per share amounts are calculated by

dividing Toyota Motor Corporation shareholders’ equities’ amount at the end of each period by the number

of shares issued and outstanding, excluding treasury stock at the end of the corresponding period.

Yen in millions

Thousands of shares

Yen

U.S. dollars in millions

U.S. dollars

Net income (loss)

attributable to

Toyota Motor

Corporation

Weighted-average

shares

Net income (loss)

attributable to

Toyota Motor

Corporation per

share

Net income

attributable to

Toyota Motor

Corporation

Net income

attributable to

Toyota Motor

Corporation per

share

For the year ended March 31, 2009

Basic net loss attributable to Toyota

Motor Corporation per common share

¥(436,937) 3,140,417 ¥(139.13)

Effect of dilutive securities

Assumed exercise of dilutive stock options

(0) ―

Diluted net loss attributable to Toyota

Motor Corporation per common share

¥(436,937) 3,140,417 ¥(139.13)

For the year ended March 31, 2010

Basic net income attributable to Toyota

Motor Corporation per common share

¥ 209,456 3,135,986 ¥ 66.79

Effect of dilutive securities

Assumed exercise of dilutive stock options

―12

Diluted net income attributable to Toyota

Motor Corporation per common share

¥ 209,456 3,135,998 ¥ 66.79

For the year ended March 31, 2011

Basic net income attributable to Toyota

Motor Corporation per common share

¥ 408,183 3,135,881 ¥ 130.17 $4,909 $1.57

Effect of dilutive securities

Assumed exercise of dilutive stock options

(0) 34 (0)

Diluted net income attributable to Toyota

Motor Corporation per common share

¥ 408,183 3,135,915 ¥ 130.16 $4,909 $1.57

Assumed exercise of certain stock options

was not included in the computation of diluted

net loss attributable to Toyota Motor Corporation

per share for the year ended March 31, 2009

because it had an antidilutive effect due to the

net loss attributable to Toyota Motor Corporation

for the period.

Certain stock options were not included in the

computation of diluted net income attributable to

Toyota Motor Corporation per share for the years

ended March 31, 2010 and 2011 because the

options’ exercise prices were greater than the

average market price per common share during

the period.

In addition to the disclosure requirements

under U.S.GAAP, Toyota discloses the informa-

tion below in order to provide financial statement

users with valuable information.

In accordance with U.S.GAAP, Toyota classifies fair value into three levels of input as follows which are

used to measure it.

Level 1: Quoted prices in active markets for identical assets or liabilities

Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for identical or

similar assets or liabilities in markets that are not active; inputs other than quoted prices that

are observable for the assets or liabilities

Level 3: Unobservable inputs for assets or liabilities

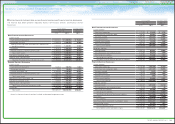

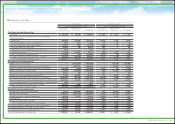

The following table summarizes the fair values of the assets and liabilities measured at fair value on

a recurring basis at March 31, 2010 and 2011:

Yen in millions

Thousands of shares

Yen

U.S. dollars in millions

U.S. dollars

Toyota Motor

Corporation

Shareholders’

equity

Shares issued

and outstanding

at the end of the

year (excluding

treasury stock)

Toyota Motor

Corporation

Shareholders’

equity per share

Toyota Motor

Corporation

Shareholders’

equity

Toyota Motor

Corporation

Shareholders’

equity per share

As of March 31, 2010 ¥10,359,723 ¥3,135,995 ¥3,303.49

As of March 31, 2011 10,332,371 3,135,699 3,295.08 $124,262 $39.63

Yen in millions

March 31, 2010

Level 1 Level 2 Level 3 Total

Assets

Cash equivalents ¥ 677,442 ¥ 69,702 ¥ ―¥ 747,144

Time deposits ―173,500 ―173,500

Marketable securities and other securities investments

Government bonds 2,654,829 ― ― 2,654,829

Common stocks 852,775 ― ― 852,775

Other 37,296 370,933 13,134 421,363

Derivative financial instruments ―349,556 19,437 368,993

Total ¥4,222,342 ¥ 963,691 ¥ 32,571 ¥5,218,604

Liabilities

Derivative financial instruments ¥

―¥(259,184) ¥(13,545) ¥ (272,729)

Total ¥

―¥(259,184) ¥(13,545) ¥ (272,729)

107

TOYOTA ANNUAL REPORT 2011