Toyota 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shareholders’ equity:

17

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

Yen in millions

U.S. dollars in millions

For the years ended March 31,

For the year

ended March 31,

2009 2010 2011 2011

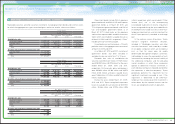

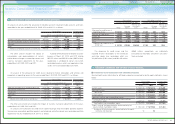

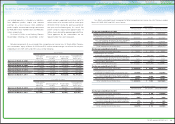

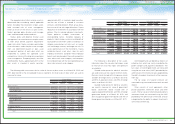

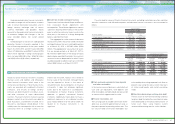

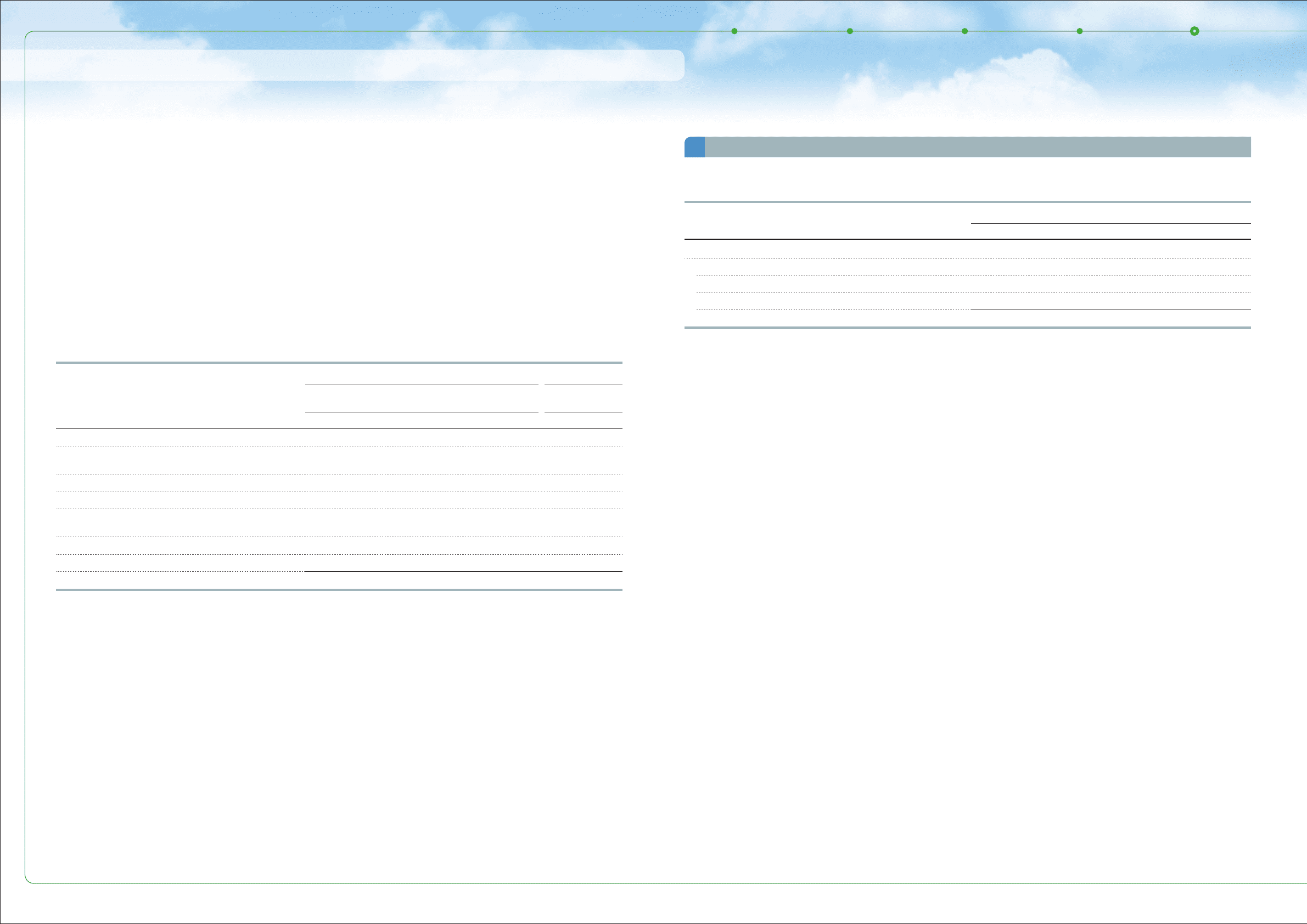

Balance at beginning of year ¥ 37,722 ¥ 46,803 ¥ 23,965 $ 288

Additions based on tax positions related to the

current year 858 2,702 213 3

Additions for tax positions of prior years 35,464 6,750 12,564 151

Reductions for tax positions of prior years (24,061) (2,802) (16,133) (194)

Reductions for tax positions related to lapse of

statute of limitations (114) (106) — —

Reductions for settlements (128) (27,409) (2,794) (34)

Other (2,938) (1,973) (2,362) (28)

Balance at end of year ¥ 46,803 ¥ 23,965 ¥ 15,453 $ 186

A summary of the gross unrecognized tax benefits changes for the years ended March 31, 2009,

2010 and 2011 is as follows:

The amount of unrecognized tax benefits

that, if recognized, would affect the effective tax

rate was not material at March 31, 2009, 2010 and

2011, respectively. Toyota does not believe it is

reasonably possible that the total amounts of

unrecognized tax benefits will significantly increase

or decrease within the next twelve months.

Interest and penalties related to income tax

liabilities are included in “Other income (loss),

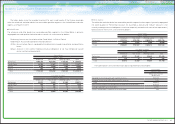

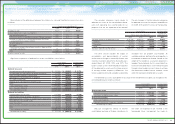

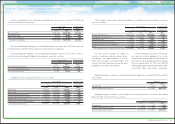

The Corporation Act provides that an amount

equal to 10% of distributions from surplus paid by

the parent company and its Japanese subsid-

iaries be appropriated as a capital reserve or a

retained earnings reserve. No further appropria-

tions are required when the total amount of the

capital reserve and the retained earnings reserve

reaches 25% of stated capital.

The retained earnings reserve included in

retained earnings as of March 31, 2010 and 2011

was ¥168,680 million and ¥171,062 million ($2,057

million), respectively. The Corporation Act

provides that the retained earnings reserve of the

parent company and its Japanese subsidiaries is

restricted and unable to be used for dividend

payments, and is excluded from the calculation of

the profit available for dividend.

The amounts of statutory retained earnings of

the parent company available for dividend

payments to shareholders were ¥5,478,747 million

and ¥5,389,432 million ($64,816 million) as of

March 31, 2010 and 2011, respectively. In

accordance with customary practice in Japan, the

distributions from surplus are not accrued in the

financial statements for the corresponding period,

but are recorded in the subsequent accounting

period after shareholders’ approval has been

obtained. Retained earnings at March 31, 2011

net”. The amounts of interest and penalties

accrued as of and recognized for the years ended

March 31, 2009, 2010 and 2011, respectively,

were not material.

Toyota remains subject to income tax

examination for the tax returns related to the years

beginning on and after January 1, 2004 and

2000, with various tax jurisdictions in Japan and

foreign countries, respectively.

include amounts representing year-end cash

dividends of ¥94,071 million ($1,131 million), ¥30

($0.36) per share, which were approved at the

Ordinary General Shareholders’ Meeting, held on

June 17, 2011.

Retained earnings at March 31, 2011 include

¥1,401,985 million ($16,861 million) relating to

equity in undistributed earnings of companies

accounted for by the equity method.

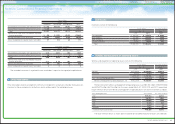

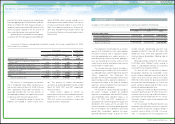

On June 22, 2007, at the Ordinary General

Shareholders’ Meeting, the shareholders of the

parent company approved to purchase up to 30

million shares of its common stock at a cost up to

¥250,000 million during the purchase period of

one year from the following day. As a result, the

parent company repurchased 30 million shares

during the approved period of time.

On February 5, 2008, the Board of Directors

resolved to purchase up to 12 million shares of its

common stock at a cost up to ¥60,000 million in

accordance with the Corporation Act. As a result,

the parent company repurchased approximately

10 million shares.

On the same date, the Board of Directors also

resolved to retire 162 million shares of its common

stock, and then the parent company retired its

common stock on March 31, 2008. This retire-

ment, in accordance with the Corporation Act

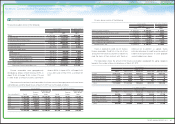

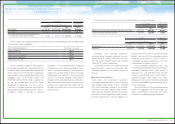

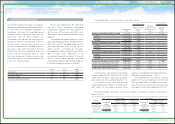

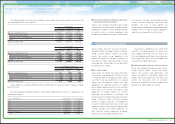

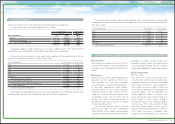

Changes in the number of shares of common stock issued have resulted from the following:

For the years ended March 31,

2009 2010 2011

Common stock issued

Balance at beginning of year 3,447,997,492 3,447,997,492 3,447,997,492

Issuance during the year ― ― ―

Purchase and retirement ― ― ―

Balance at end of year 3,447,997,492 3,447,997,492 3,447,997,492

provision for income taxes on those undistributed

earnings aggregating ¥2,709,626 million ($32,587

million) as of March 31, 2011. Toyota estimates an

additional tax provision of ¥100,957 million ($1,214

million) would be required if the full amount of

those undistributed earnings were remitted.

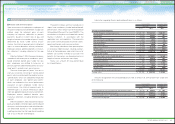

Operating loss carryforwards for tax purposes

as of March 31, 2011 were approximately ¥894,587

million ($10,759 million) and are available as an

offset against future taxable income. The majority

of these carryforwards expire in years 2012 to

2030. Tax credit carryforwards as of March 31,

2011 were ¥127,289 million ($1,531 million) and

the majority of these carryforwards expire in years

2012 to 2014.

89TOYOTA ANNUAL REPORT 2011