Toyota 2011 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

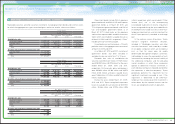

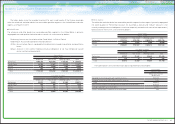

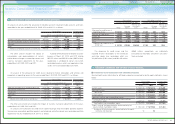

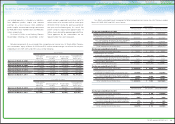

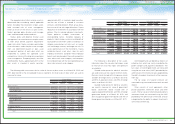

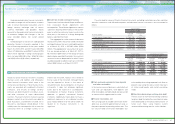

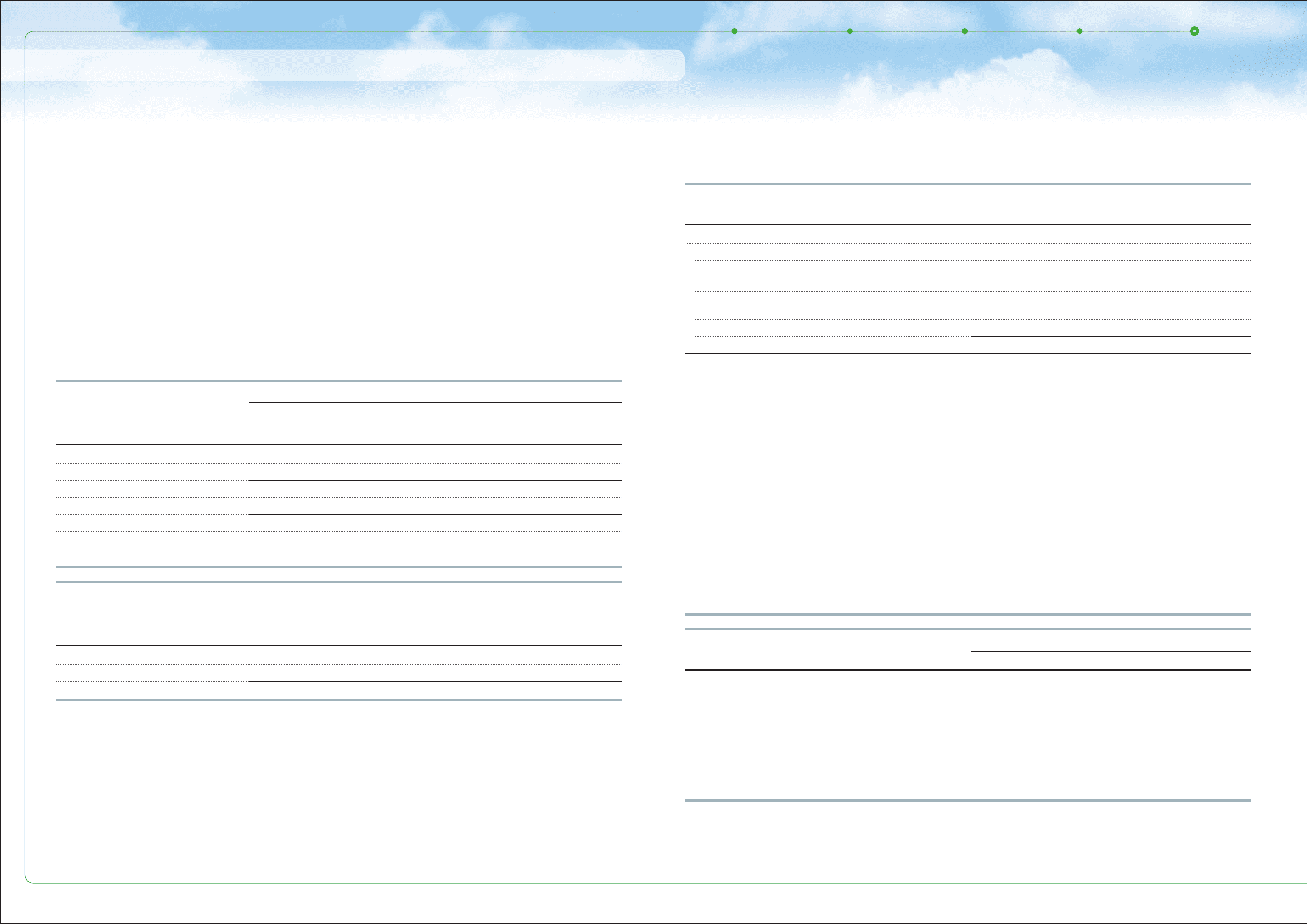

Detailed components of accumulated other comprehensive income (loss) in Toyota Motor Corpora-

tion shareholders’ equity at March 31, 2010 and 2011 and the related changes, net of taxes for the years

ended March 31, 2009, 2010 and 2011 consist of the following:

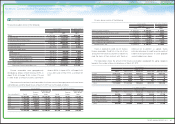

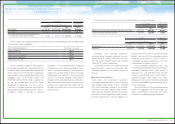

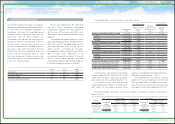

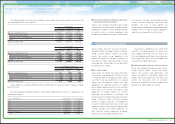

Tax effects allocated to each component of other comprehensive income (loss) for the years ended

March 31, 2009, 2010 and 2011 are as follows:

Yen in millions

Foreign currency

translation

adjustments

Unrealized gains on

securities

Pension liability

adjustments

Accumulated other

comprehensive

income (loss)

Balances at March 31, 2008 ¥ (501,367) ¥ 310,979 ¥ (50,817) ¥ (241,205)

Other comprehensive income (loss) (381,303) (293,101) (192,172) (866,576)

Balances at March 31, 2009 (882,670) 17,878 (242,989) (1,107,781)

Other comprehensive income 9,894 176,407 74,645 260,946

Balances at March 31, 2010 (872,776) 194,285 (168,344) (846,835)

Other comprehensive income (loss) (287,613) (26,058) 15,785 (297,886)

Balances at March 31, 2011 ¥(1,160,389) ¥ 168,227 ¥(152,559) ¥(1,144,721)

U.S. dollars in millions

Foreign currency

translation

adjustments

Unrealized gains on

securities

Pension liability

adjustments

Accumulated other

comprehensive

income (loss)

Balances at March 31, 2010 $(10,496) $2,337 $(2,025) $(10,184)

Other comprehensive income (loss) (3,459) (314) 190 (3,583)

Balances at March 31, 2011 $(13,955) $2,023 $(1,835) $(13,767)

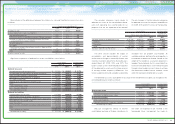

Yen in millions

Pre-tax amount Tax amount Net-of-tax amount

For the year ended March 31, 2009

Foreign currency translation adjustments ¥ (391,873) ¥ 10,570 ¥(381,303)

Unrealized losses on securities:

Unrealized net holding losses arising for the year (677,710) 255,890 (421,820)

Less: reclassification adjustments for losses included in

net loss attributable to Toyota Motor Corporation

215,249 (86,530) 128,719

Pension liability adjustments (319,613) 127,441 (192,172)

Other comprehensive income (loss) ¥(1,173,947) ¥ 307,371 ¥(866,576)

For the year ended March 31, 2010

Foreign currency translation adjustments ¥ 10,809 ¥ (915) ¥ 9,894

Unrealized gains on securities:

Unrealized net holding gains arising for the year 277,838 (102,538) 175,300

Less: reclassification adjustments for losses included in

net income attributable to Toyota Motor Corporation

1,852 (745) 1,107

Pension liability adjustments 124,526 (49,881) 74,645

Other comprehensive income ¥ 415,025 ¥(154,079) ¥ 260,946

For the year ended March 31, 2011

Foreign currency translation adjustments ¥ (294,279) ¥ 6,666 ¥(287,613)

Unrealized losses on securities:

Unrealized net holding losses arising for the year (31,899) 9,643 (22,256)

Less: reclassification adjustments for gains included in

net income attributable to Toyota Motor Corporation

(6,358) 2,556 (3,802)

Pension liability adjustments 26,681 (10,896) 15,785

Other comprehensive income (loss) ¥ (305,855) ¥ 7,969 ¥(297,886)

U.S. dollars in millions

Pre-tax amount Tax amount Net-of-tax amount

For the year ended March 31, 2011

Foreign currency translation adjustments $(3,539) $ 80 $(3,459)

Unrealized losses on securities:

Unrealized net holding losses arising for the year (384) 116 (268)

Less: reclassification adjustments for gains included in

net income attributable to Toyota Motor Corporation

(77) 31 (46)

Pension liability adjustments 321 (131) 190

Other comprehensive income (loss) $(3,679) $ 96 $(3,583)

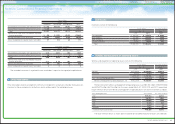

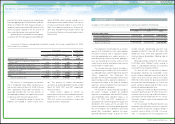

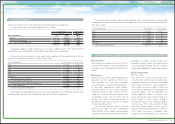

and related regulations, is treated as a reduction

from additional paid-in capital and retained

earnings. As a result, treasury stock, additional

paid-in capital and retained earnings decreased

by ¥646,681 million, ¥3,499 million and ¥643,182

million, respectively.

On June 24, 2008, at the Ordinary General

Shareholders’ Meeting, the shareholders of the

parent company approved to purchase up to 30

million shares of its common stock at a cost up to

¥200,000 million during the purchase period of

one year from the following day. As a result, the

parent company repurchased approximately 14

million shares during the approved period of time.

These approvals by the shareholders are not

required under the current regulation.

90

TOYOTA ANNUAL REPORT 2011