Toyota 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Short-term borrowings and long-term debt:

13

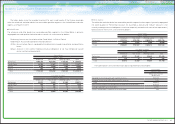

Product warranties and recalls and other safety measures:

14

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

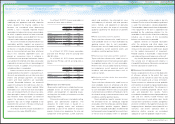

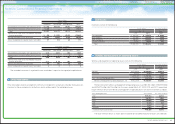

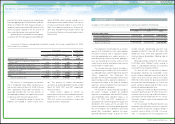

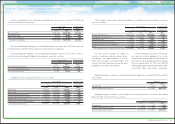

Short-term borrowings at March 31, 2010 and 2011 consist of the following:

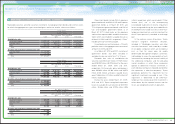

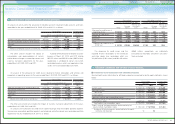

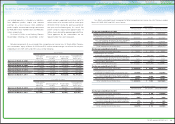

Long-term debt at March 31, 2010 and 2011 comprises the following:

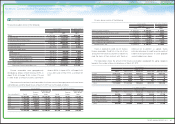

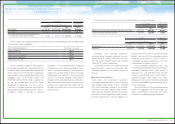

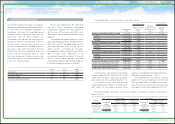

The aggregate amounts of annual maturities of long-term debt during the next five years are as follows:

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Loans, principally from banks, with a weighted-average interest at

March 31, 2010 and March 31, 2011 of 1.55% and of 1.57% per

annum, respectively ¥ 804,066 ¥1,140,066 $13,711

Commercial paper with a weighted-average interest at March 31, 2010

and March 31, 2011 of 0.44% and of 0.67% per annum, respectively 2,475,607 2,038,943 24,521

¥3,279,673 ¥3,179,009 $38,232

As of March 31, 2011, “Loans, principally from

banks” amount includes secured loans by finance

receivables securitization of ¥335,539 million

($4,035 million).

As of March 31, 2011, Toyota has unused

short-term lines of credit amounting to ¥1,954,330

As of March 31, 2011, approximately 31%,

24%, 12% and 33% of long-term debt are denomi-

nated in Japanese yen, U.S. dollars, euros, and

other currencies, respectively.

As of March 31, 2011, property, plant and

equipment with a book value of ¥57,237 million

Standard agreements with certain banks in

Japan include provisions that collateral (including

sums on deposit with such banks) or guarantees

will be furnished upon the banks’ request and that

any collateral furnished, pursuant to such

agreements or otherwise, will be applicable to all

present or future indebtedness to such banks.

million ($23,504 million) of which ¥464,564 million

($5,587 million) related to commercial paper

programs. Under these programs, Toyota is

authorized to obtain short-term financing at

prevailing interest rates for periods not in excess

of 360 days.

($688 million) and in addition, other assets

aggregating ¥1,128,957 million ($13,577 million)

were pledged as collateral mainly for certain debt

obligations of subsidiaries. These other assets

principally consist of securitized finance

receivables.

During the year ended March 31, 2011, Toyota

has not received any significant such requests

from these banks.

As of March 31, 2011, Toyota has unused

long-term lines of credit amounting to ¥8,073,898

million ($97,100 million).

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Unsecured loans, representing obligations principally to banks, due 2010 to

2029 in 2010 and due 2011 to 2029 in 2011 with interest ranging from 0.00%

to 29.25% per annum in 2010 and from 0.00% to 29.00% per annum in 2011

¥ 2,942,012 ¥ 3,386,854 $ 40,732

Secured loans, representing obligations principally to finance receivables securitization

due 2010 to 2019 in 2010 and due 2011 to 2050 in 2011 with interest ranging from

0.49% to 6.65% per annum in 2010 and from 0.37% to 5.35% per annum in 2011

381,307 619,380 7,449

Medium-term notes of consolidated subsidiaries, due 2010 to 2047 in 2010 and

due 2011 to 2047 in 2011 with interest ranging from 0.04% to 15.25% per

annum in 2010 and from 0.01% to 15.25% per annum in 2011

3,814,439 3,314,589 39,863

Unsecured notes of parent company, due 2010 to 2019 in 2010 and due 2012

to 2019 in 2011 with interest ranging from 1.07% to 3.00% per annum in 2010

and from 1.07% to 3.00% per annum in 2011

580,000 530,000 6,374

Unsecured notes of consolidated subsidiaries, due 2010 to 2031 in 2010 and

due 2011 to 2031 in 2011 with interest ranging from 0.25% to 17.03% per

annum in 2010 and from 0.27% to 15.48% per annum in 2011

1,473,732 1,349,307 16,227

Long-term capital lease obligations, due 2010 to 2028 in 2010 and due 2011 to

2028 in 2011 with interest ranging from 0.43% to 14.40% per annum in 2010

and from 0.38% to 14.40% per annum in 2011

42,243 21,917 263

9,233,733 9,222,047 110,908

Less - Current portion due within one year (2,218,324) (2,772,827) (33,347)

¥ 7,015,409 ¥ 6,449,220 $ 77,561

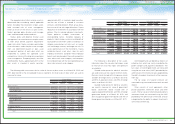

Years ending March 31, Yen in millions

U.S. dollars in millions

2012 ¥2,772,827 $33,347

2013 1,834,556 22,063

2014 1,522,659 18,312

2015 900,120 10,825

2016 1,106,492 13,307

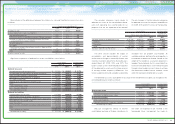

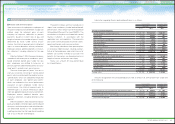

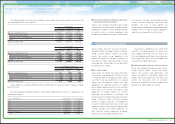

Toyota provides product warranties for certain

defects mainly resulting from manufacturing

based on warranty contracts with its customers at

the time of sale of products. Toyota accrues

estimated warranty costs to be incurred in the

future in accordance with the warranty contracts.

In addition to product warranties, Toyota initiates

recalls and other safety measures to repair or to

replace parts which might be expected to fail

from products safety perspectives or customer

satisfaction standpoints. Toyota accrues for costs

of recalls and other safety measures at the time of

vehicle sale based on the amount estimated from

historical experience.

Liabilities for product warranties and liabilities

for recalls and other safety measures have been

combined into a single table showing an

aggregate liability for quality assurances due to

the fact that both are liabilities for costs to repair

or replace defects of vehicles and the amounts

incurred to repair or replace defects of vehicles

may affect the amounts incurred for product

warranties and vice versa.

86

TOYOTA ANNUAL REPORT 2011