Toyota 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

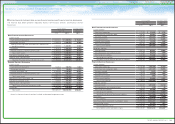

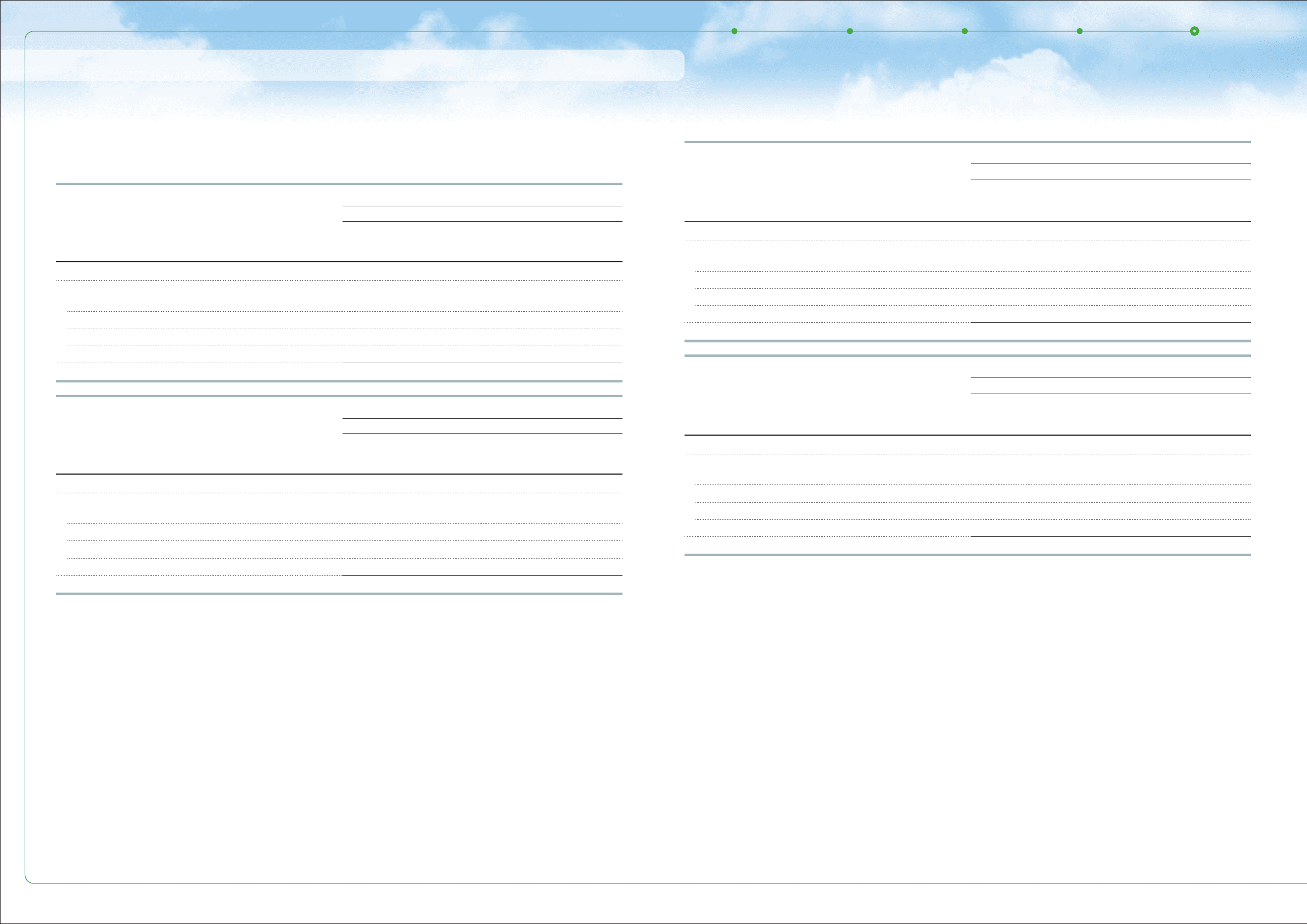

The following table summarizes the changes in Level 3 assets and liabilities measured at fair value

on a recurring basis for the periods ended March 31, 2009, 2010 and 2011:

Yen in millions

For the year ended March 31, 2009

Marketable securities

and other securities

investments

Derivative financial

instruments Total

Balance at beginning of year ¥23,818 ¥ 25,499 ¥ 49,317

Total gains (losses)

Included in earnings 586 (38,538) (37,952)

Included in other comprehensive income (loss) (1,398) — (1,398)

Purchases, issuances and settlements (1,665) 7,026 5,361

Other (1,760) 279 (1,481)

Balance at end of year ¥19,581 ¥ (5,734) ¥ 13,847

Yen in millions

For the year ended March 31, 2010

Marketable securities

and other securities

investments

Derivative financial

instruments Total

Balance at beginning of year ¥19,581 ¥ (5,734) ¥ 13,847

Total gains (losses)

Included in earnings (641) 25,057 24,416

Included in other comprehensive income (loss) (99) — (99)

Purchases, issuances and settlements (6,376) (13,582) (19,958)

Other 669 151 820

Balance at end of year ¥13,134 ¥ 5,892 ¥ 19,026

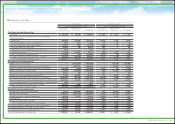

Yen in millions

For the year ended March 31, 2011

Marketable securities

and other securities

investments

Derivative financial

instruments Total

Balance at beginning of year ¥ 13,134 ¥ 5,892 ¥ 19,026

Total gains (losses)

Included in earnings 433 31,338 31,771

Included in other comprehensive income 779 — 779

Purchases, issuances and settlements (810) (8,381) (9,191)

Other (13,536) (22,055) (35,591)

Balance at end of year ¥ — ¥ 6,794 ¥ 6,794

U.S. dollars in millions

For the year ended March 31, 2011

Marketable securities

and other securities

investments

Derivative financial

instruments Total

Balance at beginning of year $ 158 $ 71 $ 229

Total gains (losses)

Included in earnings 5 377 382

Included in other comprehensive income 10 — 10

Purchases, issuances and settlements (10) (101) (111)

Other (163) (265) (428)

Balance at end of year $ — $ 82 $ 82

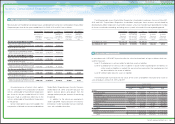

In the reconciliation table above, derivative

financial instruments are presented net of assets

and liabilities. The other amount primarily includes

the impact of currency translation adjustments for

the years ended March 31, 2009 and 2010 and

includes consolidated retained interests in securi-

tized financial receivables of ¥(13,165) million

($(158) million), certain derivative financial instru-

ments transferred into Level 2 due to be measured

at observable inputs of ¥(21,413) million ($(258)

million) and the impact of currency translation

adjustments for the year ended March 31, 2011.

Certain assets and liabilities are measured at

fair value on a nonrecurring basis. During the

years ended March 31, 2010 and 2011, Toyota

measured certain finance receivables at fair value

of ¥13,343 million and ¥15,893 million ($191

million) based on the collateral value, resulting in

loss of ¥2,485 million and gain of ¥2,083 million

($25 million). This fair value measurement on a

nonrecurring basis was classified as level 3.

During the year ended March 31, 2010, Toyota

measured certain investment in affiliated company

at fair value of ¥119,821 million based on the

quoted market price resulting in impairment loss

of ¥63,575 million. This fair value measurement

on a nonrecurring basis was classified as level 1.

109

TOYOTA ANNUAL REPORT 2011