Toyota 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

changes in sales mix, partially offset by the ¥9.0

billion impact of increases in parts sales. The

decrease in fixed costs was due mainly to the

¥178.7 billion decline in research and

development expenses and the ¥39.1 billion

decline in labor costs as a result of profit

improvement initiatives. The decrease in vehicle

unit sales and the changes in sales mix were due

to factors such as the substantial contraction of

the automotive market caused by the financial

crisis since the fall of 2008. The decrease in

research and development expenses is

attributable to reduced development costs

realized as a result of Toyota’s more focused

investment decisions for the future such as in

environmental technologies, and effective

management over research and development

expenses spending.

Cost of financing operations decreased by

¥275.1 billion, or 27.9%, to ¥712.3 billion during

fiscal 2010 compared with the prior year. The

decrease resulted primarily from the ¥83.5 billion

impact of fluctuations in foreign currency

translation rates, the ¥70.0 billion favorable

impact of changes in funding costs, the ¥64.5

billion recognition of valuation gains on interest

rate swaps stated at fair value, and the ¥50.0

billion decrease in provision for residual value

losses. The favorable impact of changes in

funding costs is attributable to a decline in market

interest rates. The decrease in provision for

residual value losses is primarily attributable to

the recovery of the used vehicles markets

particularly in the United States and other effects,

partially offset by the impact from the recalls and

other safety measures. Toyota judges this impact

does not have a material impact on Toyota’s

consolidated financial statements though it is

difficult to quantify the impact from the recalls

and other safety measures in residual value

losses accurately.

Selling, general and administrative expenses

decreased by ¥415.1 billion, or 16.4%, to ¥2,119.6

billion during fiscal 2010 compared with the prior

fiscal year. This decrease mainly reflects the

¥173.8 billion decrease for the financial services

operations and the ¥84.9 billion decrease of

marketing expense. The decrease in the financial

services operations is primarily due to the ¥140.0

billion decrease in provision for credit losses and

net charge-offs, which is attributable to the 0.46%

rise in the ratio of credit losses as a result of the

economic downturn mainly in the United States in

the prior fiscal year, partially offset by the ¥37.3

billion impact from the recalls and other safety

measures. The decrease in marketing expense is

attributable to reduced marketing costs realized

as a result of the profit improvement initiatives.

Cost of Financing Operations

Yen in millions

2010 vs. 2009

Change

Changes in cost of financing operations:

Effect of fluctuation in foreign

currency translation rates

¥ (83,500)

Effect of changes in funding costs (70,000)

Effect of increase in valuation gains

on interest rate swaps stated at

fair value (64,500)

Effect of decrease in provision for

residual value losses (50,000)

Other (7,083)

Total ¥(275,083)

Selling, General and Administrative Expenses

The following is a description of the customer

satisfaction measures related to certain Tacoma

pick-up trucks in North America referred to above.

In fiscal 2009, Toyota accrued the cost of the

customer satisfaction measures related to Tacoma

pick-up trucks in North America in order to

address the possibility of rust developing on the

frame of a portion of older model Tacoma pick-up

trucks manufactured in North America between

1995 and 2004, by rendering repair services for a

portion of the vehicles and providing warranty

extensions of up to 15 years to owners of

approximately 820 thousand vehicles, a portion

of which may include vehicle buyback.

Accordingly, the cost of approximately ¥130.0

billion was recorded in operating costs and

expenses in fiscal 2009. The repair ratio for these

customer satisfaction measures to date has been

relatively low due primarily to the low rate of

incidence of rust on the frames of these vehicles

which may occur when exposed to severe

environmental conditions including accumulation

of road salts. This low repair ratio was assumed in

the calculation of the accrual.

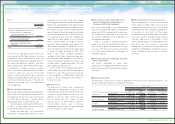

The net changes in the accrual for the

customer satisfaction measures related to Tacoma

pick-up trucks in North America described above

consist of the following:

During fiscal 2010, continued cost reduction

efforts reduced operating costs and expenses by

approximately ¥520.0 billion. The cost reduction

efforts include decreases in the prices of steel,

precious metals, non-ferrous alloys including

aluminum, plastic parts and other production

materials and parts. In fiscal 2010, the decline in

raw materials prices and, continued cost reduction

efforts, by working closely with suppliers,

contributed to the improvement in earnings.

These cost reduction efforts related to ongoing

value engineering and value analysis activities,

the use of common parts that result in a reduction

of part types and other manufacturing initiatives

designed to reduce the costs of vehicle

production.

Cost of products sold decreased by ¥1,496.9

billion, or 8.6%, to ¥15,971.5 billion during fiscal

2010 compared with the prior fiscal year. The

decrease resulted primarily from the ¥738.5

billion impact of fluctuations in foreign currency

translation rates, the ¥520.0 billion impact of cost

reduction efforts, the ¥159.4 billion of decrease

in fixed costs and other efforts including the

¥178.7 billion decrease in research and

development expenses, and the ¥88.0 billion

impact of the decrease in vehicle unit sales and

Yen in millions

Year ended March 31,

2010

Balance at the beginning of year

¥ —

Accrual 89,000

Amounts paid (32,400)

Balance at the end of year ¥ 56,600

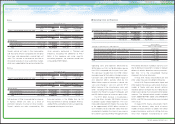

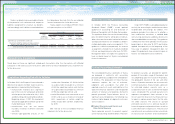

Yen in millions

Year ended March 31,

2009 2010 2011

Balance at the

beginning of year

¥ — ¥ 57,500 ¥ 50,100

Accrual 130,000 21,000 —

Amounts paid (72,500) (28,400) (22,600)

Balance at the

end of year ¥ 57,500 ¥ 50,100 ¥ 27,500

Cost Reduction Efforts

Cost of Products Sold

59TOYOTA ANNUAL REPORT 2011