Toyota 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

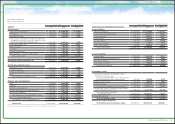

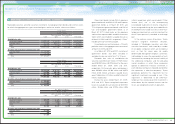

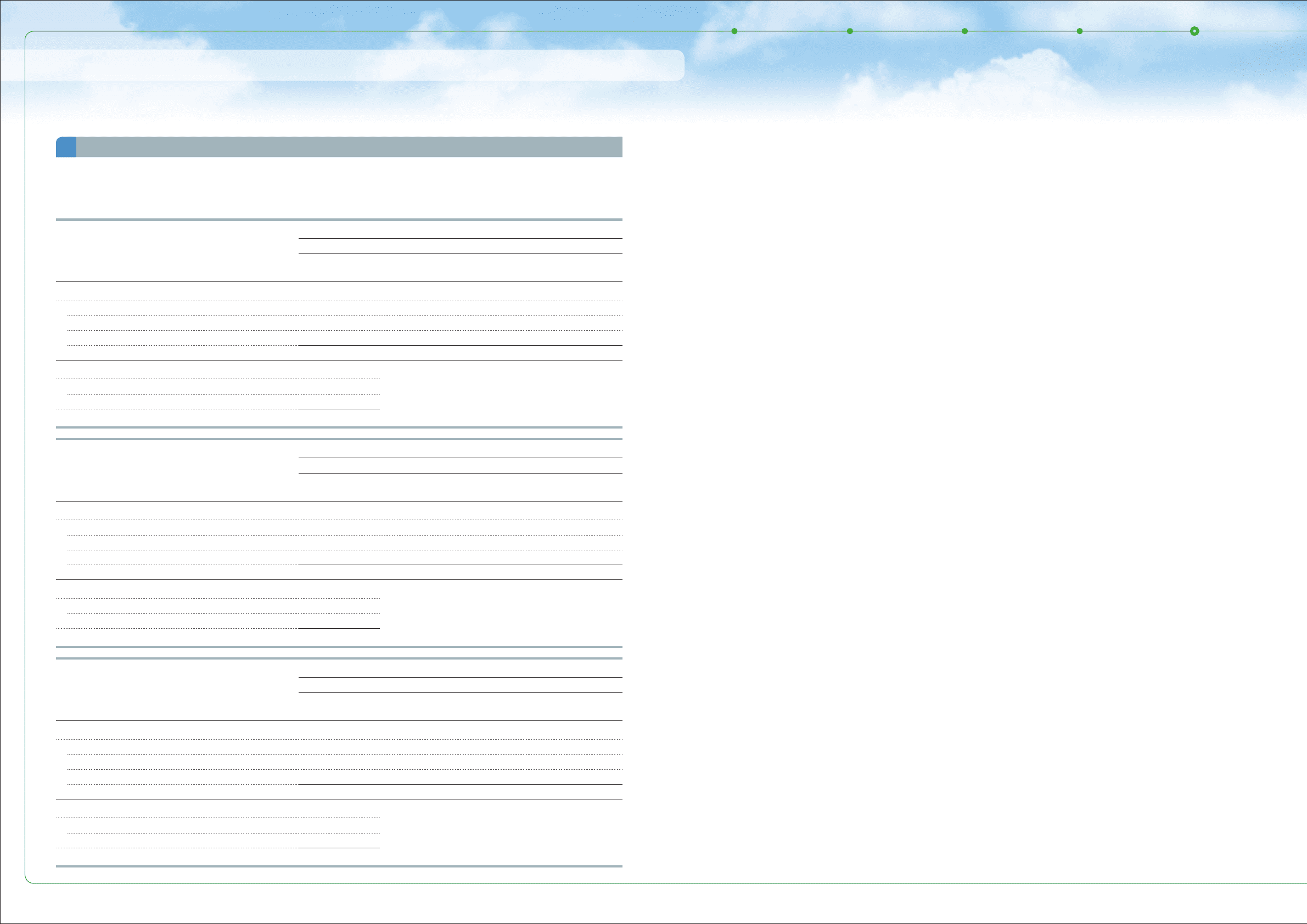

Marketable securities and other securities investments:

6

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

Marketable securities and other securities investments include government bonds and common stocks

for which the aggregate cost, gross unrealized gains and losses and fair value are as follows:

Yen in millions

March 31, 2010

Cost

Gross unrealized

gains Gross unrealized

losses

Fair value

Available-for-sale

Government bonds ¥2,695,248 ¥ 24,228 ¥ 64,647 ¥2,654,829

Common stocks 555,526 369,670 72,421 852,775

Other 403,776 17,588 1 421,363

Total ¥3,654,550 ¥411,486 ¥137,069 ¥3,928,967

Securities not practicable to determine fair value

Common stocks ¥ 95,304

Other 25,173

Total ¥ 120,477

Yen in millions

March 31, 2011

Cost

Gross unrealized

gains Gross unrealized

losses

Fair value

Available-for-sale

Government bonds ¥3,174,236 ¥ 21,712 ¥ 68,778 ¥3,127,170

Common stocks 670,405 398,140 108,316 960,229

Other 561,387 15,940 376 576,951

Total ¥4,406,028 ¥435,792 ¥177,470 ¥4,664,350

Securities not practicable to determine fair value

Common stocks ¥ 109,203

Other 23,069

Total ¥ 132,272

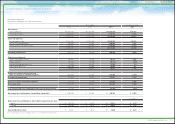

U.S. dollars in millions

March 31, 2011

Cost

Gross unrealized

gains Gross unrealized

losses

Fair value

Available-for-sale

Government bonds $38,175 $ 261 $ 827 $37,609

Common stocks 8,063 4,788 1,303 11,548

Other 6,751 192 4 6,939

Total $52,989 $5,241 $2,134 $56,096

Securities not practicable to determine fair value

Common stocks $ 1,313

Other 278

Total $ 1,591

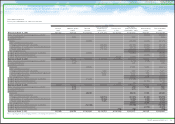

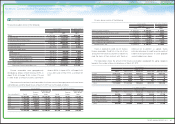

Government bonds include 76% of Japanese

government bonds, and 24% of U.S. and European

government bonds as of March 31, 2010, and

77% of Japanese government bonds, and 23% of

U.S. and European government bonds as of

March 31, 2011. Listed stocks on the Japanese

stock markets represent 88% and 86% of common

stocks which are included in available-for-sale as

of March 31, 2010 and 2011, respectively. “Other”

includes primarily commercial paper.

Unrealized losses continuing over a 12 month

period or more in the aggregate were not material

at March 31, 2010 and 2011.

As of March 31, 2010 and 2011, maturities of

government bonds and other included in

available-for-sale are mainly from 1 to 10 years.

Proceeds from sales of available-for-sale

securities were ¥800,422 million, ¥77,025 million

and ¥189,037 million ($2,273 million) for the years

ended March 31, 2009, 2010 and 2011,

respectively. On those sales, gross realized gains

were ¥35,694 million, ¥3,186 million and ¥8,974

million ($108 million) and gross realized losses

were ¥1,856 million, ¥7 million and ¥87 million ($1

million), respectively.

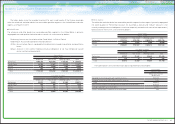

During the years ended March 31, 2009,

2010 and 2011, Toyota recognized impairment

losses on available-for-sale securities of ¥220,920

million, ¥2,486 million and ¥7,915 million ($95

million), respectively, which are included in “Other

income (loss), net” in the accompanying

consolidated statements of income. Impairment

losses recognized during the year ended March

31, 2009 primarily include a loss for an other-than-

temporary impairment on a certain investment for

which Toyota previously recorded an exchange

gain.

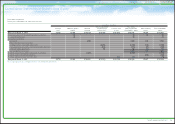

In the ordinary course of business, Toyota

maintains long-term investment securities,

included in “Marketable securities and other

securities investments” and issued by a number

of non-public companies which are recorded at

cost, as their fair values were not readily

determinable. Management employs a systematic

methodology to assess the recoverability of such

investments by reviewing the financial viability of

the underlying companies and the prevailing

market conditions in which these companies

operate to determine if Toyota’s investment in

each individual company is impaired and whether

the impairment is other-than-temporary. Toyota

periodically performs this impairment test for

significant investments recorded at cost. If the

impairment is determined to be other-than-

temporary, the carrying value of the investment is

written-down by the impaired amount and the

losses are recognized currently in operations.

80

TOYOTA ANNUAL REPORT 2011