Toyota 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

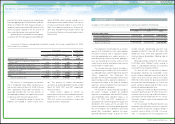

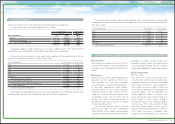

Amounts recognized in accumulated other comprehensive income (loss) as of March 31, 2010 and

2011 are comprised of the following:

Other changes in plan assets and benefit obligations recognized in other comprehensive income

(loss) are as follows:

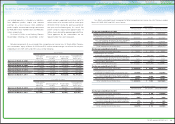

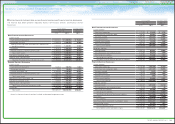

Weighted-average assumptions used to determine benefit obligations as of March 31, 2010 and 2011

are as follows:

Weighted-average assumptions used to determine net periodic pension cost for the years ended

March 31, 2009, 2010 and 2011 are as follows:

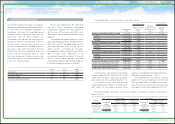

The accumulated benefit obligation for all defined benefit pension plans was ¥1,571,061 million and

¥1,584,627 million ($19,057 million) at March 31, 2010 and 2011, respectively.

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for

which the accumulated benefit obligations exceed plan assets are as follows:

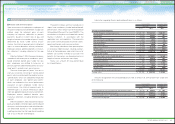

Components of the net periodic pension cost are as follows:

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Net actuarial loss ¥(385,266) ¥(347,494) $(4,179)

Prior service costs 97,587 72,324 870

Net transition obligation (3,570) (1,626) (20)

Net amount recognized ¥(291,249) ¥(276,796) $(3,329)

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Projected benefit obligation ¥508,501 ¥500,046 $6,014

Accumulated benefit obligation 452,019 453,111 5,449

Fair value of plan assets 65,905 72,359 870

Yen in millions

U.S. dollars in millions

For the years ended March 31,

For the year

ended March 31,

2009 2010 2011 2011

Service cost ¥ 84,206 ¥ 75,558 ¥ 82,422 $ 991

Interest cost 52,959 50,559 52,502 631

Expected return on plan assets (43,053) (32,251) (42,364) (509)

Amortization of prior service costs (17,677) (15,063) (24,032) (289)

Recognized net actuarial loss 5,752 27,246 16,095 194

Amortization of net transition obligation 1,944 1,944 1,944 23

Net periodic pension cost ¥ 84,131 ¥107,993 ¥ 86,567 $1,041

Yen in millions

U.S. dollars in millions

For the years ended March 31,

For the year

ended March 31,

2009 2010 2011 2011

Net actuarial gain (loss) ¥(303,074) ¥ 81,949 ¥(21,978) $(264)

Recognized net actuarial loss 5,752 27,246 16,095 194

Prior service costs 2,096 3,080 1,429 17

Amortization of prior service costs (17,677) (15,063) (24,032) (289)

Amortization of net transition obligation 1,944 1,944 1,944 23

Other 17,003 2,594 40,995 493

Total recognized in other comprehensive income (loss)

¥(293,956) ¥101,750 ¥ 14,453 $ 174

The other amount includes the impact of

transition to defined contribution pension plans,

consolidation and deconsolidation of certain

entities due to changes in ownership interest and

currency translation adjustments during the years

ended March 31, 2009, 2010 and 2011.

The estimated prior service costs, net actuarial

loss and net transition obligations that will be

amortized from accumulated other comprehensive

income (loss) into net periodic pension cost during

the year ending March 31, 2012 are ¥(15,700)

million ($(189) million), ¥16,000 million ($192 million)

and ¥1,900 million ($23 million), respectively.

March 31,

2010 2011

Discount rate 2.8% 2.8%

Rate of compensation increase 0.5-10.0% 0.8-11.0%

For the years ended March 31,

2009 2010 2011

Discount rate 2.8% 2.8% 2.8%

Expected return on plan assets 3.6% 3.6% 3.8%

Rate of compensation increase 0.1-10.0% 0.1-10.0% 0.5-10.0%

93

TOYOTA ANNUAL REPORT 2011