Toyota 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Toyota annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0822

Financial Section and

Investor Information

Business and

Performance Review

Special FeatureMessage/Vision

Management and

Corporate Information

Notes to Consolidated Financial Statements

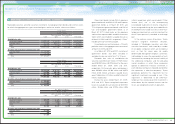

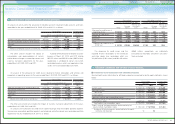

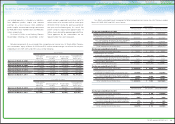

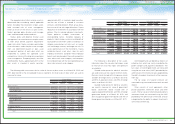

The valuation allowance mainly relates to

deferred tax assets of the consolidated subsid-

iaries with operating loss carryforwards for tax

purposes that are not expected to be realized.

The net changes in the total valuation allowance

for deferred tax assets for the years ended March

31, 2009, 2010 and 2011 consist of the following:

The other amount includes the impact of

consolidation and deconsolidation of certain

entities due to changes in ownership interest and

currency translation adjustments during the years

ended March 31, 2009, 2010 and 2011. The

factors used to assess the likelihood of realization

of the deferred tax assets are the future reversal

of existing taxable temporary differences, the

future taxable income and available tax planning

strategies that are prudent and feasible. All

available evidence, both positive and negative, is

considered to determine whether, based on the

weight of that evidence, a valuation allowance is

needed. Toyota believes that it is more likely than

not that the net deferred tax assets will be realized

through future taxable income. Failure to achieve

the forecasted taxable income, however, could

affect the realization of deferred tax assets.

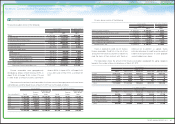

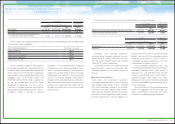

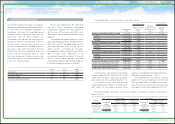

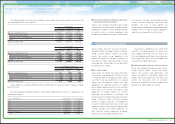

The deferred tax assets and liabilities that comprise the net deferred tax liability are included in the

consolidated balance sheets as follows:

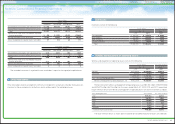

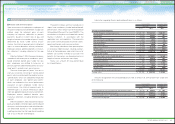

Because management intends to reinvest

undistributed earnings of foreign subsidiaries to

the extent not expected to be remitted in the

foreseeable future, management has made no

Yen in millions

U.S. dollars in millions

For the years ended March 31,

For the year

ended March 31,

2009 2010 2011 2011

Valuation allowance at beginning of year ¥ 82,191 ¥208,627 ¥239,269 $2,877

Additions 145,707 46,704 55,791 671

Deductions (3,511) (14,066) (10,077) (121)

Other (15,760) (1,996) (4,298) (52)

Valuation allowance at end of year ¥208,627 ¥239,269 ¥280,685 $3,375

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Deferred tax assets

Deferred income taxes (Current assets) ¥ 632,164 ¥ 605,884 $ 7,287

Investments and other assets - other 122,617 118,849 1,429

Deferred tax liabilities

Other current liabilities (9,338) (14,919) (179)

Deferred income taxes (Long-term liabilities) (813,221) (810,127) (9,743)

Net deferred tax liability ¥ (67,778) ¥(100,313) $(1,206)

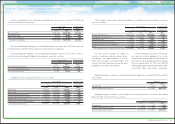

Significant components of deferred tax assets and liabilities are as follows:

Yen in millions

U.S. dollars in millions

March 31, March 31,

2010 2011 2011

Deferred tax assets

Accrued pension and severance costs ¥ 210,268 ¥ 226,093 $ 2,719

Accrued expenses and liabilities for quality assurances 277,696 395,513 4,757

Other accrued employees’ compensation 106,404 103,020 1,239

Operating loss carryforwards for tax purposes 146,114 296,731 3,568

Tax credit carryforwards 73,061 127,289 1,531

Property, plant and equipment and other assets 188,745 176,229 2,119

Other 474,380 277,449 3,337

Gross deferred tax assets 1,476,668 1,602,324 19,270

Less - Valuation allowance (239,269) (280,685) (3,375)

Total deferred tax assets ¥ 1,237,399 ¥ 1,321,639 $ 15,895

Deferred tax liabilities

Unrealized gains on securities (147,494) (146,874) (1,766)

Undistributed earnings of foreign subsidiaries (12,797) (26,783) (322)

Undistributed earnings of affiliates accounted for by the equity method

(575,929) (578,756) (6,961)

Basis difference of acquired assets (38,977) (38,351) (461)

Lease transactions (457,316) (537,174) (6,460)

Gain on securities contribution to employee retirement benefit trust

(66,523) (66,523) (800)

Other (6,141) (27,491) (331)

Gross deferred tax liabilities (1,305,177) (1,421,952) (17,101)

Net deferred tax liability ¥ (67,778) ¥ (100,313) $ (1,206)

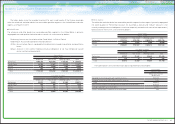

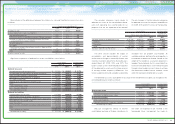

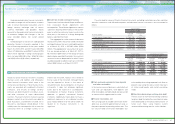

For the years ended March 31,

2009 2010 2011

Statutory tax rate 40.2% 40.2% 40.2%

Increase (reduction) in taxes resulting from:

Non-deductible expenses (5.0) 1.9 2.2

Deferred tax liabilities on undistributed earnings of foreign subsidiaries

(2.5) 4.4 4.8

Deferred tax liabilities on undistributed earnings of affiliates

accounted for by the equity method (2.5) (0.6) 12.6

Valuation allowance (25.4) 11.2 8.1

Tax credits 10.0 (11.8) (2.6)

The difference between the statutory tax rate in Japan and that

of foreign subsidiaries 1.6 (12.9) (12.1)

Other (6.3) (0.6) 2.3

Effective income tax rate 10.1% 31.8%55.5%

Reconciliation of the differences between the statutory tax rate and the effective income tax rate is

as follows:

88

TOYOTA ANNUAL REPORT 2011