TCF Bank 2003 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 7

Finally, the management of interest rate risk in this record low interest rate environment remains a major challenge.

This is not something we have previously experienced to this extent. Over time, we intend to reduce TCF’s risk of

prepayments. Much of this will be accomplished by the reduction of residential loans and mortgage-backed securities as

well as replacing borrowings with core deposits. However, we will also explore other strategies to reduce this risk in our

mortgage-banking operations.

Risks We think it is appropriate to also mention here what we consider to be the other major risks to our continued

success. First is the success of our new branch expansion. We are relying on the continued, long-term success of branch

banking. Second, TCF, like all banks, is subject to the effects of any economic downturn. In particular, a significant decline

in home values in our markets could have a negative effect on our results. A bad economy can create increased loan and

lease losses. The third risk is our ability to attract and retain new customers. Our overall growth is dependent on our

ability to grow our checking accounts. Deposit losses (fraudulent checks, etc.) remain high and combating them is a con-

tinuing challenge. Technological change is a risk. Additionally, as became very clear in 2003, rising and falling interest

rates affect our results. Legal, regulatory and tax issues are always a risk (the Visa debit card lawsuit is a good example

of this legal risk).

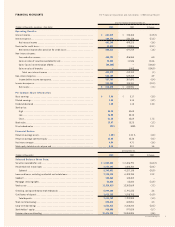

New Branch Expansion

(number of new branches opened)

Supermarket Traditional

04 Plan

27 27

19

28

22

6

25

35

106

02 03010098 99

New Branch1 Total Deposits

(millions of dollars)

03

$1,225

$1,088

$744

$594

$190

$344

02010098 99

1 Branches opened since January 1, 1998

New Branch1 Banking Fees

& Other Revenue2

(millions of dollars)

03

$126

$108

$85

$61

$14

$39

02010098 99

1 Branches opened since January 1, 1998

2 Consisting of fees and service charges, debit card revenue,

ATM revenue, and investments and insurance commissions