TCF Bank 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

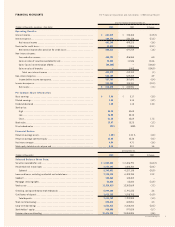

6TCF Financial Corporation and Subsidiaries

Innovative Products and Services In addition to our new branch expansion strategy, innovative products and services

continue to contribute to our success. “Totally Free Checking,” “Free Small Business Checking,” home equity loans,

debit cards, investment sales and supermarket branch banking have been our most successful innovations. Over the last

few years we have introduced TCF Express.com®(our online banking service), TCF Express Trade (our securities broker-

age service), TCF Leasing (one of our equipment leasing subsidiaries), TCF Express CoinSM Service (offering free self

service coin counting to TCF customers), and TCF is now open seven days-a-week in almost all of our branches. In

2003, TCF’s debit card revenues were $53 million, TCF leasing operations earned $29.3 million and TCF’s supermarket

banking division earned $25.8 million. All, or a significant part of these operations, were at one time de novo activities.

TCF has successfully used innovation to increase profits and grow our customer base.

A Time of Great Change This is also a time of great change in the banking industry.

First, several colossal bank mega-mergers have recently been announced. TCF continues to compete in an industry

that is in a large-scale consolidation cost take-out mode. In the short run, these types of mergers creating trillion dollar

banks are good for TCF when they happen in our marketplace. The employee and customer disruptions caused by the

mergers highlight TCF’s local presence and result in growth of new customers. We think too much emphasis in these

mergers is placed on scale when the real determining factor should be skill. Being smaller allows TCF to be more focused

and make quicker decisions.

However, for the first time the recently announced mergers lay the foundation for nationwide banking. The ever

increasing control over the banking system by a few very large nationwide players, including payment systems like Visa

and automated clearing house (ACH), remains a real source of concern to us. When you walk with elephants, sometimes

you get stepped on.

Second, for the first time in history, the actual number of checks written by our average customer at TCF declined in

2003 by approximately 10%. We have been hearing this prediction for years – and it finally happened.

Our customers have increased their use of the debit card to replace checks and cash transactions. This is a good thing for

TCF since it brings us interchange revenue and reduces our costs. The debit card is now an integral part of a checking account.

Customers are also continuing to increase their use of automated clearing house (ACH) transactions, which also

reduces check volumes. Customers like the convenience of making their payments on a regular basis in this fashion.

Customer behavior will continue to evolve and change as these payment systems become more widely used. The longer-

term impact of these changes on deposits and related deposit service charge revenues is not entirely clear. We are spending

a lot more time and resources studying our customer’s behavior in order to get ahead of this curve.