TCF Bank 2003 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8TCF Financial Corporation and Subsidiaries

Over the long term, the success and viability of our supermarket partners are important to TCF. If our partners sell

or contract their stores, we are at risk; though over time, as we build out our traditional branch system, this risk is mit-

igated somewhat. We continue to work closely with our partners to optimize our businesses and to be aware of and address

any potential risks.

None of these risks are new. Our consistent results have proven that we have managed these risks in the past and we

believe we are adequately prepared to manage them in the future. Our philosophy at TCF is to run a highly profitable

bank and to minimize risk. TCF does not utilize unconsolidated subsidiaries and has no exotic derivatives, foreign loans,

bank owned life insurance, etc. In our opinion, TCF’s accounting is conservative.

A careful reading of this Annual Report will tell you generally everything about our company. We try to keep our

financial reporting simple, but as complete as possible. We have a lot to be proud of and nothing to hide.

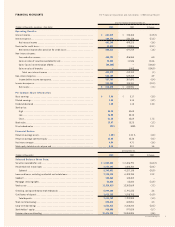

Fee Revenue

Per Checking Account

(dollars)

03

$223

$218

$209

$190

$168

02010099

Checking Accounts

(thousands)

12/03

1,444

1,338

1,249

1,131

1,032

12/0212/0112/0012/99