TCF Bank 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 19

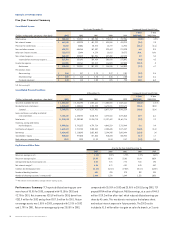

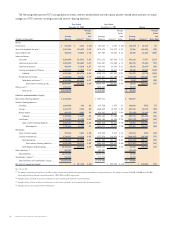

Net interest income, the difference between interest income,

earned on loans and leases and on investments, and interest

expense, paid on deposits and short-term and long-term borrowings,

represents 53.4% of TCF’s total revenue. Net interest income can

change significantly from period to period based on general levels

of interest rates, customer prepayment patterns, the mix of interest

earning assets and the mix of interest bearing and non-interest

bearing deposits and borrowings. TCF manages the risk of changes

in interest rates on its net interest income through an Asset/Liability

Committee and through related interest rate risk monitoring and

management policies.

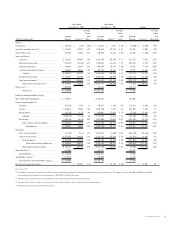

The historically low interest rates in 2003 were a significant chal-

lenge to the management of asset/liability risk and TCF made several

key decisions that impacted the year’s results. These very low interest

rates caused a high level of prepayment in the residential loan and

mortgage-backed securities portfolio, which declined a combined

$1.5 billion in total during the year. Early in 2003, TCF decided to

stop reinvesting cash flows created by the high level of prepayments

into new mortgage-backed securities as the available yields on new

investments were deemed unacceptable. Additionally during the

year, TCF prepaid $954 million of high cost fixed-rate Federal Home

Loan Bank (“FHLB”) borrowings, at a cost of $44.3 million, and

replaced some of these borrowings with lower cost borrowings that

will reduce interest expense over the remaining term of the prepaid

borrowings into 2004. TCF does not utilize any unconsolidated sub-

sidiaries or special purpose entities to provide off-balance sheet

borrowings. If interest rates continue at similar low levels through-

out 2004, TCF will continue to experience prepayments of higher

yielding assets that might not be replaced. Therefore, net interest

margin and net interest income would continue to decline.

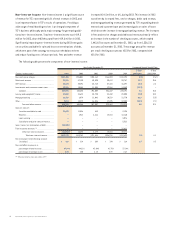

The Company’s VISA®debit card program has grown significantly

since its inception in 1996. According to a September 30, 2003

statistical report issued by VISA®

, TCF, with approximately 1.5 million

cards outstanding, was the 12th largest VISA®Classic debit card

issuer in the United States, based on the number of cards outstand-

ing, and 11th largest based on sales volume of $998.7 million for the

2003 third quarter. TCF earns interchange revenue from customer

debit card transactions. During 2003, 90.9% of TCF’s debit card sales

volume was generated from off-line (signature-based) transactions.

The average interchange rate on these off-line transactions declined

from 1.55% in 2002 to 1.43% in 2003. The decline in the average off-

line interchange rate was the result of VISA®USA lowering interchange

rates for many merchants effective August 1, 2003, as part of the

settlement of class action lawsuits brought by these merchants

against VISA challenging rules imposed by VISA governing the accep-

tance of debit and credit cards by merchants. Additionally, as part

of the settlement, VISA established new interchange rates which

took effect in February 2004, and these rates increased slightly from

the rates established August 1, 2003. In 2003, TCF renegotiated its

contract with VISA and agreed to an extension through 2013. The

effect of this new contract is to lower various costs that TCF pays

for processing and marketing of the VISA debit cards. The continued

success of TCF’s debit card program is dependent on the success and

viability of VISA and the continued use by customers and acceptance

by merchants of debit cards.

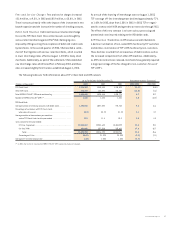

TCF’s mortgage banking business originates residential mortgage

loans and sells them to investors, primarily retaining the servicing

rights and related servicing revenue. Generally accepted accounting

principles require TCF to record the value of the servicing rights on

the balance sheet at the time the loans are sold. Capitalized servic-

ing rights are amortized based on the expected pattern and life of

related servicing revenues and are also evaluated quarterly for

impairment. As interest rates fall, there is a higher probability of

prepayment as the customer can generally refinance the loan with

relative ease. In addition, as property values increase, customers’

home equity increases, enabling customers to engage in “cash-out”

refinance transactions where the customer refinances an existing

mortgage into a higher balance loan in order to draw out the

increased home equity. The historically low mortgage interest rate

environment in 2003 and continued increases in property values in

our markets led to historically high prepayments and refinancing

resulting in unusually high levels of servicing rights amortization

and a $21.2 million provision for impairment. At December 31, 2003,

60% of TCF’s servicing portfolio consisted of loans with interest rates

below 6%. If interest rates remain at current levels or increase in

2004, there should be significantly reduced refinance activity and

reduced related amortization and provision for impairment. TCF

does not utilize derivatives to manage the impairment risk in its

capitalized mortgage servicing rights.

The following portions of the Management’s Discussion and

Analysis focus in more detail on the results of operations for 2003,

2002 and 2001 and on information about TCF’s balance sheet, credit

quality, liquidity and funding resources, capital, critical accounting

estimates and other matters.