TCF Bank 2003 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 11

Simple, straightforward, and enduring strategies, which are based on

a well-grounded philosophy coupled with successful execution and

solid management, have made TCF one of the top performing banks in

the United States.

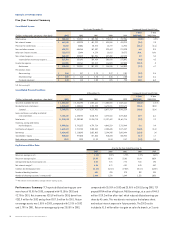

DE NOVO EXPANSION

TCF’s future growth is contingent on a continuing investment in de novo

expansion, both in our branch network and in our development of new

products and services. Each of these components play a fundamental

and complementary role – adding new branches supports our growing

customer base and provides new products and services, allowing us to

attract new customers and deepen our customer relationships.

Since January of 1998, TCF has added 228 new branches to our rapidly

growing branch network – nearly 57 percent of our existing branches.

In 2003, we opened more traditional branches than supermarket

branches. With the opportunity to add new supermarket branches

slowing in some markets, TCF has a greater opportunity to support and

complement these branches with more new traditional branches.

Traditional branches require a higher initial investment. They

act as a visible anchor in our communities, providing convenient,

full-service banking not only to our retail customers but also to our

growing commercial and small business customers. In 2004, TCF plans

to open 22 new traditional offices.

Supermarket banking continues to play a key role in TCF’s ability to

provide the most convenient banking services in the markets we serve,

especially in Minnesota and the Chicagoland area. Our customers enjoy

the convenience of one-stop shopping and banking, causing these

lower-cost, high-volume branches to become profitable more quickly

than traditional branches. Our supermarket branches in Cub Foods

and Jewel-Osco play an important role in our expansion strategy. In

2004, TCF plans to open six new supermarket branches.

The other key element of TCF’s de novo expansion strategy is the evo-

lution of our convenient products and services. New products attract

new customers, allowing us to develop additional relationships with

our existing customers. TCF’s innovative culture fuels the strategic

initiatives that have led to the introduction of many of our products

and services.

Totally Free Checking remains the best example of a successful inno-

vative product brought to market by TCF. We listened to our customers,

and what they wanted was a very low-cost checking account. We gave

them a free account, which remains our most popular checking

account. Most of our competitors are attempting to copy this product.

Building for the Future TCF’s de novo

strategy of branch expansion and product line

improvements continues to complement each

other. New products and services with convenient

locations attract new customers and deepen our

customer relationships.