TCF Bank 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

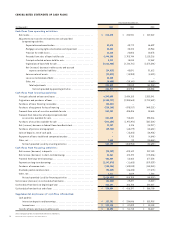

46 TCF Financial Corporation and Subsidiaries

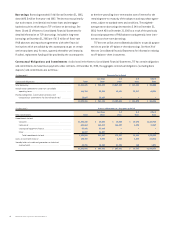

income taxes, lease financings and pension liability and expenses.

See Note 1 of Notes to Consolidated Financial Statements for further

discussion of critical accounting estimates.

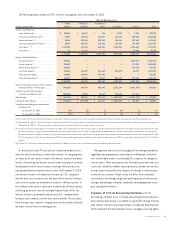

Recent Accounting Developments In January 2003, the

Financial Accounting Standards Board (“FASB”) issued FASB

Interpretation (“FIN”) No. 46 “Consolidation of Variable Interest

Entities,” which addresses consolidation and disclosure of interests

in variable interest entities (“VIEs”). See Note 1 of Notes to

Consolidated Financial Statements for information relating to

investments in affordable housing limited partnerships. There

was no impact on TCF’s financial statements upon adoption of

this interpretation.

In December 2003, the FASB issued a revised version of FIN No.46.

The revised FIN No.46 clarifies some of the provisions of the original

interpretation and adds new scope exceptions. TCF expects no sig-

nificant impact on TCF’s financial statements upon adoption of the

revised interpretation.

In April 2003, the FASB issued SFAS No. 149, “Amendment of

Statement 133 on Derivative Instruments and Hedging Activities.”

SFAS No.149 amends and clarifies financial accounting and reporting

for derivative instruments, including certain derivative instruments

embedded in other contracts and for hedging activities under

SFAS No.133, “Accounting for Derivative Instruments and Hedging

Activities.” This Statement is generally effective for contracts entered

into or modified and hedging relationships designated after June 30,

2003. There was no impact on TCF’s financial statements as a result

of the adoption of this Statement.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain

Financial Instruments with Characteristics of both Liabilities and

Equity.” SFAS No.150 establishes standards for how an issuer classi-

fies and measures certain financial instruments with characteristics

of both a liability and equity. It requires that an issuer classify certain

financial instruments as a liability, although the financial instrument

may previously have been classified as equity. This Statement was

effective for financial instruments entered into or modified after

May 31, 2003 and otherwise was effective at the beginning of the first

interim period beginning after June 15, 2003. There was no impact on

TCF’s financial statements upon adoption of this Statement.

On December 8,2003, the Medicare Prescription Drug,Improvement,

and Modernization Act of 2003 (the “Act”) was signed into law. This

Act includes a prescription drug benefit and a federal subsidy for

sponsors of retiree healthcare plans beginning in 2006. TCF offers a

prescription drug benefit to certain retirees in its post-retirement

medical plan. In January 2004, the FASB issued limited guidance

regarding the effects of the Act on the estimated costs of providing

this retirement benefit under SFAS No.106, “Employers’ Accounting

for Postretirement Benefits Other Than Pensions” with various

implementation options. The impact of the Act has not yet

been included in TCF’s determination of post retirement benefit

obligations or expense. TCF is currently reviewing the Act and

considering its options. However, the effects of this Act are not

expected to be significant.

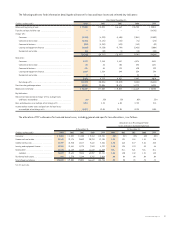

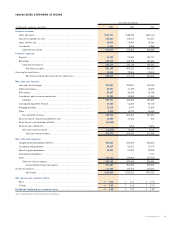

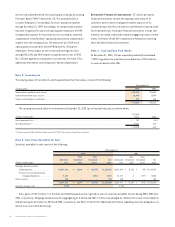

Fourth Quarter Summary In the fourth quarter of 2003, TCF

reported net income of $59.5 million, compared with $59.8 million in

the fourth quarter of 2002. Diluted earnings per common share was

86 cents for the fourth quarter of 2003, compared with 82 cents for

the fourth quarter of 2002. TCF opened 10 new branches in the fourth

quarter of 2003, of which two were supermarket branches.

Net interest income was $119.1 million and $126.6 million for

the quarter ended December 31, 2003 and 2002 respectively. The

net interest margin was 4.68% and 4.59% for the fourth quarter of

2003 and 2002, respectively. TCF’s net interest income declined by

$7.5 million, or 5.9% over the fourth quarter of 2002. Of this decline

in net interest income $11.6 million was due to interest rate changes,

partially offset by an increase of $4 million due to volume changes.

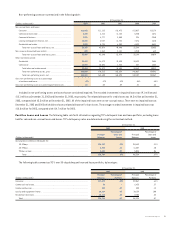

TCF provided $4 million for credit losses in the fourth quarter

of 2003, compared with $4.1 million in the fourth quarter of 2002.

Net loan and lease charge-offs were $6.1 million, or .30% of average

loans and leases outstanding, compared with $3.2 million, or .16%

of average loans and leases outstanding during the same 2002

period. Included in net charge-offs was a $1.3 million charge-off

related to an office building that TCF took ownership of during the

fourth quarter of 2003. Included in leasing and equipment net

charge-offs in the fourth quarter of 2003 was a $1.3 million charge-

off related to the sale of $5.6 million of under-performing leases

from the transportation portfolio.

Non-interest income increased $5.7 million, or 5.2%, during the

fourth quarter of 2003 to $114.9 million. The increase was primarily

due to increased leasing and mortgage banking revenues and fees

and service charges.

Non-interest expense increased $993 thousand, or.7%, in the

fourth quarter of 2003 to $142.2 million. Increases from the fourth

quarter of 2002 in occupancy expense of $1.2 million due to branch

expansion and in advertising of $1 million to support checking

account promotions were mostly offset by a $1.9 million decrease in

other non-interest expense primarily due to lower mortgage banking

volumes and lower ATM and debit card processing expense.

In the fourth quarter of 2003, the effective income tax rate was

reduced to 32.14% of income before tax expense for the quarter due

to the increased investments in affordable housing limited partner-

ships and a reduction in state and local income taxes.

Earnings Teleconference and Website Information TCF

hosts quarterly conference calls to discuss its financial results.

Additional information regarding TCF’s conference calls can be

obtained from the investor relations section within TCF’s website at

www.tcfexpress.com or by contacting TCF’s Corporate Communications

Department at (952) 745-2760. The website also includes free access

to company news releases, TCF’s annual report, quarterly reports,