TCF Bank 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 TCF Financial Corporation and Subsidiaries

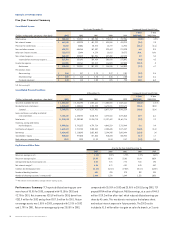

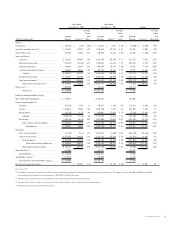

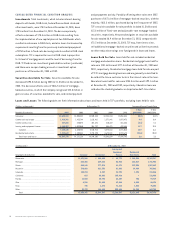

The following table presents the components of the changes in net interest income by volume and rate:

Year Ended Year Ended

December 31, 2003 December 31, 2002

Versus Same Period in 2002 Versus Same Period in 2001

Increase (Decrease) Due to Increase (Decrease) Due to

(In thousands) Volume(1) Rate(1) Total Volume(1) Rate(1) Total

Interest income:

Investments . . . . . . . . . . . . . . . . . . . . . . . . . $ (2,375) $ (48) $ (2,423) $ (495) $ (1,537) $ (2,032)

Securities available for sale . . . . . . . . . . . . 713 (15,164) (14,451) 11,099 (5,094) 6,005

Loans held for sale . . . . . . . . . . . . . . . . . . . 2,421 (4,869) (2,448) 3,429 (5,231) (1,802)

Loans and leases:

Consumer . . . . . . . . . . . . . . . . . . . . . . . 40,204 (32,725) 7,479 30,889 (38,835) (7,946)

Commercial real estate . . . . . . . . . . . . 7,026 (16,514) (9,488) 18,414 (16,187) 2,227

Commercial business . . . . . . . . . . . . . . 518 (4,197) (3,679) 1,791 (8,985) (7,194)

Leasing and equipment finance . . . . . 8,009 (11,544) (3,535) 7,094 (10,778) (3,684)

Residential real estate . . . . . . . . . . . . (49,442) (13,857) (63,299) (70,036) (8,784) (78,820)

Total interest income . . . . . . . . . . . . . . . . . . . . 1,006 (92,850) (91,844) (5,876) (87,370) (93,246)

Interest expense:

Checking . . . . . . . . . . . . . . . . . . . . . . . . . . 211 (742) (531) 498 (2,568) (2,070)

Savings . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,535 (9,161) (6,626) 4,838 3,614 8,452

Money market . . . . . . . . . . . . . . . . . . . . . . . (329) (4,961) (5,290) 396 (11,803) (11,407)

Certificates . . . . . . . . . . . . . . . . . . . . . . . . (10,602) (15,542) (26,144) (21,878) (40,438) (62,316)

Short-term borrowings . . . . . . . . . . . . . . . 2,685 (3,137) (452) (15,787) (19,139) (34,926)

Long-term borrowings . . . . . . . . . . . . . . . . (26,843) (7,878) (34,721) (3,914) (5,068) (8,982)

Total interest expense . . . . . . . . . . . . . . . . . . . . (7,544) (66,220) (73,764) (15,329) (95,920) (111,249)

Net interest income . . . . . . . . . . . . . . . . . . . . . . 685 (18,765) (18,080) (3,465) 21,468 18,003

(1) Changes attributable to the combined impact of volume and rate have been allocated proportionately to the change due to volume and the change due to rate.

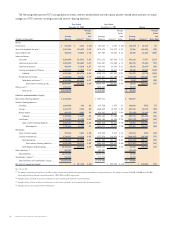

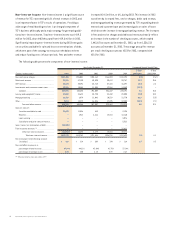

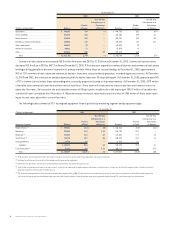

During 2003, TCF prepaid $954 million of fixed-rate borrowings.

These borrowings had an average interest rate of 5.66% and an aver-

age remaining maturity of 13 months. Certain of these borrowings

were replaced with $787 million of fixed-rate borrowings with an

average maturity of 12 months and an average interest rate of 1.42%.

2003 net interest income and net interest margin were positively

impacted by $12.2 million, and 12 basis points, respectively, as a

result of the reduction in interest expense related to the debt

prepayment and replacement funding. TCF may, from time to time,

sell mortgage-backed securities. During 2003, TCF sold $816.5 mil-

lion of fixed-rate mortgage-backed securities with a weighted-

average coupon of 6.49% and recognized $32.8 million in gains on

securities available for sale. At December 31, 2003, the unrealized

gain on TCF’s securities available for sale portfolio was $8.9 million.

Changes in net interest income are dependent upon the movement

of interest rates, the volume and mix of interest-earning assets and

deposits and borrowings and the level of non-performing assets.

Achieving net interest margin growth over time is dependent on TCF’s

ability to generate higher-yielding assets and lower-cost retail

deposits. The net impact of the changes in interest-bearing assets

and deposits and borrowings has positioned TCF to be more asset

sensitive (i.e. more assets than liabilities will be maturing, repricing,

or prepaying during the next twelve months). Although this positive

gap position will benefit TCF in a rising rate environment, if interest

rates remain at current levels or fall further, the net interest margin

may continue to compress and net interest income may decline. An

increase in interest rates would affect TCF’s fixed-rate/variable-rate

product origination mix and would extend the estimated life of its