TCF Bank 2003 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4TCF Financial Corporation and Subsidiaries

3. Recognizing that the assets financed by our borrowings had run-off, we prepaid $954 million of high cost fixed-rate

borrowings at a cost of $44.3 million ($.41 EPS). This action hurt 2003 earnings but allowed us to reduce our cost

of funds in future periods.

4. Over 50 percent of TCF’s $5 billion mortgage servicing portfolio prepaid in 2003, resulting in amortization and

provision for impairment expense of $44.8 million in 2003. Increased gains on sales of mortgage loans and

mortgage-backed securities offset this expense.

5. The unplanned VISA®debit card litigation settlement reduced TCF’s interchange revenues by approximately $6 million

in 2003. Although TCF was not a party to this litigation, the settlement adversely impacted our results.

POWER ASSETS®and POWER LIABILITIES®On a more positive note, TCF experienced strong growth in its core businesses

in 2003. Power Assets grew $814.4 million, or 13 percent, despite the economic uncertainties present in 2003. TCF’s

consumer loans increased $624.5 million, or 21 percent. Commercial loans increased $68.5 million, or three percent.

Leasing and Equipment Finance increased $121.4 million, or 12 percent. All of these areas are well poised for future

growth in 2004.

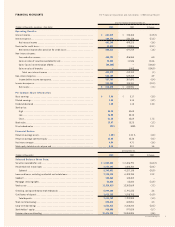

TCF Check Card

Interchange Revenue

(millions of dollars)

03

$53.0

$47.2

$37.6

$28.8

$19.5

02010099

Retail Distribution Growth

(number of branches)

Traditional Supermarket

03

401

395

375

352

338

02010099

Net Interest Income

(millions of dollars)

03

$481

$499

$481

$439

$424

02010099